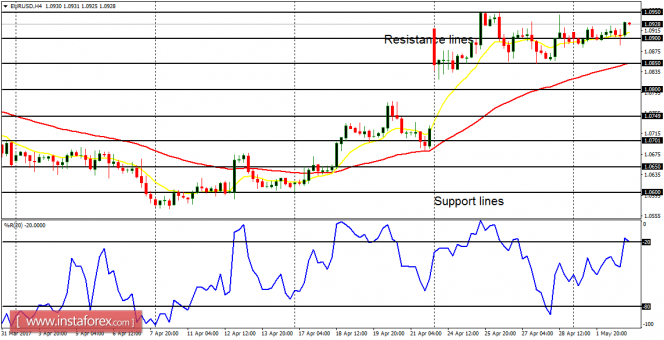

EUR/USD: The EUR/USD pair has moved sideways so far this week in the context of an uptrend. There is a Bullish Confirmation Pattern in the market and a further bullish movement is possible until bears come in to push price lower. The bears are expected to resume their pressure this week or next.

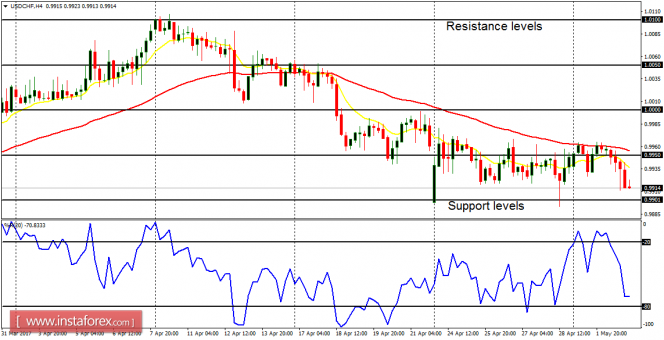

USD/CHF: The USD/CHF pair trended lower yesterday in the context of a downtrend. There is a Bearish Confirmation Pattern in the market, and a further bearish movement is possible until EUR/USD drops significantly. That is the only condition that can cause a meaningful rally on USD/CHF.

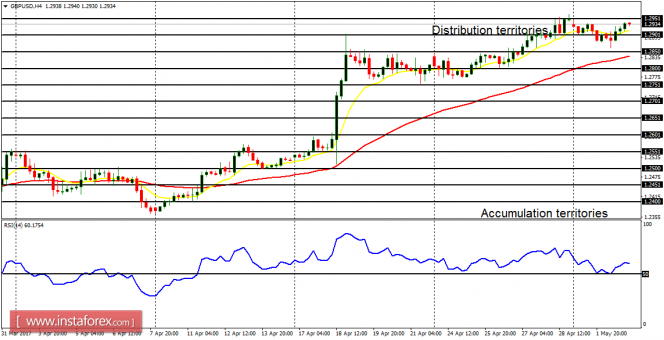

GBP/USD: The Cable is now going northwards slowly and gradually. There is still a visible bullishness in the market and the distribution territories at 1.2950, 1.3000, and 1.3050 could be tested within the next few days. Short trades are not currently recommended. Rather, bearish corrections should be taken as opportunities to go long again.

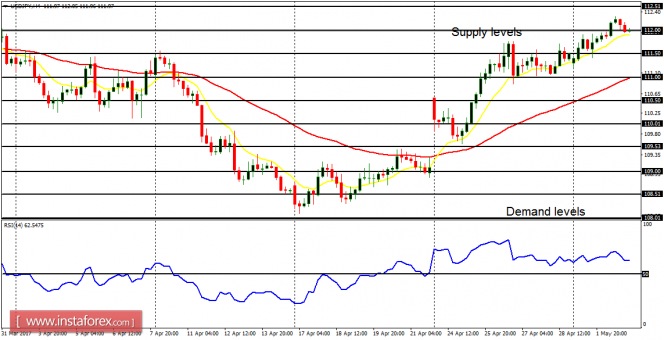

USD/JPY: This currency trading instrument is also making some bullish efforts. The supply levels at 112.50 and 113.00 may be tested, as price goes further upwards. At last, there would be a pullback in the market, which could threaten the current bullish bias, especially when price pulls back by about 250 pips.

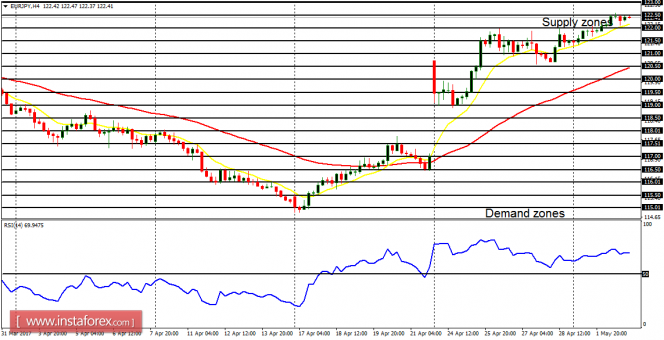

EUR/JPY: The EUR/JPY pair has been attempting to trend further upwards, following the gap-up that happened last week. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. However, price would eventually come down, because the outlook on JPY pairs is bearish for this month.