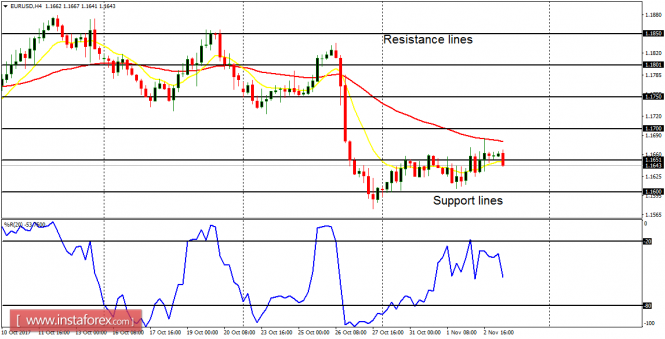

EUR/USD: The EUR/USD is still consolidating in the context of a downtrend. When volatility returns to the market, it would most probably favor bears, for the price is expected to reach the support lines at 1.1600 and 1.1550, which would be tested between today or next week.

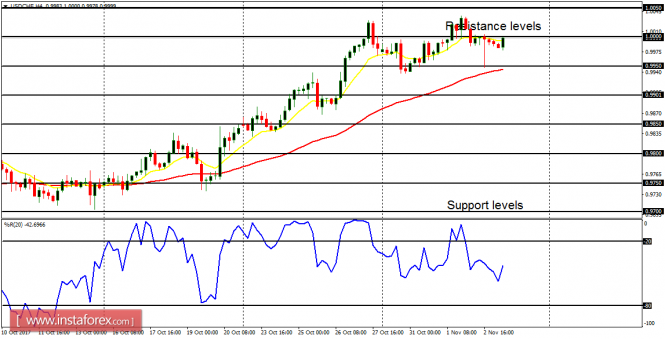

USD/CHF: This currency trading instrument is moving sideways in the context of an uptrend. A rise in momentum is expected today or early next week, which would either take price above the resistance level at 1.0050 or take it below the support level at 0.9900. Price currently hovers around the psychological level at 1.0000.

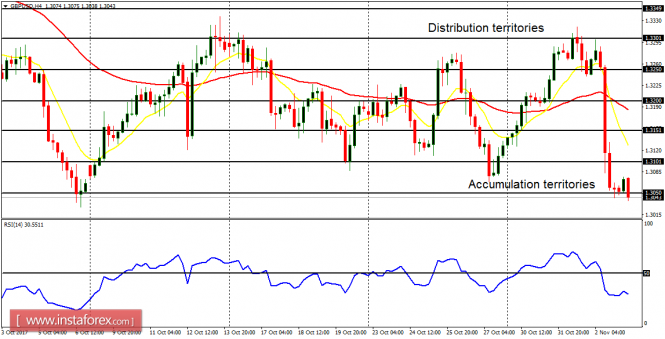

GBP/USD: The GBP/USD dropped more than 200 pips yesterday. Other GBP pairs dropped, while the EUR/GBP shot upwards. Generally, the drop, after the distribution territory at 1.3300 was tested, is about 250 pips. Price is now below the distribution territory at 1.3050, going towards the accumulation territory at 1.3000. There is a Bearish Confirmation Pattern in the 4-hour chart, and a further drop is highly probable.

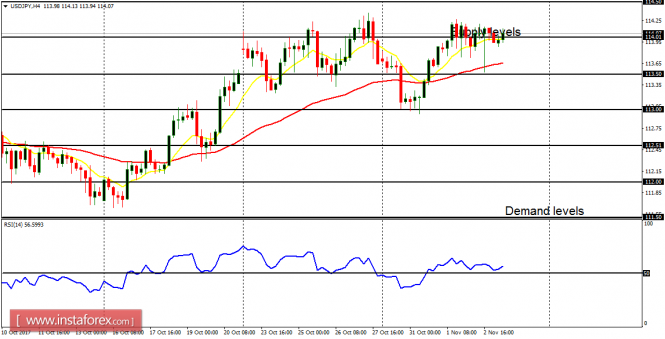

USD/JPY: The USD/JPY has not done much this week, but the bias on the market is essentially bullish. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. It is highly probable that when momentum returns to the market, it would be in favor of bulls. The next targets could be the supply levels at 114.50 and 115.00 would be tested very soon.

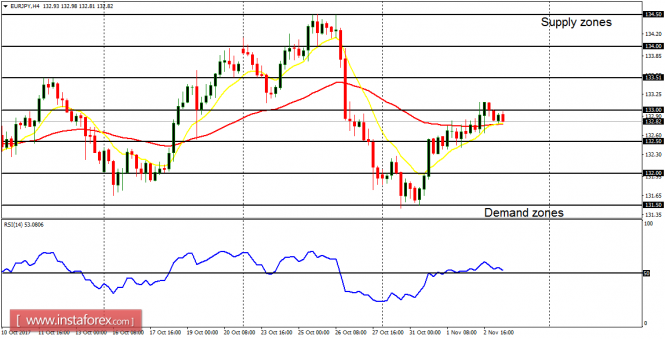

EUR/JPY: A bullish signal has almost been generated on this cross, for the EMA 11 has crossed the EMA 56 to the upside. The RSI period 14 is above the level 50. Although the price is currently consolidating, it would soon move above the supply zone 133.50, thus creating a vivid Bullish Confirmation Pattern in the market.