The Japanese yen confidently leads the race for the title of best performer of the year among the G10 currencies, has strengthened against the US dollar by 5.4% since early 2018. Jerome Powell's speech before the Congress is viewed by investors as a clue about the future dynamics of USD / JPY pair to determine the continuation of the southern campaign of the pair, regardless of what the new chairman of the Fed said.

At first glance, the strengthening of the yen to the highest level since autumn 2016 was facilitated by short-term factors including the repatriation of capital by residents on the eve by the end of the fiscal year (March 31), rumors about the purchase of local bonds by the world's largest pension fund (GPIF), an increase in demand for asylum assets or the correction of world stock indices and talk about the decline in leverage by the regulators of leverage on Forex trading. Indeed, despite the growth of share purchases by Japanese investors for 4 consecutive weeks, non-residents have been net sellers for 1.5 months. At the same time, judging by the conversations in the market, their return is required to restore the uptrend on the Nikkei225 and TOPIX.

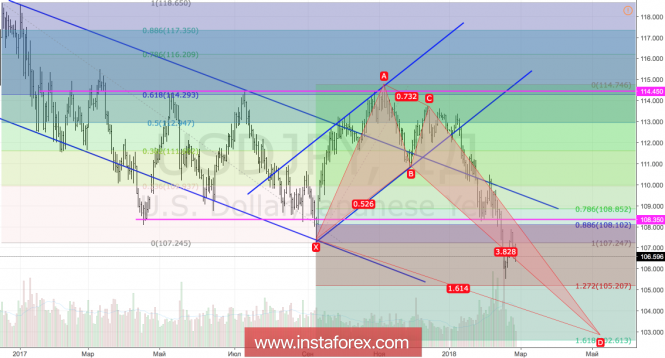

However, the double deficit in the U.S. as the end of the era of cheap liquidity. Moreover, the associated ultra-low volatility shows that the USD / JPY pair has outperformed beyond the long-term consolidation range at 108.35-114.45 is just the beginning of the end of the bullish 2012-2015. If the carry trade strategies popular in 2015-2017 have exhausted themselves, a return to the funding currencies will make the Japanese yen a strong asset, regardless of the state of health of the US dollar.

Dynamics of the carry carry index

Source: Bloomberg.

In this regard, the speech of Jerome Powell before Congress is unlikely to drastically change anything in the dynamics of USD / JPY pair. Indeed, if the head of the Fed will rely on an aggressive tightening of monetary policy, in contrast to his predecessor Janet Yellen, the growth of yield on US Treasury bonds will increase the risk of a correction of the S&P 500. In such conditions that are usually identified with a worsening global appetite for risk, the safe-haven assets are deservedly popular. On the contrary, the "dovish" rhetoric of the chairman of the Fed will return interest of investors to sales of the US dollar.

The main victim in the current situation is the Bank of Japan. Revaluation of the yen slows the growth rates of import prices, PPI and CPI, that prolongs the timing of inflation targeting. At the same time, the companies of the Land of the Rising Sun have a formal excuse to get out of the implemented recommendation of Tokyo's official salary increase. However, when corporate earnings fall due to a strong yen, you need to sit and see how events will develop further. Perhaps, if BoJ does not come up with anything new in terms of monetary expansion, the USD / JPY pair is likely to continue its decline.

Technically, the inability of the bulls to cling to an important level of 107.25 allows us to talk about their weakness. "Bears" are seriously counting on the implementation of the targets at 127.2% and 161.8% on the "Crab" pattern.

USD / JPY pair, daily chart