Dear colleagues.

For the EUR / USD pair, the price is close to the key support for the upward movement of June 21 at 1.1621. For the GBP / USD pair, the price is in the correction zone from the rising structure on June 21. For the USD / CHF pair, we follow the downward structure from June 21. We continue to move downwards after the breakdown of 0.9863. For the USD / JPY pair, the price is in correction from the downward structure on June 15. For the EUR / JPY pair, the price has entered the equilibrium state. For the GBP / JPY pair, the continuation of the movement downwards is expected after the breakdown at 145.00. The range of 146.20 - 146.58 is the key resistance level.

Forecast for June 27:

Analytical review of currency pairs in the scale of H1:

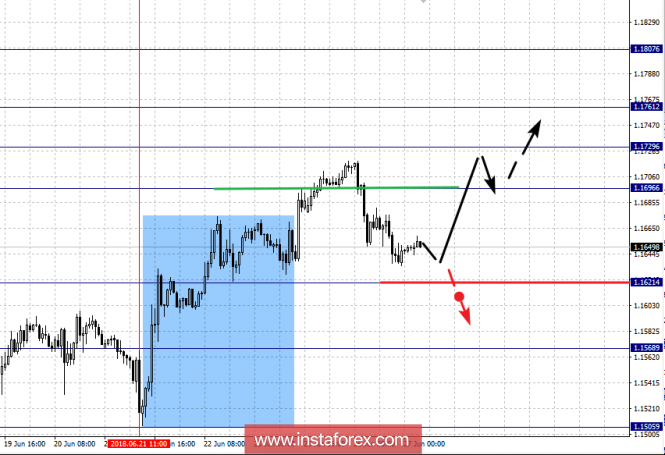

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1807, 1.1761, 1.1729, 1.1683, 1.1660, 1.1621 and 1.1568. Here, the price is close to lifting the upward structure from June 21, which requires breakdown at the level of 1.1621. In this case, the first potential target is 1.1568. The continuation of the upward movement is expected after the breakdown of 1.1696. Here, the first target is 1.1729. The breakdown of this level will allow us to count on the movement towards 1.1761. Near this level is the consolidation of the price. The potential value for the top is the level of 1.1807. Upon reaching this level, we expect a pullback downwards.

The main trend is the upward structure of June 21, the stage of deep correction.

Trading recommendations:

Buy: 1.1698 Take profit: 1.1727

Buy 1.1730 Take profit: 1.1760

Sell: 1.1618 Take profit: 1.1575

Sell: Take profit:

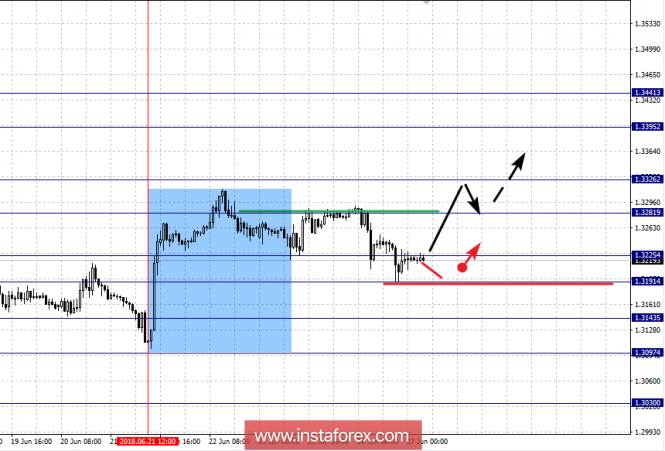

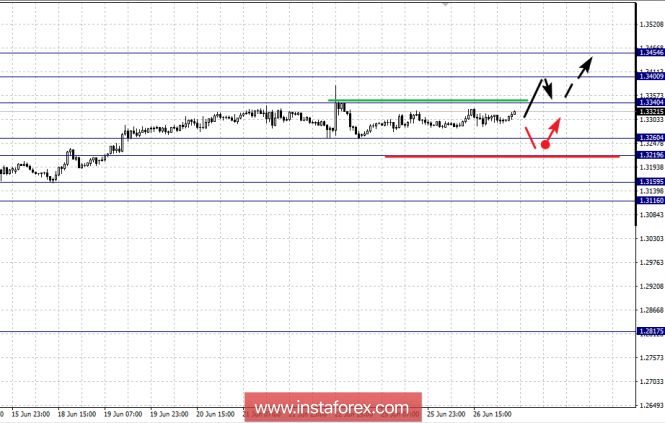

For the GBP / USD pair, the key levels on the scale of H1 are 1.3441, 1.3395, 1.3326, 1.3281, 1.3225, 1.3191, 1.3143, 1.3097 and 1.3030. Here, the price is in the zone of initial conditions for the upward movement of June 21. Short-term upward movement is expected in the area of 1.3281 - 1.3326. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3395. We consider the level of 1.3441 to be a potential value for the upward trend. From this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.3225 - 1.3191. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3143. This level is the key resistance for the bottom. Its breakdown will lead to a movement towards the level of 1.3097. The potential value for the bottom is the level of 1.3030.

