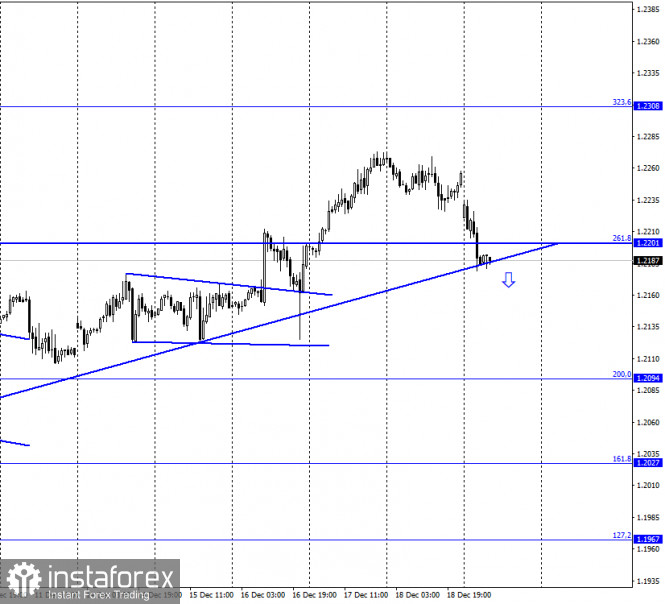

EUR/USD – 1H.

On December 18, the EUR/USD pair began a weak process of falling and it performed a fall to the ascending trend line. Closing the pair's rate under this line will work in favor of continuing the fall of quotes in the direction of the corrective level of 200.0% (1.2094). Rebound - will work in favor of the EU currency and the resumption of growth in the direction of the corrective level of 323.6% (1.2308). The fall in the euro currency quotes at the very beginning of the trading week was caused by a message from the UK about a new strain of coronavirus called NS501Y. The problem is not in the new strain itself, as it has long been known that the COVID-2019 coronavirus has several varieties. The problem is that this strain is spreading much faster than the usual coronavirus and at the moment it is not entirely clear whether only recently created vaccines against this strain work or not? If the latter – then the whole of humanity is facing a new epidemiological problem. The world has only recently started vaccination, which can last from several months to a year, and even in this case, not all the population of the planet and not even the entire population of developed countries will be vaccinated. That is, vaccination does not mean that in six months you can forget about the coronavirus and treat it as seasonal flu or SARS. The new strain may be resistant to existing vaccines. It could already leave the UK, which only this weekend announced the "out-of-control" of the new strain. Thus, the potential problems for the whole world and the economy are very high.

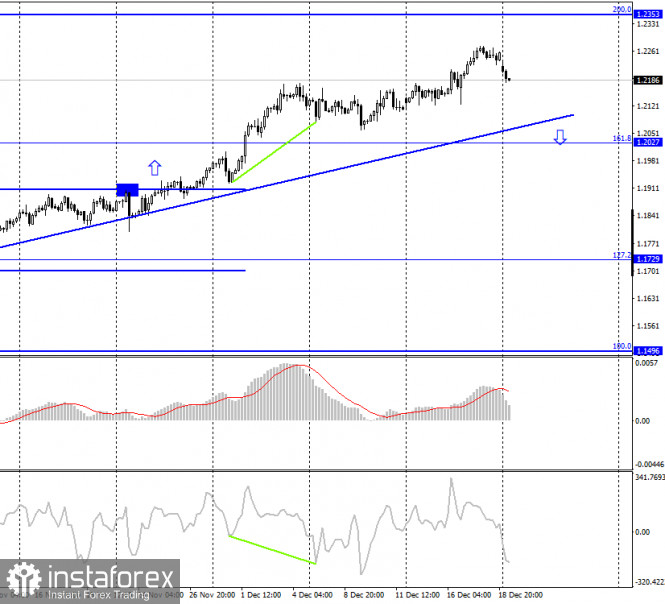

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the US currency and began the process of falling in the direction of the upward trend line, which continues to characterize the current mood of traders as "bullish". Today, the divergence is not observed in any indicator.

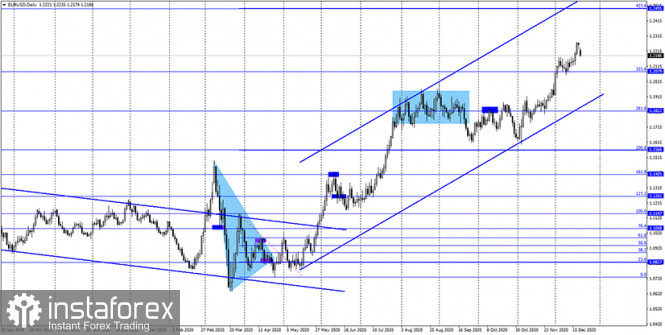

EUR/USD – Daily.

On the daily chart, the EUR/USD pair quotes continue the growth process in the direction of the corrective level of 423.6% (1.2495). Until the pair completes its consolidation below the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 18, the European Union and the United States did not have any important economic reports or events. This explains the relatively low activity of traders during the day.

News calendar for the United States and the European Union:

On December 21, the US and EU economic event calendars are empty. Thus, the information background will be absent today.

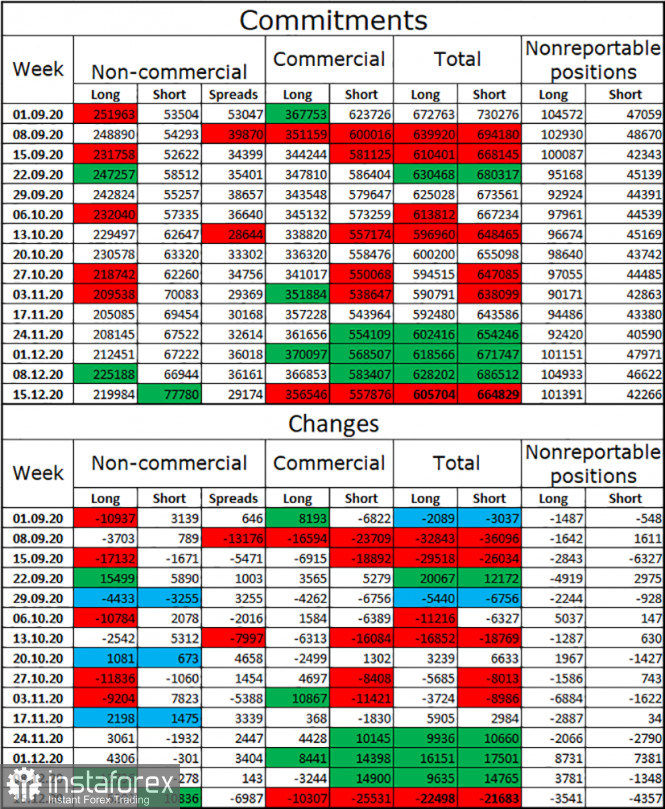

COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately collapse. The latest COT report shows that speculators are once again preparing for a fall in the euro currency, or at least for the end of its growth.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with a target of 1.2094, if the consolidation is made under the trend line on the hourly chart. New purchases of the pair can be opened with a target of 1.2308 when the quotes rebound from the trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com