In the absence of significant macroeconomic news, the markets have retreated from the February lows and are trying to comprehend what happened - either a technical correction, or a fundamental collapse. Depending on the answer to this question, strategies for further action are developed that look appear in the opposite direction.

If the decline is technical, the fundamentals should show strong and sustained growth, which, among other things, should lead to the rally of risky assets. If the fall is of a deeper nature, then in the near future a new wave of declining markets is imminent, which will lead to an increased demand for defensive assets.

Apparently, investors are still inclined towards the first option - on most indicators there is no reason to fear another serious collapse. In its recent quarterly update, the Philadelphia Fed offers new average benchmarks for a number of key indicators of the US economy, which seem to be openly exaggerated.

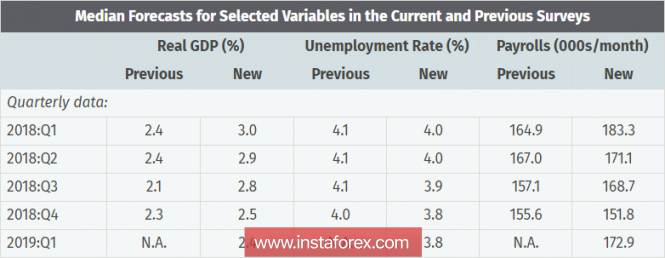

The forecast for GDP growth rates was upgraded for the first quarter, which is traditionally weak due to the influence of seasonal factors. It was revised from 2.4% to 3.0% (a similar forecast from the Atlanta Fed, even higher - 3.2%), an improved performance for the entire 2018. Unemployment rate, which is already extremely low, should, according to the forecast, is seen to be even lower, and in turn correspond to full employment. And, of course, new jobs, the pace of their creation, are revised upwards for the first three quarters at least.

If you recall the Fed's minutes published last week, then it should be noted that hawkish notes prevailed in them. So far, the Fed follows the same strategies and assures the markets that it will adhere to the announced growth rate of the rate, that is, there are three increases in 2018 and two more in the next, which will raise the target range to a long-term level of 2.75%, this level of the Fed considers economically justified. Philadelphia Fed's also sees inflation higher than a quarter ago. At the end of the year, the rate is seen to be at the level of 2.2%, and not 2.1%, as in the previous forecast.

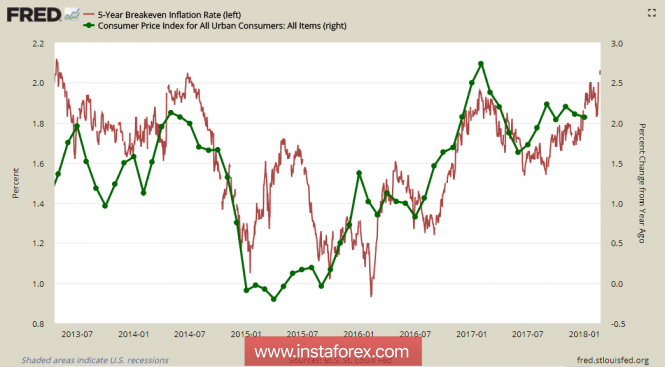

Inflation expectations, according to the dynamics of rates Tips bonds rose on Friday to hit a 4.5-year high.

Among other things, this means that expectations from the macroeconomic data next week are positive.

And data will be quiet few. On Tuesday, a January update will be published for orders for durable goods, which simultaneously characterizes both industrial production and consumer demand. On Wednesday there will be updated data on GDP in the fourth quarter of 2017 and the index of spending on personal consumption, on Thursday - a report on personal expenses and income in January. Apparently, a good sentiment is created, including, and positive forecasts, which should show a steady growth of the American economy.

Thus, the picture is quite complacent, and opinions are already expressed that the first appearance of the new head of the Federal Reserve Powell in the Congress, scheduled for Tuesday, February 27, may cause strong volatility in the markets. Powell can publicly announce changes in the Fed's policy, making it more aggressive than Janet Yellen's plans.

Thus, the dollar feels quite confident, with no reasons for the macroeconomic nature to reduce it. Trump, like a real businessman, focused all his attention on protectionist policies in an effort to correct the trade balance. After the washing machines came the turn of steel and aluminum. The decision will be taken into consideration until the middle of April. The attempt to correct the trade balance in this manner is unlikely to be successful, since the trade balance deficit first of all indicates the excess of consumption level over the level of production, but nobody expresses plans to limit consumption for some reason. On the contrary, attempts to correct the trade balance are being made simultaneously with supporting consumption growth, this is possible only with simultaneous outpacing growth in production and a decrease in the trade-weighted dollar exchange rate.

The implementation of the planned measures, including the tax reform, will not yield any positive result if the dollar strengthens, so the pressure on the main trading partners, primarily China and Europe, will only increase.

Hence it is clear that the strengthening of the dollar is short-term, the dollar index next week will be traded in the lateral range with a downward trend.

The material has been provided by InstaForex Company - www.instaforex.com