AUD/JPY had an impulsive bullish counter move after weeks of a non-volatile bearish trend. The pair is still in the bearish trend, but it seems quite exhausted after a good amount of impulsive bearish pressure since the bounce off the trend line retest. Today AUD had positive high-impact economic events, which impacted the overall performance of this pair today. Today AUD Employment Change report was published with a positive result of 60.9k (vs. 20.3k expected), which in fact is a great jump from the previous value of 2.8k. Addition to the Employment Change, AUD Unemployment Rate was unchanged at 5.9% as expected and MI Inflation Expectations was 4.1% up, which previously was at 4.0%. On the other hand, today JPY had M2 Money Stock, which showed an increase of 4.3% (vs. 4.2% expected) and 30-y Bond Auction report was also released today with a slight change at 0.80|3.1 (vs. 0.82|3.1 previously). In comparison to JPY events, AUD had a bigger upper hand today, which helped the currency to nearly engulf two days of bearish price action. The Employment Change had a big impact on the Australian economy and AUD is expected to gain more strength in the coming days.

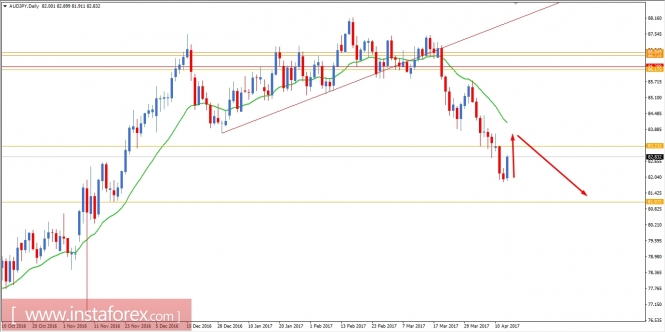

Now let us look at the technical view. After the upbeat Employment Change report, the price has impulsively moved up today. Currently, the price is heading towards the dynamic resistance of 20 EMA; and if the price shows any kind of bullish rejection after retesting the 20 EMA as resistance, we will be looking forward to sell in this pair with a downward target at 81.10. On the other hand, if the price violates the 20 EMA and shows a daily close above the 20 EMA, then we will change our bearish bias to bullish and will target 86.15 as the upward target.