Trading plan for 18/05/2017:

Sentiment on the Asian stock market is weak and the US Dollar remains close to the lows as the Washington scandal maintains uncertainty about the future of Trump's economic policy. At the currency market, the Australian Dollar is the strongest after very good data on the labor market. The commodity market is stable for now.

On Thursday 18th of May, the event calendar is quite busy with important economic releases, so market participants will pay attention to Retail Sales With Auto Fuel data from the UK, ECB Monetary Policy Meeting Accounts, and Unemployment Claims data from the US. There is a speech from ECB President Mario Draghi scheduled for later in the day.

GBP/USD analysis for 18/05/2017:

Another set of data from the UK is scheduled for release today at 09:30 am GMT and this time it is Retail Sales With Auto Fuel data. Market participants expect the sales to jump 1.2% after a -1.9% decline last month. On a yearly basis, the sales should jump as well from the level of 1.7% to the level of 2.2%. Retail sales are the primary gauge of consumer spending, which accounts for the majority of overall economic activity. If the expectations are accurate, news of firmer growth will alleviate, if only slightly, concerns that stronger inflation is taking its toll on retail sales. In the earlier report, the UK consumer price index accelerated to a 2.7% annual gain in April, touching a 3.5 year high, so the slowdown in retail spending in this year's first quarter will be attributed to higher inflation.

Let's now take a look at the GBP/USD technical picture on the H4 time frame. The market tested the level of 1.2990 three times already and failed to break out above it so far. The round psychological level of 1.3000 still attracts the price, but the current market conditions look overbought and the momentum indicator starts to show a bearish divergence. In a case of a sell-off caused by worse than expected data, the immediate technical support is seen at the level of 1.288, but any violation of the golden trend line support will lead to the test of the next technical support at the level of 1.2844.

EUR/USD analysis for 18/05/2017:

The ECB Monetary Policy Meeting Accounts report is scheduled for release at 11:30 am GMT. This report contains the texts of the ECB Governing Council members' speeches on detailed assessments of economic conditions that influence the interest rates decision. The other news that might influence EUR/USD is the economic data from the US that will be released at 12:30 pm GMT in form of the Unemployment Claims. The recent data from the US job market were good, so market participants expect a trend continuation here and predict the number of unemployed people in the US at the level of 240k (236k last week). Any number below 240k might give a reason for the US Dollar bulls to step into the market and buy it.

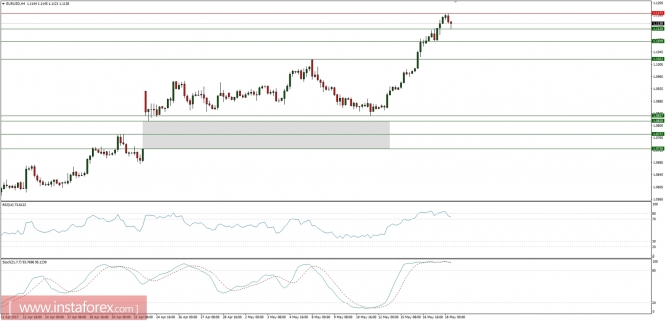

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The bulls have managed to make another marginal higher high at the level of 1.1171, but the move upward looks overstretched a little. The market conditions look overbought at this time frame and the momentum indicator shows a clear bearish divergence. The immediate support is seen at the level of 1.1120 and the next one is seen at the level of 1.1079.

Market snapshot: Gold under important resistance

The price of Gold have managed to retrace 61% of the previous swing down and now is trading at the level of $1,256 at the time of writing. The further advance was stopped by the navy trend line and supply zone between the levels of $1,259 - $1,270. The market conditions look overbought, but there is no clear sign of a reversal yet. The immediate support is seen at the level of $1,253.