EUR/JPY has been quite impulsive with the bearish gains recently after rejecting the bulls off the 132.00 area with a daily close. It has been bearish for straight 5 days since the rejection and expected to push lower towards 129.50 area in the coming days from where it has equal chances of pushing higher and breaking below to push much lower in the future.

Despite the Trade War tensions and G-20 Meetings, EUR has been struggling to sustain the momentum it had over JPY earlier. Today EUR French Flash Manufacturing PMI report is going to be published which is expected to increase to 52.6 from the previous figure of 52.5, French Flash Services PMI report is expected to decrease to 55.7 from the previous figure of 55.9, German Flash Manufacturing PMI is expected to decrease to 55.5 from the previous figure of 55.9 and German Flash Services PMI is expected to increase to 54.6 from the previous figure of 54.5. Moreover, today Eurozone Flash Manufacturing PMI report is also going to be published which is expected to decrease to 54.7 from the previous figure of 54.9 and Flash Services PMI is also expected to decrease to 55.0 from the previous figure of 55.2.

On the other hand, today JPY Flash Manufacturing PMI report was published with a decrease to 51.6 from the previous figure of 53.0 which was expected to increase to 53.2 and BOJ Core CPI report was published with a decrease to 0.4% from the previous value of 0.5% which was expected to increase to 0.6%.

As of the current scenario, the EURO has been quite a pessimist about the economic reports to be published today whereas JPY has been quite worse with it as well. Despite the economic reports and events about global trade problems, JPY is quite ahead of EURO in all perspective and expected to dominate further whereas certain volatility may occur in the process leading to certain indecisions as well.

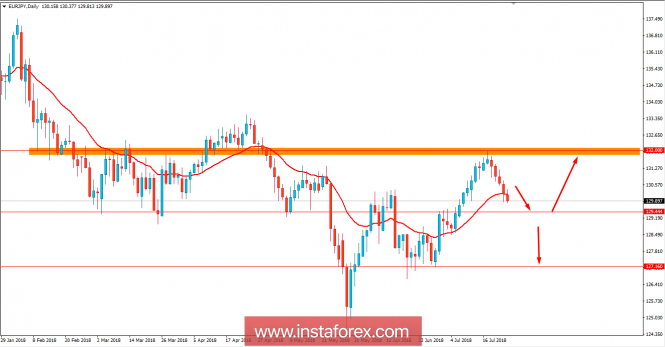

Now let us look at the technical view. The price is currently quite bearish having intersected by the dynamic level of 20 EMA just above the support area of 129.50 from where there are certain chances of price bouncing off and pushing higher towards 132.00 area in the future. Though having a daily close above 129.50 is expected to inject certain bullish pressure in the market but a daily close below 129.50 is expected to push the price much lower towards 127.00 area in the future. As of the current formation, there is a higher probability of price pushing further lower in the coming days.

SUPPORT: 129.50, 127.00

RESISTANCE: 132.00

BIAS: BEARISH

MOMENTUM: IMPULSIVE