EUR/CAD has been quite impulsive with the bullish gains recently which led the price to reside at the edge of 1.5350 area from where currently the price is climbing higher as expected. EUR has been quite soft with the recent economic reports whereas CAD has been affected by the recent trade jitters.

As the EU Economic Summit is going on since yesterday, certain volatility and indecisive momentum can be observed throughout the day. Additionally, today German Retail Sales report was published with a decrease to -2.1% from the previous value of 1.6% which was expected to be at -0.5%, German Import Prices increased to 1.6% from the previous value of 0.6% which was expected to be at 1.0%, French Prelim CPI was published as expected with a decrease to 0.1% from the previous value of 0.4%, French Consumer Spending increased to 0.9% from the previous negative value of -1.8% which was expected to be at 0.8%, and German Unemployment Change showed a decrease to -15k from the previous figure of -12k which was expected to be at -8k. Moreover, CPI Flash Estimate report was published with an increase to 2.0% as expected from the previous value of 1.9% and Core CPI Flash Estimate decreased to 1.0% as expected from the previous value of 1.1%.

On the other hand, today Canada's GDP report is due today which is expected to decrease to 0.0% from the previous value of 0.3%, RMPI is expected to increase to 1.2%, IPPI is expected to increase to 0.9% from the previous value of 0.5%. Besides, BOC Business Outlook Survey is going to be released a few hours before the market close today which is expected to inject certain volatility, mostly leading to further weakness of CAD as a result of the trade conflict.

As for the current scenario, EUR is expected to have an upper hand over CAD in the coming days as CAD could not sustain its bearish momentum. Though the eurozone's economic reports revealed mixed results, BOC policy decision may create indecisive mood in the pair, mostly leading to CAD weakness.

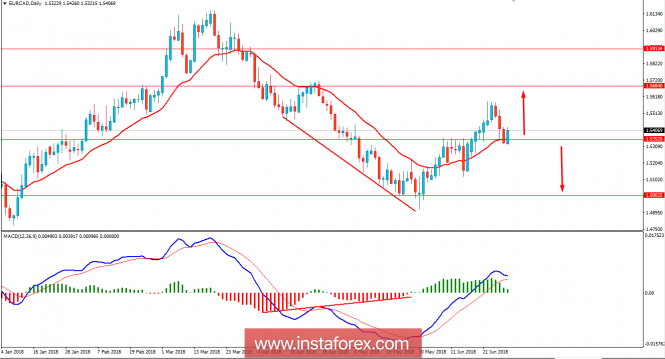

Now let us look at the technical view. The price has bounced off the 1.5350 area which is yet to get sealed with a daily close today. Ahead of the upcoming high impact economic reports and event of CAD today, certain volatility is expected to striker the market momentum. A daily close below or above 1.5350 will decide further definite pressure in the pair for the coming days.