EUR/USD has been quite corrective and volatile recently after breaking below the 1.2350 price area with an impulsive daily close. Due to the observance of the Easter Monday, no economic reports are due today on the EUR side. Later this week, German Retail Sales report is expected to show an increase to 0.7% from the previous negative value of -0.7% and CPI Flash Estimate report is going to be published which is expected to increase to 1.4% from the previous value of 1.1%. Looking back, USD failed to sustain its bearish momentum in the pair due to worse economic reports which failed to provide a fresh impetus for the currency. Ahead of the high impact economic reports this week including Non-Farm Employment Change, Average Hourly Earnings and Unemployment rate, today US ISM Manufacturing PMI report is going to be published which is expected to have a slight decrease to 60.1 from the previous figure of 60.8, Construction Spending is expected to increase to 0.4% from the previous value of 0.0%, ISM Manufacturing Prices is expected to decrease to 72.5 from the previous figure of 74.2, and Final Manufacturing PMI is expected to be unchanged at 55.7. As for the current scenario, the US economic reports are forecasted to be quite optimistic that is likely to make a positive impact on the USD, thus pushing the price further downward in the coming days. Ahead of the high impact economic reports on Friday, which are also predicted to have better readings, the pair is expected to be quite USD biased.

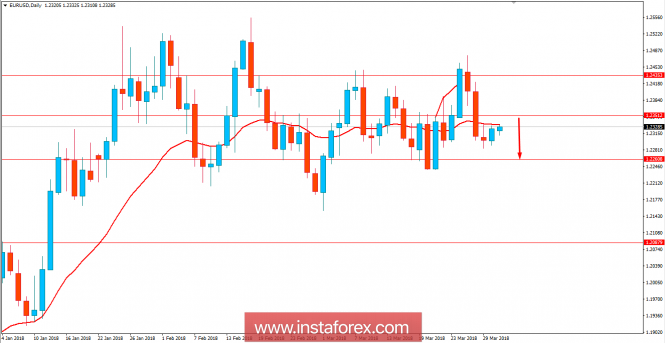

Now let us look at the technical view. The price is currently residing at the edge of dynamic level 20 EMA resistance and also below the important price area of 1.2350 from where it is expected to push lower towards 1.2260 and later towards 1.2080 support area in the coming days. Despite having a bullish daily close on Friday, the bears are still quite strong currently and as the price remains below 1.2350 with a daily close, the bearish bias is expected to continue.