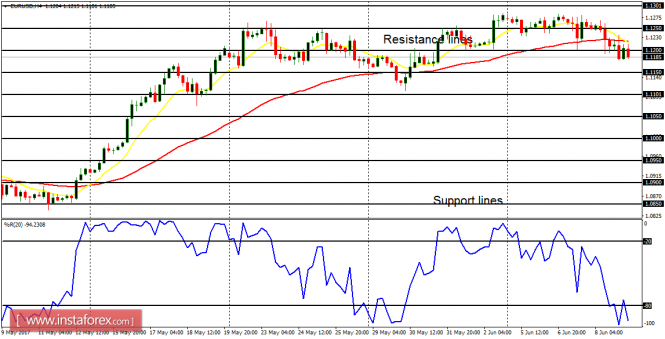

EUR/USD: There is a bearish threat on this pair. Though the price has consolidated so far this week, and it is gradually going downwards. A movement below the support line at 1.1150 would lead to a bearish signal, while a movement above the resistance line at 1.1300 would result in a bullish signal. A movement towards the resistance line at 1.1250 would make price return to the neutral territory.

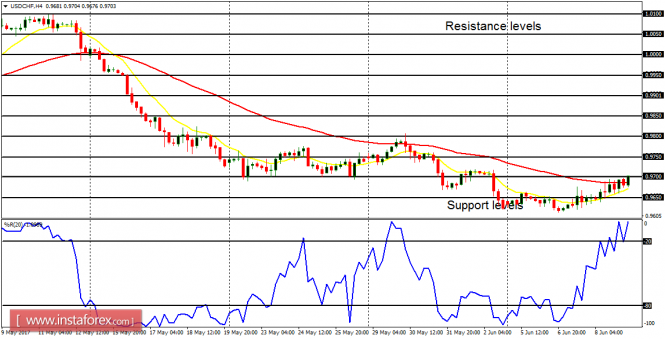

USD/CHF: The USD/CHF is gradually moving upwards, following the consolidation movements of Monday and Tuesday. A movement above the resistance level at 0.9800 would result in a bullish bias; while a drop from here would result in the resumption of the recent bearish bias on the market.

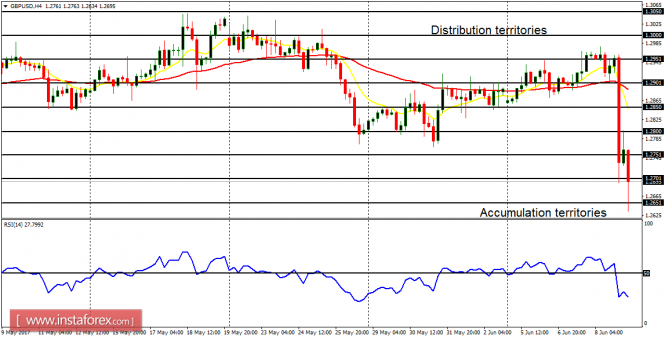

GBP/USD: There was a significant pullback on the GBP/USD yesterday, losing about 300 pips, and testing the accumulation territory at 1.2700. The bearish movement was in agreement with the expected bearishness on GBP pairs for the month of June. This has forced a Bearish Confirmation Pattern to appear in the chart, and further bearish movement is possible next week.

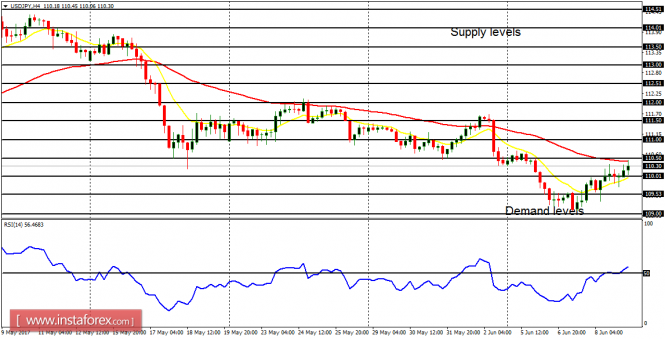

USD/JPY: In the last few days, this currency trading instrument has been going upwards gradually, though in the context of a downtrend. A southwards movement from here would result in the confirmation of the recent bearish bias, while further northwards movement would lead to a Bullish Confirmation Pattern. The RSI period 14 is above the level 50, and the EMAs are yet to confirm a bullish signal.

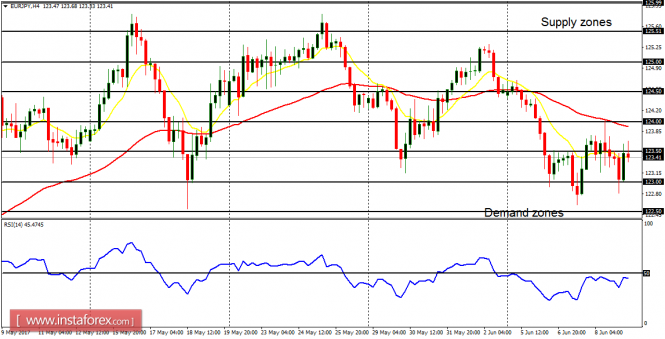

EUR/JPY: This cross pair has dropped 140 pips this week, leading to a bearish outlook on the market, which was well anticipated. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. The market is currently volatile, but a further bearish movement is expected.