EUR/USD is currently struggling at the 1.23 price area ahead of the ECB President Draghi's speech. The price has been quite indecisive at the edge of the 1.23 price area as it is the most important event level from where if broken below the price is expected to be quite impulsive with further bearish pressure. This week USD is expected to be quite strong in nature having Fed Chair Powell to testify the interest rates which is expected to hike in March and also the upcoming monetary policies. Today, USD Home Sales report is going to be published which is expected to show an increase to 655k from the previous figure of 625k. If the economic report comes positive then USD in the coming days is expected to quite impulsive. As of the current scenario, USD is expected to gain momentum further in the coming days of the week whereas EUR may struggle to co-op with the impulsive pressure on the USD side.

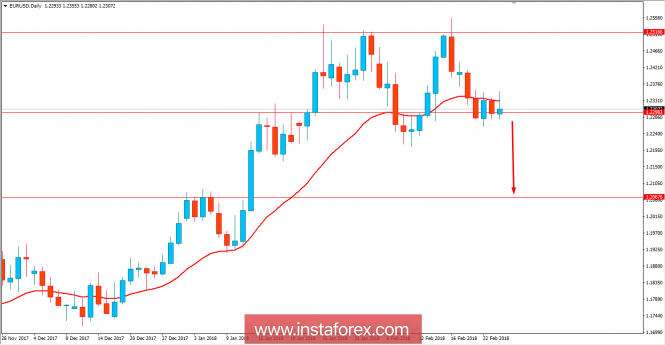

Now let us look at the technical view. The price is currently residing below the dynamic level of 20 EMA above the 1.23 price area. Ahead of the upcoming high impact economic reports on the USD side, the price is expected to break below 1.23 this week from where the price is expected to be quite impulsive with the bearish pressure with target towards the 1.2050 support area. As the price remains below 1.2350 with a daily close, the bearish bias is expected to continue further.