Global macro overview for 06/04/2017:

The Minutes of the FOMC Meeting back on March 15th contained some hawkish commentaries. Most officials in the Federal Reserve saw the institution beginning to shrink its balance sheet which is warranted and mentioned starting the process later this year. "There was nothing to change the view that 2017 will see three rate hikes, but if rate hikes happen concurrently with a shrinking Fed balance sheet, that may have an impact on the terminal Funds rate" we can read in the official FED Minutes. The considered balance sheet reduction is around $4.5 trillion for this year and it will be viewed as effectively as an additional rate hike. In conclusion, the institution led by Janet Yellen is pleased with the advance in the US economy but expressed some concerns regarding high levels of stock prices. The general outlook regarding the further interest rate hikes has not been changed.

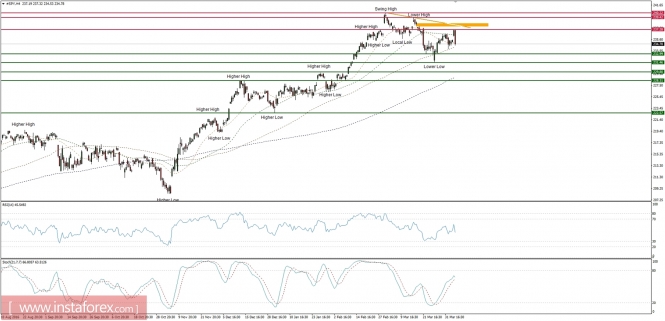

Let's now take a look at the SPY (SP500 ETF) technical picture at the H4 time frame. The market reaction to the FED Meeting Minutes was bearish and the index fell to the level of 235 points. The gap around the level of 238 is still not filled and the golden trend line has not been violated as well. The most important technical support at the level of 231 is still valid and due to the increasing momentum and lack of any negative divergence the intraday outlook remains bullish.

from www.instaforex.com