USD/CHF has been quite volatile and corrective below 0.9980 to 1.0035 area from where it is still expected to slip lower towards 0.9850 and later towards 0.97 area. USD has been the dominating currency in the pair amid the recent rate hike by the US Fed. However, as trade jitters are increasing, USD is expected to lose some momentum in the process.

This week, Switzerland Retail Sales report was published with a significant decrease to -0.1% from the previous value of 2.9% which was expected to be at 2.6% and Manufacturing PMI report was published with a slight better-than-expected figure of 61.2, decreasing from 62.4 which was expected to be at 61.1. Though today Switzerland does not post macroeconomic reports, tomorrow CPI report is going to be published which is expected to decrease to 0.1% from the previous value of 0.4%.

On the other hand, despite lingering trade jitters, USD has been quite solid in light of upbeat economic reports, which helped the currency to sustain the bullish momentum in the pair. Ahead of US nonfarm payrolls which are due on Friday, today the economic calendar does not contain macroeconomic reports from the US amid Independence Day. But tomorrow, just the day before NFP, ADP Non-Farm Employment Change report is going to be published which is expected to increase to 190k from the previous figure of 178k and Unemployment Claims report is expected to increase to 231k from the previous figure of 227k.

As for the current scenario, CHF has been quite mixed amid the recent economic reports whereas USD has been consistently firm which may lead to further bullish momentum in the pair. However, pending macroeconomic reports from the US have sour outlook, so USD may look quite weak ahead of the news. Besides, worse-than-expected result may lead to weakness of USD against CHF.

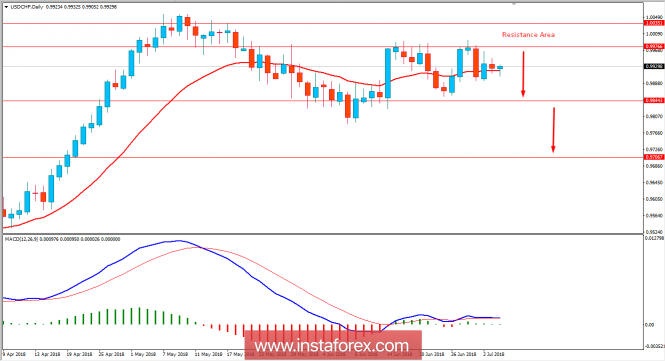

Now let us look at the technical view. The price is currently residing above the dynamic level of 20 EMA with certain bullish momentum. As the price remains below 0.9980 to 1.0035 area with a daily close, the bearish bias is expected to continue to push the price lower with a target towards 0.9850 and later towards 0.97 area. Though the Bearish Regular Divergence cannot be spotted clearly at the moment, the current corrective phase is expected to push the price lower in the coming days.