The forced agreement about the new stimulus measures which was concluded yesterday, led to a sharp growth in the US dollar today amid a decline in futures for US stock indices and multi-directional dynamics of Asian stock indices.

At the same time, the market's incomplete reaction regarding some investors' fixation on previously received profit is likely to eventually manifest itself with the opening of the US session. The US dollar had previously declined in the wake of the Fed's large-scale super-soft monetary policy, which weakened in the currency markets and turned it into a funding currency. Now, investors will be forced to assess new prospects for demand for the company's shares and dollar's dynamics after Congress decides to take $ 900 billion in support measures, which will be direct payments and will go to help unemployed Americans and those in need. This can result in unpleasant pitfalls.

The question arises, what impact will these incentives have on the amount of liquidity and how can they really affect the dollar?

It is clear that the previous stimulus measures had a strong impact on the demand for company shares and weakened the dollar, but are there any guarantees that these will have a similar impact? So far, investors psychologically perceive any measures to support the US economy as negative for the dollar. However, these will have to go mostly in the form of financial assistance to the Americans, which is contrary to the previously undertaken large-scale incentives. They will act as support measures and will inevitably be spent by them, as they say, on life, on food and other household items. Moreover, this may lead to an increase in demand in the domestic consumer market and become a starting point for starting inflationary processes in the long term. Given this, we believe that the dollar's clearly expected weakening may stop in the future, and the Fed will be forced to start the reverse process of exceeding interest rates after inflation reaches the level of 2.0% or even a little higher.

In such conditions, speculative demand for company shares will undoubtedly fall and the previously inflated financial bubbles will begin to deflate, but this is still a process of the future, which is probably already being laid down now.

There is one more important point that should be considered. Finance Minister, Ms. J. Yellen, who was the previous Fed's head before J. Powell, will be in the government of J. Biden. This morning, it became known from Bloomberg's news feed that Yellen may move away from a long-term policy of a weak dollar and prevent its devaluation, which also fits neatly into the probable scenario of events outlined above, possibly as early as next year.

Forecast of the day:

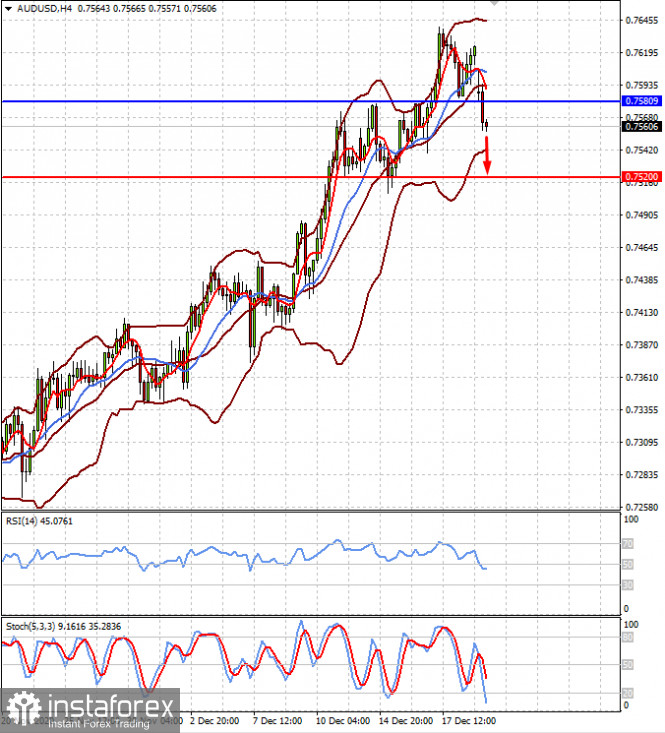

The AUD/USD pair is trading below the level of 0.7580 amid US dollar's local strengthening after the decision of the US Congress on new support measures for the population amid the COVID-19. Against this background, the pair may decline to 0.7520 or even lower to 0.7500.

The GBP/USD pair is under strong pressure due to the problems of the Brexit negotiations and the local strengthening of the dollar. Thus, it is very likely that the pair will further decline to the level of 1.3180.