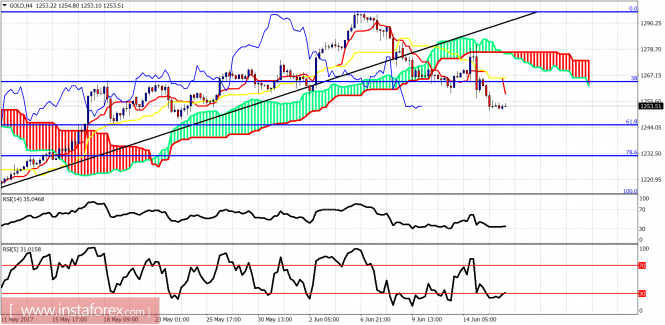

Gold price has reached the $1,250 area as we expected from $1,280 and higher. Trend is bearish. I believe that Gold weakness will continue and we might see even below $1,245 where important support is found. However Gold bears should be cautious as the time for a bullish reversal is approaching.

Red line - trend line support

Blue line - long-term support trend line

Gold price is approaching the red trend line support after being rejected at the black long-term trend line resistance. Price is above the weekly cloud. A bounce off the weekly Kumo at $1,245 will be a very bullish sign. As I have been saying last week, Gold was not ready for a big breakout. I believe the time for a big breakout has come closer and I remain longer-term bullish.

The material has been provided by InstaForex Company - www.instaforex.com