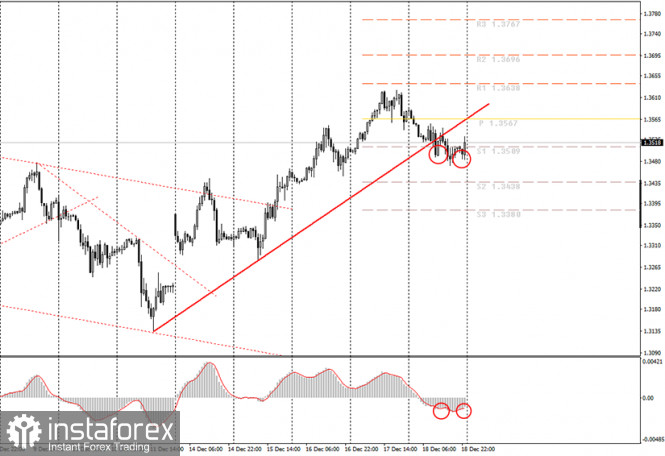

The hourly chart of the GBP/USD pair.

The GBP/USD pair at the end of the current working week still started a weak downward movement, which in all respects fits the definition of "correction". However, according to our technical picture, the pair's quotes were fixed below the upward trend line, thus, the trend changed to a downward trend. Thus, now we expect a downward movement of the pound/dollar pair. Novice traders should now consider short positions. We remind you that the pound continues to rise in price unreasonably if we take into account all the factors available to us. Thus, we consider almost any downward movement as a possible beginning of a new long-term downward trend. At the moment, despite overcoming the trend line, the MACD indicator has already turned up, thus, now you need to wait for new sell signals. We remind you that the MACD indicator should be discharged to zero (in practice, this means that the indicator should be as close to it as possible or exceed it).

The British pound continues to grow despite everything. We have been repeating this for several months. However, nothing changes. At the end of last week, nothing was interesting in either the UK or the US. In Britain, a report on changes in retail sales volumes for November was published, however, despite higher values of indicators than expected, it was the pound that fell on Friday, which once again proves the lack of desire among market participants to pay attention to the fundamental background and macroeconomic reports. For novice traders, this is a very confusing situation, as markets usually react to the fundamental background and reports. But now this is the specifics of the movement of almost all instruments. There's nothing you can do about it.

On Monday, December 21, the UK will release a completely secondary indicator of the CBI on the change in the volume of industrial orders for December. It is unlikely that traders will even pay attention to this report. But maybe at least this week the negotiations on a trade deal between the UK and the EU will become clear? Recall that negotiations have been underway for 9 months and this is considered very small for a deal of such volume and scale. Therefore, it is not surprising that the parties cannot agree. They simply don't have enough time at their disposal. However, it is surprising that the pound continues to strengthen, given the growing likelihood of no deal in 2021. But we have repeatedly drawn attention to the fact that the markets do not want to take this factor into account now and firmly believe that London and Brussels will eventually agree.

As of December 21, the following scenarios are possible:

1) The upward trend is temporarily canceled, as the price is fixed below the upward trend line. Thus, now to be able to start traders to consider again trading on the increase, you need to wait for the end of the downward trend or the formation of a new upward one. Until then, it is not recommended to buy the pound.

2) Sales, from our point of view, are now appropriate since the price is fixed below the trend line. Thus, it is now possible to open short positions with the targets of support levels 1.3438 and 1.3380. To do this, you need to wait for the discharge of the MACD indicator and its new sell signal.

What's on the chart:

Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them.

Red lines – channels or trend lines that display the current trend and show which direction is preferable to trade now.

Up/down arrows – show when you reach or overcome what obstacles you should trade for an increase or decrease.

MACD indicator – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines(channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement.

Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period.

The material has been provided by InstaForex Company - www.instaforex.com