Saudi Arabia's report on the reduction in oil production in July by 20 thousand b / s stirred the market of black gold. According to secondary sources, the indicator even fell by 53 thousand b / s, and investors are actively discussing what is happening? Why is the OPEC leader, one of the first responders to Donald Trump's calls to increase production to contain price increases, now gives a backup? Riyadh responds simply, oil refineries are no longer needed, but when did their interests become the cornerstone of the nationwide strategy?

In the second half of the summer, the oil market fell into a logical consolidation, balancing the long-term "bullish" driver in the form of a reduction in Iranian exports by about 1 million b / s and short-term "bearish" factors. OPEC and Russia had to close the hole. Both the cartel and Moscow increased production in July by 41 thousand and 20 thousand b / s, respectively, but for whatever reasons, Saudi Arabia turned out to be a problem, remains a mystery. Some investors argue that Riyadh does not want to allow a sharp decline in prices. He is satisfied with a range of $ 70-80 per barrel in the North Sea grade. Others are sure that the Saudis do not want to get rid of Iran, which actively resisted the idea of increasing production at the last OPEC summit. Still, others suggest that official statistics were understated in order to prevent a sharp collapse of Brent and WTI.

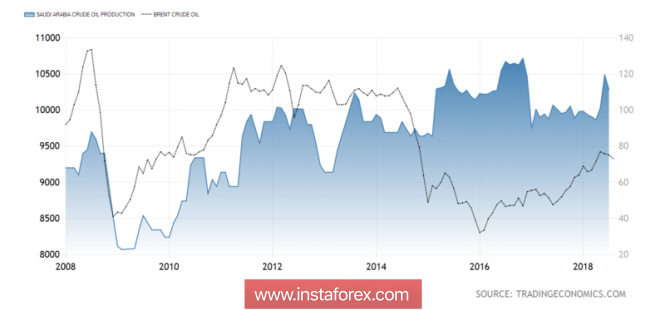

Dynamics of Brent and oil production by Saudi Arabia

In my opinion, Riyadh will not be able to play this game for a long time, and in the near future, the markets will return to the idea of their own balance. At the same time, the cartel's reduction in forecasts of growth in demand for its own oil in 2018 to +1.64 million b / s and in 2019 to +1.43 million b / s speaks of OPEC's concern about the prospect of slowing global GDP. Protectionism and trade wars already affect the economies of China, the eurozone, and developing countries, if the US also faces the effect of fading the effect of the fiscal stimulus, the world GDP will not get better.

There are "bulls" for Brent and WTI and another cause for concern. According to OPEC studies, oil production outside the cartel will increase by 2.13 million b / d next year, which is by 30 thousand b / s more than in the July forecast. The main increase will come from the States. Indeed, the US Energy Information Administration expects that the production of black gold from 7 major shale sources will increase by 93 thousand b / s in September and reach the level of 7.52 million b / s. Let me remind you that at current price levels, US companies have the opportunity to actively increase production, hedging the risks through futures contracts.

Technically, Brent "bears" for the second time in the last couple of weeks have tried to test the important support at $ 71.35-71.9 per barrel. Both times ended in a fiasco, which allows talking about the weakness of the sellers and inspires the bulls to continue the attack towards the lower boundary of the rising long-term trading channel.

Brent, the daily chart