The pound's decline from last Friday was quite impressive, albeit stretched out in time. That is, the pound was simply gradually losing its positions throughout the day. This was largely due to two factors. First, we are talking about Brexit, or rather about the endless negotiations on a trade agreement. In fact, the market began to play back the news that the negotiations were officially suspended once again. According to the old tradition, London blamed Brussels for everything again, because according to them, the European Union refuses to make concessions on fishing. At the same time, both the UK and the European Union announced that talks are ongoing, but unofficially. Such a strange situation somewhat surprised everyone, but most importantly, it became unequivocally clear to everyone that the negotiations would not be completed by Sunday, which means that they would either be renewed again, or everything would go according to the worst scenario. That is, the likelihood of an unregulated Brexit is looming on the horizon again. Although we should consider this scenario as the most likely. Secondly, we shouldn't forget that London announced the re-introduction of spring quarantine measures, and although this issue was not finally predetermined, the tension only grew. In general, the sentiments of the market participants were clearly rather pessimistic.

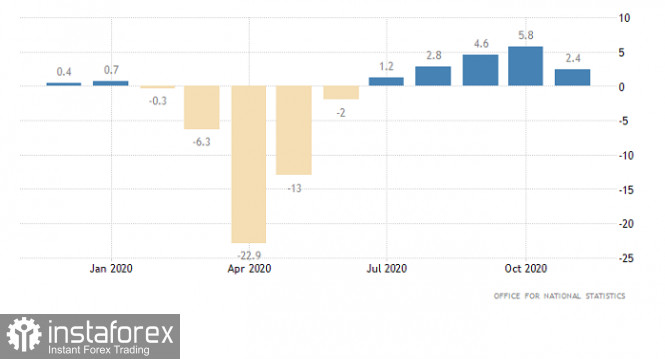

At the same time, the pound was under additional pressure due to retail sales, whose growth rates literally collapsed from 5.8% to 2.4%. Of course, a decline in retail sales was expected, but only to 3.2%. But such a large-scale decline in consumer activity does not provide optimism.

Retail Sales (UK):

The week began with a gap for the pound. Downwards. And the thing is that in fact the most terrible fears were justified. Negotiations never came to anything, and they had to be extended once again. This time everyone is talking about the need to be in time before Christmas. That is, they will keep us in suspense for at least another three or four days. So the pound will clearly be in a fever depending on the nature of the upcoming news. And if this does not seem enough for anyone, Prime Minister Boris Johnson announced the introduction of strict quarantine in the south and east of England. And it's all about a new kind of coronavirus, which seems to be noticeably more infectious. In addition, Scotland announced similar measures, but only after Christmas. So it is not surprising that the pound is rapidly losing its position. After all, news from Great Britain comes worse than the other.

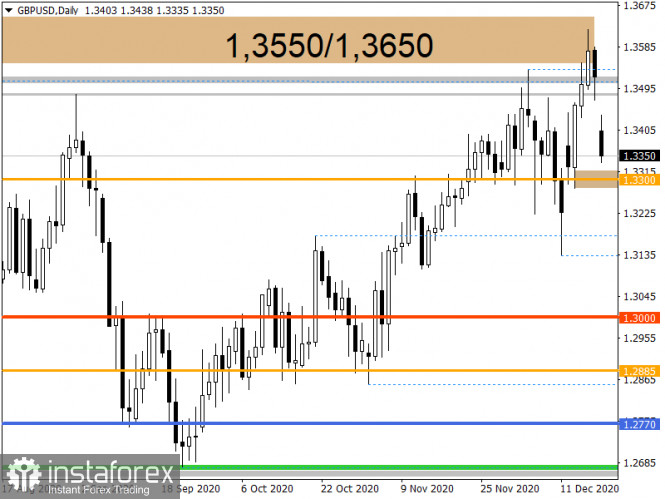

After a rapid upward move, the GBPUSD pair found a resistance point in the area where trading forces interact at 1.3550/1.3650, where a stop emerged and, as a result, a quote reversal. The overbought signal of the pound has repeatedly indicated the possibility of a reversal, this time the signal was confirmed.

As for the market dynamics, the daily volatility indicator has a high level, more than 100 points, which signals speculative interest in the market.

If we proceed from the quote's current location, we can see that the new trading week began with a gap of 110 points, which was a kind of shock for traders.

Looking at the trading chart in general, the daily period, you can see a medium-term upward trend, at the peak of which a corrective move is formed.

We can assume that speculators will continue to follow the information flow, where new impulsive leaps will appear depending on the nature of the incoming information.

If we pay attention to the technical analysis, we can single out the price level of 1.3300, which can serve as a temporary support when building a downward move. We consider positions for selling when the quote has finally settled below 1.3300 with the prospect of heading towards 1.3200-1.3135.

From the point of view of a complex indicator analysis, we can see that due to a sharp price change, technical indicators changed their signal from buy to sell.