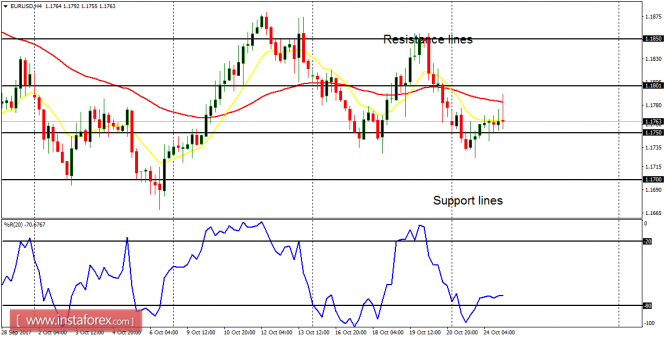

EUR/USD: The EUR/USD has not moved significantly this week. However, a movement that is directional is expected soon, which either would take price above the resistance line at 1.1850 or below the support line at 1.1700. Until one of the two boundaries are breached, the bias on the market would be neutral.

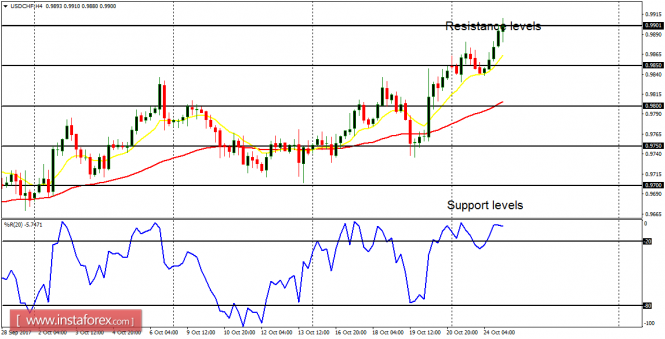

USD/CHF: The USD/CHF has gone upwards this week, gaining 60 pips and testing the resistance level at 0.9900. The resistance level would be breached to the upside today or tomorrow as price targets other resistance levels at 0.9950 and 1.0000 (which would be difficult to breach to the upside, for it is a psychological level).

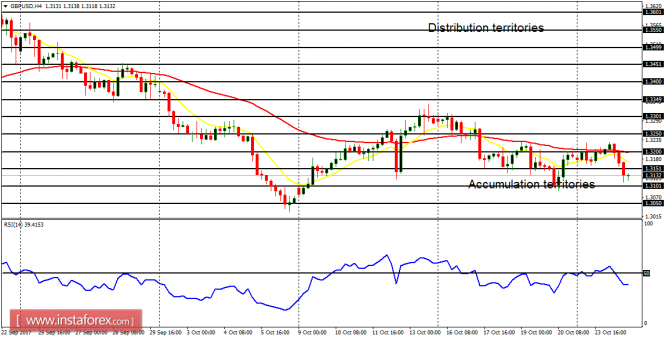

GBP/USD: The Cable went downwards on Tuesday, to put more emphasis on the recent bearishness in the market. There is a Bearish Confirmation Pattern in the 4-hour chart, and the price has moved below the distribution territory at 1.3150, as further bearish movement is anticipated. The next targets for bears are located at the accumulation territories at 1.3100 and 1.3050.

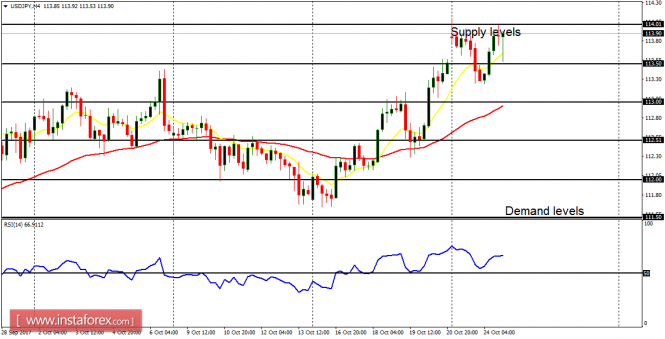

USD/JPY: This currency trading instrument is bullish in the short-term (though quite volatile). The supply level at 114.00 has been tested and it would be tested again, as price journeys further upwards towards another supply levels at 114.50 and 115.00, which would require a strong bullish momentum.

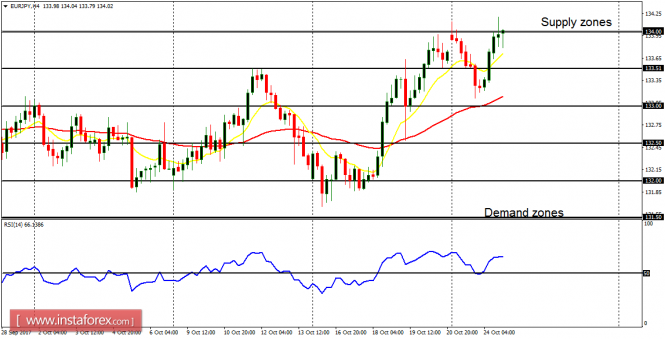

EUR/JPY: What happened on the EUR/JPY is quite similar to what happened on USD/JPY. The market is bullish but volatile. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. The supply zone at 134.00 has been tested and it would soon be breached to the upside as price journeys further northwards. As long price is above the demand zone at 132.50, the outlook on the market would remain bullish.