Trading plan for 20/10/2017:

The US Senate approved the budget for 2018 yesterday. In the first reaction, EUR/USD fell from around 1.1850 to 1.18. USD/JPY shot up to 113.30 and GBP/USD went down at 1.31. US Dollar gains versus other majors without exception and in the Asian session, the weakest are JPY and NZD and CHF.

On Friday 20th of October, the event calendar is quite busy with important economic news releases, but mainly during the US session, when Canada will post Consumer Price Index and Retail Sales data and the US will reveal Existing Home Sales. Moreover, there is a scheduled speech from BOJ Governor Haruhiko Kuroda early in the morning.

EUR/USD analysis for 20/10/2017:

It is clear that in the absence of important macroeconomic publications and central bank meetings, politics has dominated the markets. The tensions over Catalonia and tough government positions in Madrid have not been able to weaken the euro (although on the black Monday the European stock markets were affected). At night, the US Dollar jumped after the Senate approved the 2018 budget. This is a big step towards a smooth implementation of the reform of the tax system. In this context, it is important to remember the collapse of the NZD after the formation of the government without the Conservative Party and the weekend elections in Japan. In this environment and ahead of the ECB meeting, expectations should narrow the range of fluctuations with a tendency to moderate appreciation of the US Dollar.

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The market tried to rally to 61% Fibo at the level of 1.1876, but was again rejected even lower, at the level of 1.1860. Currently, the price is back under 1.1800 and the overbought market conditions indicate a possible slide further towards the next technical support at the level of 1.1766.

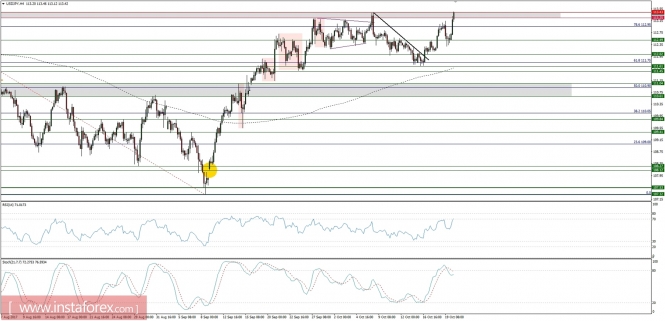

Market Snapshot: USD/JPY at the key technical resistance

The price of USD/JPY is trading at the level of 113.43, which is the previous swing high and the key technical resistance. The market conditions are overbought, but in case of a sudden spike, the next technical resistance is seen at the level of 114.37.

Market Snapshot: Gold get rejected at resistance

The price of Gold got rejected at the technical resistance at the level of $1,289 and currently is dropping towards the key technical support at the level of $1,276. The market conditions are still oversold, so the price might bounce form the support and keep trading sideways before any major breakout.