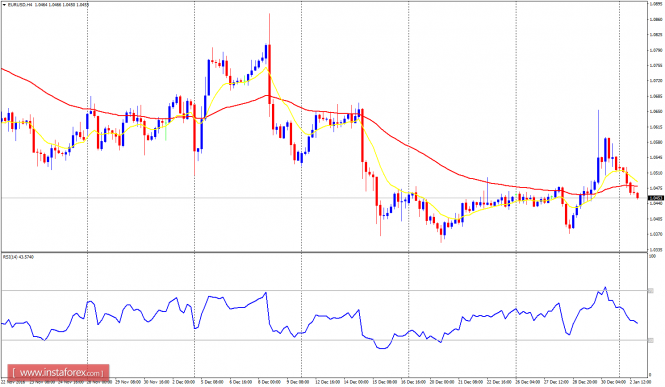

EUR/USD: The EUR/USD tried to trend downwards on Monday, in a bid to correct what happened last week, to go along the recent bearish bias in the market. It is possible that price would move downwards by around 100 pips this week – an event that could emphasize the recent bearish bias on the market. The bearish bias would essentially remain valid as long as price stays below the resistance line at 1.0600.

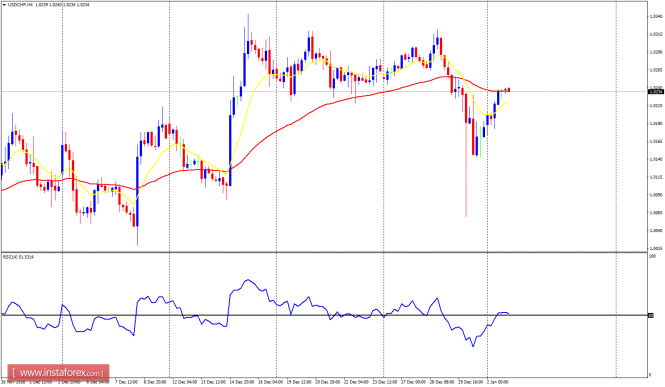

USD/CHF: The USD/CHF pair tried to trend upwards on Monday, in a bid to recover the loss of the last week. Price is likely to move upwards by around 200 pips this week – an event that could emphasize the recent bullish bias on the market. The bullish bias would essentially remain valid as long as price stays above the support level at 1.0000.

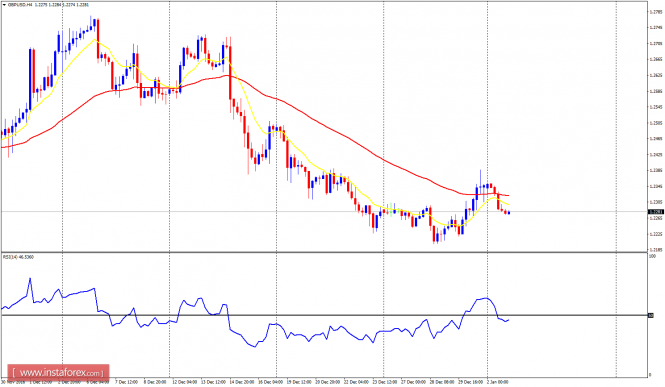

GBP/USD: The GBP/USD pair moved sideways last week, before making a bullish attempt at the end of the week. The outlook is still bearish (unless the distribution territory at 1.2500 is overcome), and the distribution territories at 1.2200 and 1.2150 could be tested this week because a strong bearish movement is expected in the market. There was some southward movement on January 2, 2017.

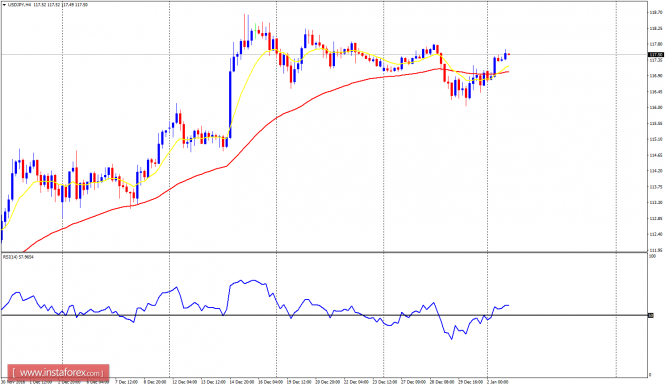

USD/JPY: There is a bullish signal on the USD/JPY pair, owing to a clean Bullish Confirmation Pattern that is present on the 4-hour chart. Price is currently above the demand level at 117.00, and it may reach the supply level at 118.00 today or tomorrow. There is a need for price to go down by at least, 300 pips, before there could be any threats to the current bullish outlook.

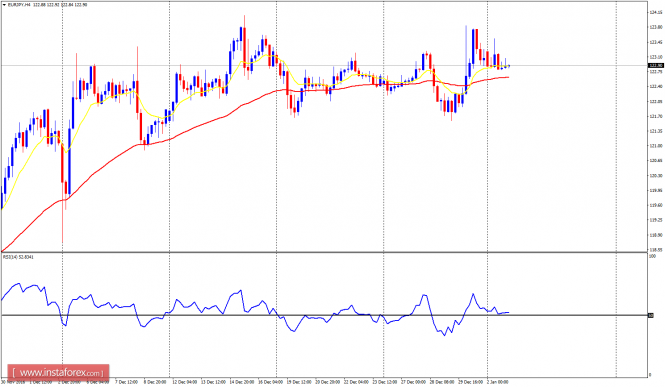

EUR/JPY: This currency trading instrument could still go further upwards this week. Since EUR made some bullish attempts last week, price went upwards, closing above the demand zone at 122.50, and generating a new bullish signal, owing to a Bullish Confirmation Pattern in the market.