To open long positions on GBP/USD, you need:

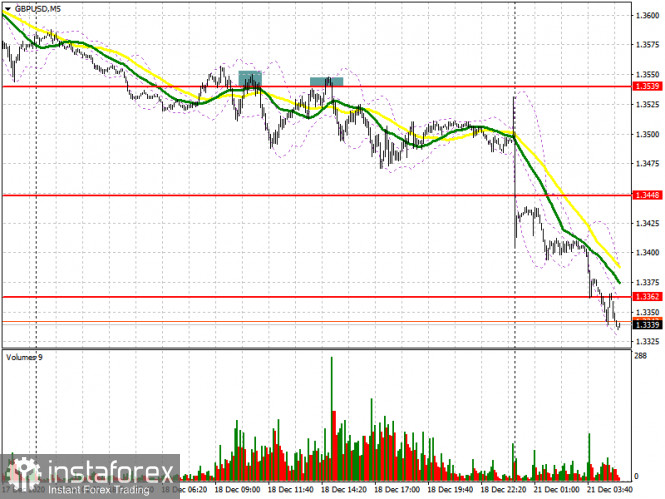

In last Friday's afternoon forecast, I paid attention to a signal to sell the pound and advised you to open short positions from the 1.3539 level, which happened. If you look at the 5-minute chart, you will see how the bears formed a false breakout around 1.3539 and then they returned after testing this level from the bottom up, which caused the pound to fall by more than 50 points. Unfortunately, we fell short of the target in the 1.3448 area.

Before examining the technical picture of the pound, let's take a look at what happened in the futures market last week. The demand for the pound has clearly slowed after the continued disagreement between the UK and the EU, but the belief of traders that eventually a trade agreement will be signed at the last moment keeps the pound at current highs. The expectation that the leaders will still be able to make concessions and find the necessary common ground on the key issue of fisheries leaves hope for the pound's succeeding growth. In the Commitment of Traders (COT) reports for December 15, there is a decrease in interest in the British pound for both buyers and sellers. Long non-commercial positions decreased from 39,344 to 35,128. At the same time, short non-commercial positions decreased from 33,634 to 31,060. As a result, the non-commercial net position, although it remained positive, dropped to 4,068, against 5,710 versus a week earlier. All this suggests that traders are taking a wait-and-see attitude, although a small preponderance of buyers, even in the current situation, continues to be observed. Given that the UK has imposed tough quarantine measures due to a new strain of coronavirus that has gotten out of control and for which there is no vaccine yet, then expecting the pound to strengthen further at the end of this year will not be the right decision. Only good news on Brexit can bring new players back into the market, betting on GBP/USD growth.

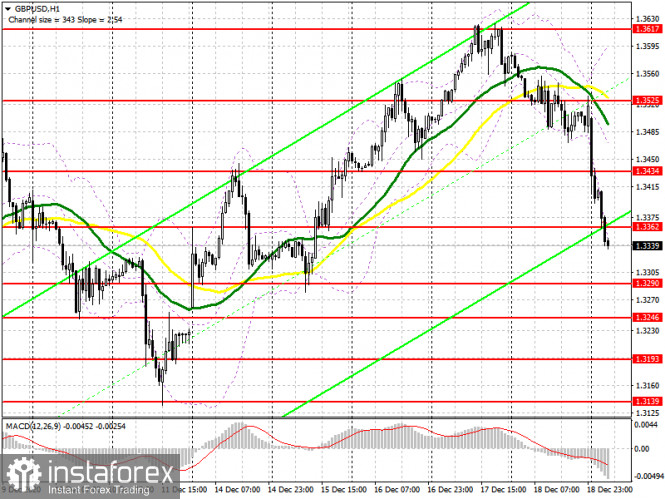

As for the technical picture of the pair, the pound sharply fell during the Asian session, which indicates how traders are nervous due to the current situation with quarantine measures in the UK, which may lead to economic paralysis. Buyers' task in the first half of the day is to maintain control over the 1.3362 level. Forming a false breakout there will be a signal to open long positions in hopes for the pound to recover in the short term towards the resistance of 1.3434. The main goal is for the pair to surpass it. Testing this level from top to bottom produces an additional entry point into long positions in hopes to reach a high of 1.3525, where I recommend taking profits. The next targets will still be resistances 1.3617 and 1.3690, but they will only be available if we receive good news on the Brexit deal. In case bulls are not active in the 1.3362 support area, it is best not to rush into long deals, but wait until the 1.3290 low has been updated. However, I recommend opening long positions from this level only after forming a false breakout. A larger support level is seen in 1.3246 and 1.2193, where you can buy GBP/USD immediately on a rebound, counting on a correction of 20-30 points.

To open short positions on GBP/USD, you need:

The lack of important fundamental reports, as well as the lack of news on Brexit, will create some pressure on investors who are intimidated by the strict quarantine measures in the UK. Forming a false breakout in the resistance area of 1.3362 will return pressure to the pair and lead to its continued decline and a test of the next support at 1.3290. Surpassing this level and testing it from the bottom up, similar to last Friday's sales, which I analyzed above, produces a good signal to open short positions in the pound in hopes of pulling it down to lows of 1.3246 and 1.3193, on which the bear market will depend. Bad news on the trade deal will sharply pull down GBP/USD towards the 1.3114 low. If the bulls manage to beat the 1.3362 level, then it is better not to rush with short positions. The optimal scenario for selling the pound will be failure to settle above 1.3434. I recommend opening short positions immediately on a rebound from the high in the 1.3525 area, counting on a downward correction of 25-30 points within the day. Let me remind you that Brexit talks will proceed this week and the deadline for which the parties must agree is on Christmas.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates the pound's succeeding decline in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If the pair grows, the average border of the indicator in the 1.3455 area will act as a resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.