Trading plan for 27/04/2017:

Trump's tax plan did not bring surprises and financial markets cooled earlier optimism. The Bank of Japan kept the policy unchanged without significantly affecting the USD/JPY rate. Reports that the White House does not intend to break the Nafta agreement, are helping CAD and MXN. In Asia, Nikkei loses 0.2 percent and Shanghai Composite is trading flat.

On Thursday 27th of April, the main economic event is the European Central Bank interest rate decision and press conference, but global investors will keep an eye on Durable Goods Orders and Unemployment Claims data as well.

EUR/USD analysis for 27/04/2017:

The ECB interest rate decision is scheduled for release at 11:45 am GMT and the press conference is scheduled for 12:30 pm GMT. Market participants do not expect any changes in interest rates (it is likely to stay at the level of 0.0%), deposit facility rate (-0.40%), marginal lending facility (0.25%) and asset purchase target (EUR80B). Nevertheless, the more important is the press conference and the overall tone of Mario Draghi's statement. Any hawkish clues regarding an interest rate hike in June 2017 or sooner will be unexpected and bullish for the euro.

Let's now take a look at the EUR/USD technical picture on the H4 timeframe. The market had made a marginally higher high at the level of 1.0950, but the RSI indicates a bearish divergence and the trading conditions are now overbought on this time frame. The next support is seen at the level of 1.0854 and if Draghi disappoints market participants, then this support will be tested in no time and the market might start attempts to fill the weekend gap between the levels of 1.0730 - 1.0820.

USD/JPY analysis for 27/04/2017:

The Durable Goods Orders and Unemployment Claims data are both scheduled for release at 12:30 pm GMT. On a monthly basis, the Durable Goods Orders are expected to decline to 1.5%, while the previous month seen a gain of 1.7%. Nevertheless, on the positive note, that figure would be the third straight increase and the year-on-year trend is on track to remain positive too. On the other hand, a downside surprise would weigh on sentiment in the wake of the softer PMI figures and raise new questions about next week's April reading of the ISM Manufacturing Index.

Let's now take a look at the USD/JPY technical picture on the H4 timeframe. The pair managed to retrace 50% of the previous swing down and the price was capped at the level of 111.80. Currently, the market is trading between 38%Fibo at the level of 110.94 and 50%Fibo at the level of 111.81 as it awaits the fundamental data. The trading conditions are overbought but there is no visible bearish divergence. Better-than-expected data will likely make USD/JPY move higher towards the next technical resistance at the level of 112.21.

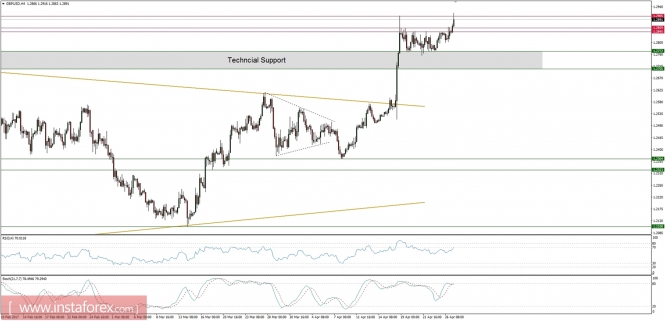

Market snaphot: GBP/USD breaks out of the range

After some time, the GBP/USD pair broke out of the trading range/bullish flag pattern and made a marginal higher high this morning at the level of 1.2910. Nevertheless, the trading conditions are overgounght and the bearish divergence is starting to form between the price and the momentum oscillator. The longer-term bias remains bullsih as long as the techcnial support at the level of 1.2705 - 1.2772 is clearly violated.