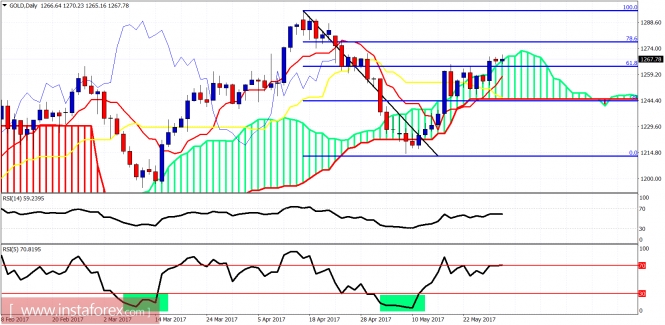

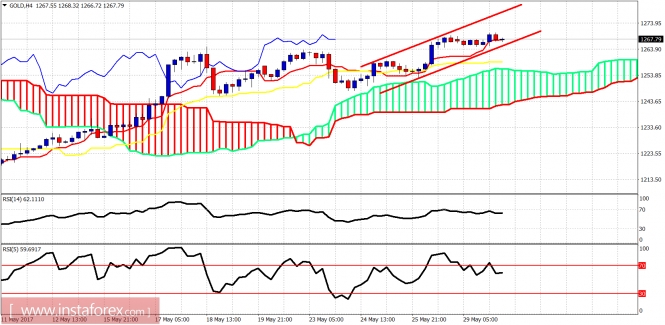

Gold price continues to make higher highs. The trend remains bullish but we have several bearish divergence signals. Gold is likely to make a pullback towards $1,200 before the up trend resumes towards $1,400. I do not expect gold to make any major breakout now.

Gold is trading above both the tenkan- and kijun-sen indicators. The trend is bullish. However, the RSI (5) produces some bearish divergence signals. I believe bulls should be extremely cautious as a break below $1,263 will open the way for a bigger correction towards $1,243 at least.