The main trend is the formation of the potential for faiths from June 21.

Trading recommendations:

Buy: 1.3282 Take profit: 1.3324

Buy: 1.3328 Take profit: 1.3395

Sell: 1.3224 Take profit: 1.3192

Sell: 1.3188 Take profit: 1.3147

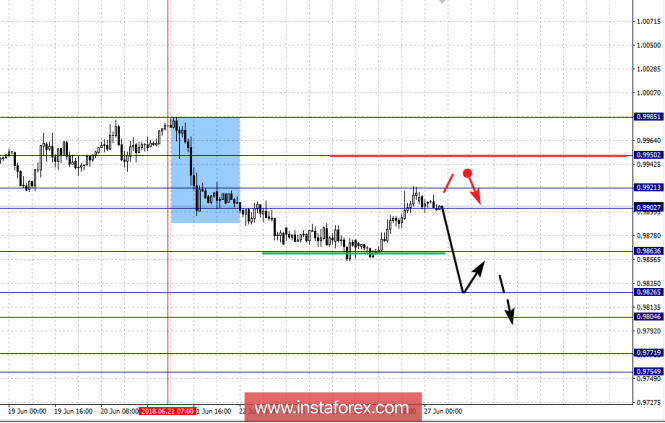

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9950, 0.9921, 0.9902, 0.9863, 0.9826, 0.9804, 0.9771 and 0.9754. Here, we follow the formation of a downward structure from June 21. Currently, the price is in correction. The continuation of the downward movement is expected after the breakdown of 0.9860. In this case, the target is 0.9826. In the area of 0.9826 - 0.9804 is short-term downward movement as well as the consolidation of the price. The breakdown at the level of 0.9804 will allow us to count on the movement towards the potential target of 0.9754. Upon the reaching this level, we expect consolidation in the area of 0.9771 - 0.9804.

Short-term upward movement is possible in the area of 0.9902 - 0.9921. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9950. This level is the key support for the downward structure from June 21.

The main trend is the formation of a downward structure from June 21.

Trading recommendations:

Buy: 0.9902 Take profit: 0.9920

Buy: 0.9925 Take profit: 0.9950

Sell: 0.9860 Take profit: 0.9828

Sell: 0.9824 Take profit: 0.9808

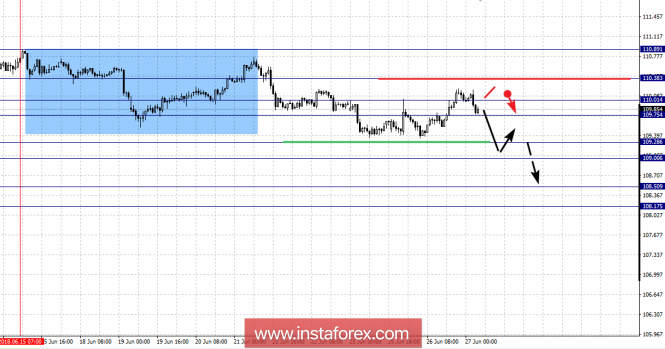

For the USD / JPY pair, the key levels on a scale are: 110.89, 110.38, 110.01, 109.75, 109.28, 109.00, 108.50 and 108.17. Here, we follow the downward structure of June 15. At the moment, the price is in the correction zone. Short-term downward movement is expected in the area of 109.28 - 109.00. The breakdown of the last value will lead to in-depth correction. Here, the target is 108.50. The potential value for the top is the level of 108.17. After reaching this level, we expect a rollback to the top.

Consolidated traffic is possible in the area of 109.75 - 110.01. The breakdown of the last value will lead to in-depth correction. Here, the target is 110.38. This level is the key support for the downward structure from June 15.

The main trend is the downward structure of June 15.

Trading recommendations:

Buy: 109.75 Take profit: 110.00

Buy: 110.04 Take profit: 110.35

Sell: 109.28 Take profit: 109.02

Sell: 109.00 Take profit: 108.52

For the CAD / USD pair, the key levels on the H1 scale are: 1.3454, 1.3400, 1.3340, 1.3260, 1.3219, 1.3159 and 1.3116. Here, we follow the local upward structure of May 31. The continuation of the upward movement is expected after the breakdown of 1.3340. In this case, the target is 1.3400. Near this level is the consolidation of the price. The potential value for the top is the level of 1.3454. From this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.3260 - 1.3219. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3160. The range of 1.3159 - 1.3116 is the key support for the top.

The main trend is the upward structure of May 31.

