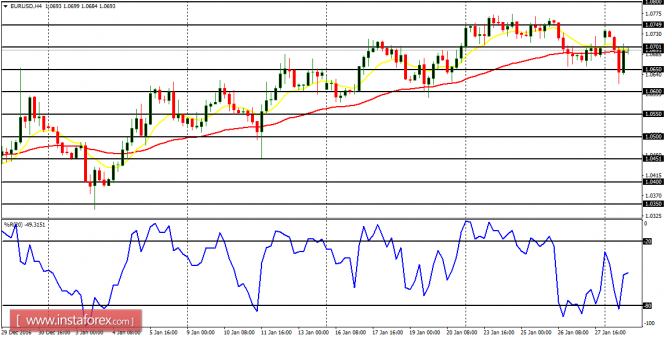

EUR/USD: This pair experienced a minor pullback on January 30, in the context of an uptrend. As long as price does not go below the support line at 1.0500, the uptrend would be valid. Normally, price may go above the resistance lines at 1.0750, 1.0800 and 1.0850 this week.

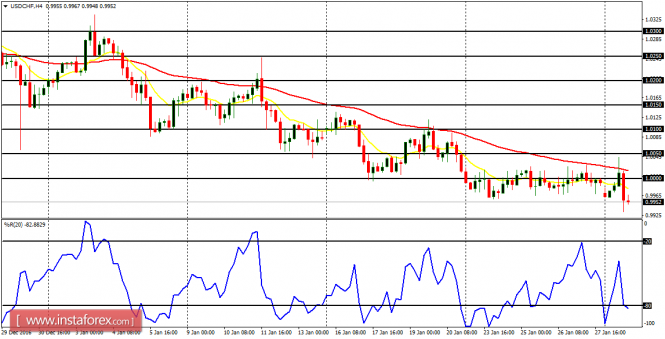

USD/CHF: The USD/CHF only went flat throughout last week, in the context of a downtrend. The market has, interestingly oscillated around the psychological level at 1.0000. Should the market stay around that level for the next several trading days, the bias on the market would turn neutral.

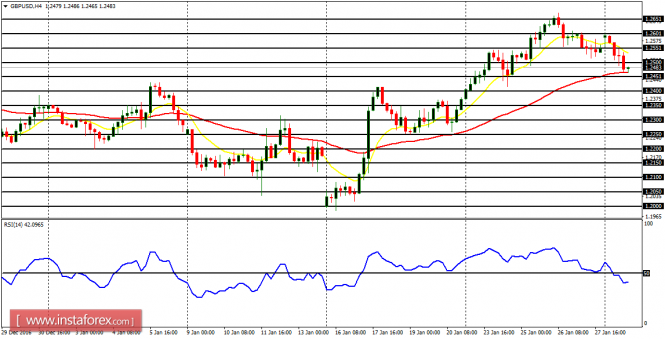

GBP/USD: The Cable has continued the bearish correction it started last Friday. Further bearish correction would pose a threat to the recent bullish outlook, especially when the accumulation territory at 1.2300 is breached to the downside. Should price rally significantly from here, it would help re-establish the recent bullish bias.

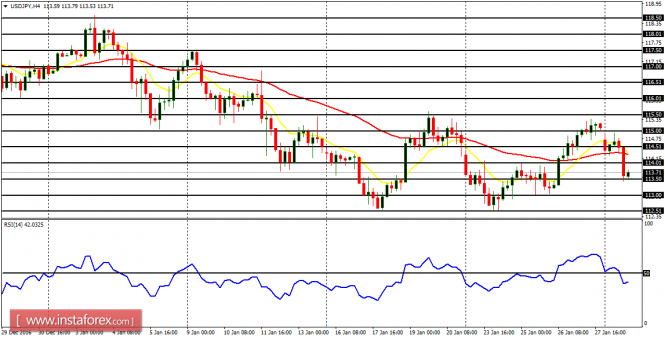

USD/JPY: The market went slightly downwards yesterday, just in conjunction with the extant bearish outlook. It turned out that the rally that was seen at the end of last week was simply a good opportunity to go short at better prices. There is a clean Bearish Confirmation Pattern in the market, and further southwards movement is anticipated.

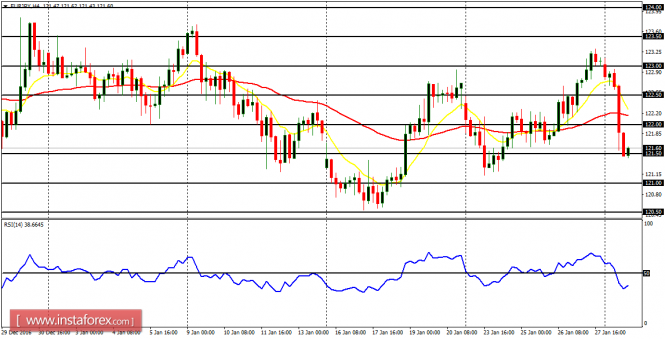

EUR/JPY: The EUR/JPY went downwards on Monday, now above the demand zone 121.50. Price may go upwards from here, generating a bullish signal in the short term. On the other hand, a movement below the demand zones at 121.00 and 120.00 would result in a bearish signal.