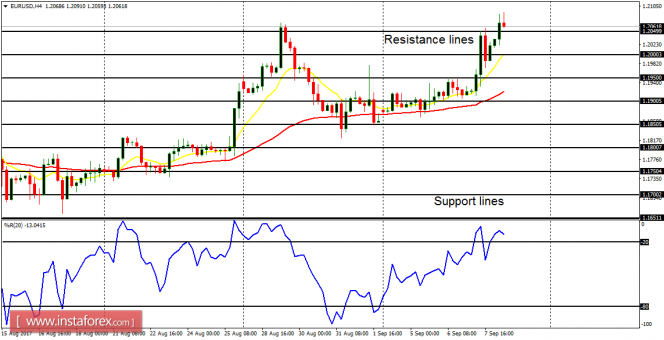

EUR/USD: The ongoing northwards movement that has been witnessed on this pair has put an end to the short-term neutrality on it. Price has gained about 170 pips and that has resulted in a bullish bias. Further northward movement may bring price towards the resistance lines at 1.2100, 1.2150 and at last, 1.2200.

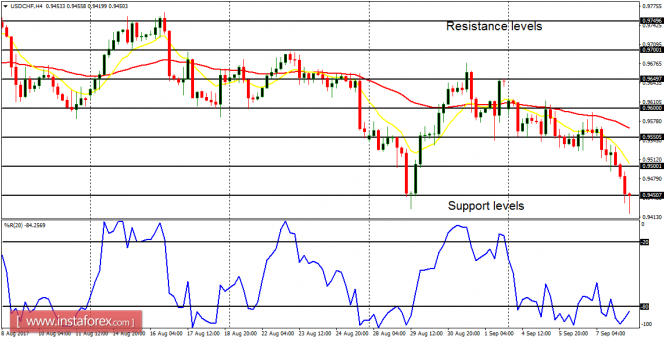

USD/CHF: The USD/CHF has gone further downwards this week, because the EUR/USD has gone upwards. Price has lost about 170 pips, leading to a Bearish Confirmation Pattern in the market. The bearish movement is expected to continue, as price goes towards the support line at 0.9400, which would be tested today or next week.

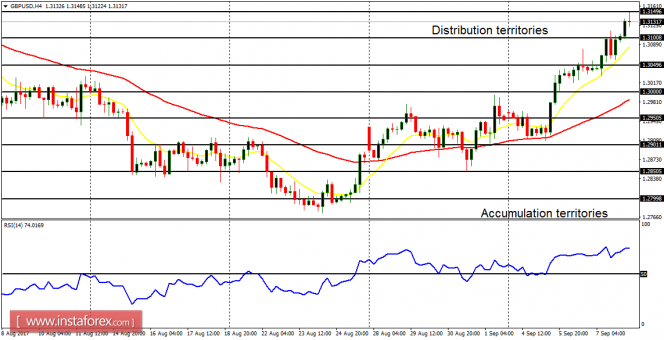

GBP/USD: This currency trading instrument has gained close to 200 pips this week, leading to a strong bullish bias on the market. The next targets for bulls are located at the distribution territories at 1.3150 (which has been previously tested), 1.3200 and 1.3250.

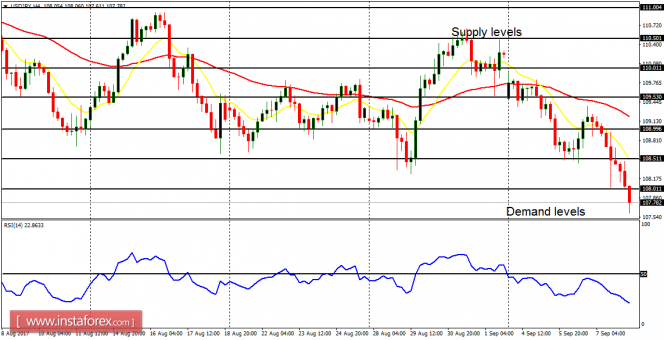

USD/JPY: The USD/JPY has dropped by at least, 220 pips this week, leading to a clean Bearish Confirmation Pattern in the market. Price is now below the supply level at 108.00, going towards the demand level at 107.50 (which may be breached to the downside soon). The southward movement is made possible by the weakness in USD as well as the stamina in JPY. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50, portending continual selling pressure.

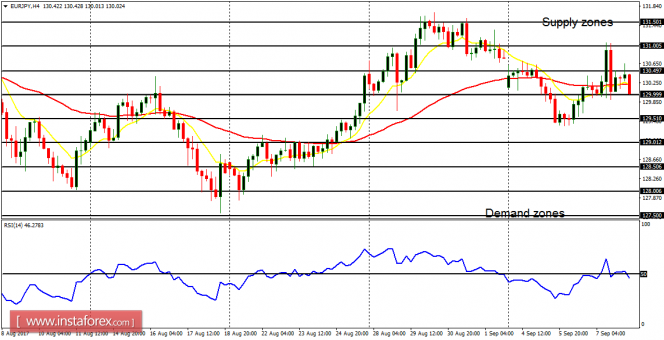

EUR/JPY: This cross is also is getting neutral and the market is getting choppy. Should the current consolidation continue, it could lead to a neutral bias on the market. On the other hand, a breakout to the upside or to the downside is expected (at least 200 pips to the upside or to the downside), which would bring an end to the current neutrality and lead to a directional movement.