Trading recommendations:

Buy: 1.3340 Take profit: 1.3400

Buy: 1.3402 Take profit: 1.3452

Sell: 1.3260 Take profit: 1.3220

Sell: 1.3216 Take profit: 1.3160

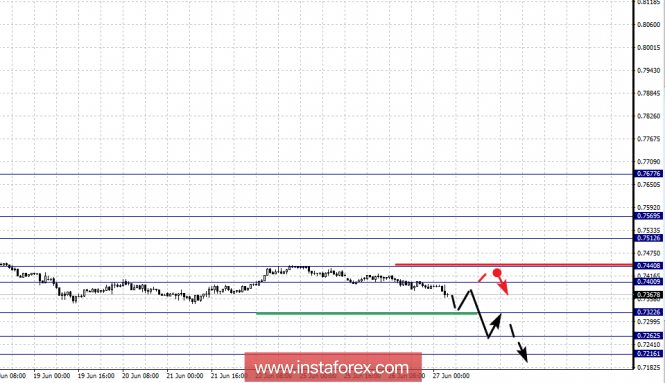

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7569, 0.7512, 0.7440, 0.7400, 0.7322, 0.7262 and 0.7216. Here, we continue to follow the downward cycle from June 6. The continuation of the downward movement is expected after the breakdown of the level of 0.7322. Here, the target is 0.7262. In the area of 0.7262 - 0.7216 is the consolidation and from here, we expect a key upward turn.

Consolidated traffic is possible in the area of 0.7400 - 0.7440. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7512. We expect initial conditions for the upward cycle to reach the level of 0.7569.

The main trend is the downward cycle from June 6, the correction stage.

Trading recommendations:

Buy: 0.7442 Take profit: 0.7510

Buy: 0.7514 Take profit: 0.7566

Sell: 0.7320 Take profit: 0.7264

Sell: 0.7260 Take profit: 0.7218

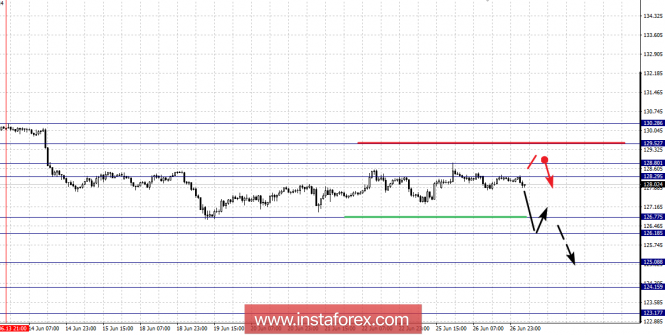

For the EUR / JPY pair, the key levels on the scale of H1 are: 129.52, 128.80, 127.80, 126.77, 126.18, 125.08 and 124.15. Here, the situation has entered the equilibrium state. Short-term downward movement is expected in the area of 126.77 - 126.18. The breakdown of the last value will lead to a movement towards the level of 125.08. Near this level is the consolidation of the price. The potential value for the bottom is the level of 124.15. From this level, we expect a rollback upward.

Short-term upward movement is possible in the area of 127.80 - 128.29. The breakdown of the last value will lead to in-depth correction. Here, the target is 128.80. This level is the key support for the downward structure from June 13. Its breakdown will lead to the development of an upward structure. In this case, the potential goal is 129.52.

The main trend is the equilibrium state.

Trading recommendations:

Buy: 127.80 Take profit: 128.25

Buy: 128.32 Take profit: 128.80

Sell: 126.75 Take profit: 126.20

Sell: 126.14 Take profit: 125.15

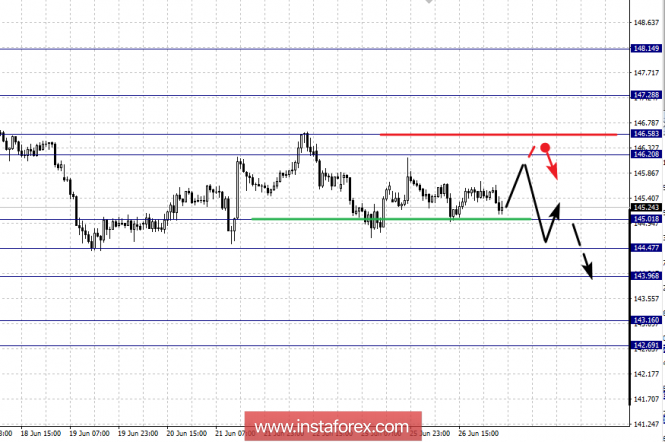

For the GBP / JPY pair, the key levels on the scale of H1 are: 146.58, 146.20, 145.01, 144.47, 143.96, 143.16 and 142.69. Here, the price is in correction from the downward structure on June 7. The continuation of the downward movement is expected after the breakdown of the level of 145.01. Here, the first target is 144.47. In the area of 144.47 - 143.96 is short-term downward movement as well as the consolidation of the price. The breakdown at 143.95 should be accompanied by a pronounced movement towards the level of 143.16. The potential value for the bottom is the level of 142.69. From this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 146.20 - 146.58. This range is the key support for the downward structure. Passing the price will lead to the development of the upward movement. In this case, the target is 147.28. Near this level is the consolidation of the price.

The main trend is the downward cycle from June 7, the correction stage.

Trading recommendations:

Buy: 146.20 Take profit: 146.55

Buy: 146.65 Take profit: 147.25

Sell: 145.00 Take profit: 144.50

Sell: 144.41 Take profit: 144.00

The material has been provided by InstaForex Company - www.instaforex.com