The latest COT report (Commitments of Traders). Weekly prospects for EUR/USD

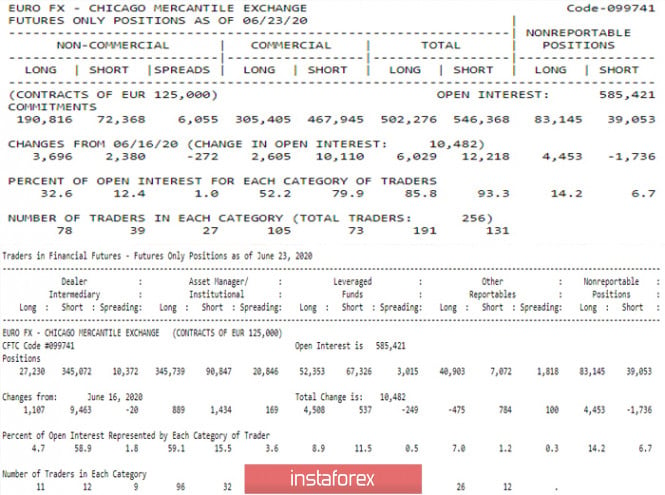

The situation has slightly stabilized. The latest COT report (Commitments of Traders) showed an increase in open interest in the euro again (585,421 against 574,939). After fixing a certain part of the profit and some thought, global players make plans again and increase their positions. In the statistics of the general report, an unbalance increase in short positions by the Commercials group is noteworthy. Players who have information about the real state of Affairs in the economy, actively increased bearish positions almost four times more. The trend in the preferences of this group of players has not changed for a long time, despite some different behaviors. For hedgers in the euro, priority and dominance of bearish interests remain. Therefore, in the long-term, COT reports allow us to draw conclusions about long-term plans, revision and change of the trend on such timeframes as a week and a month is not expected yet. In the financial report, the key indicator of the distribution of forces of the largest dealers (Dealer intermediate) retains the preponderance of forces in favor of long positions in the Euro, but it is no longer a peak value and has begun to change its structure since the last time. These circumstances constrain confidence in the percentage of positions (58.9 - 4.7) and require additional confirmation.

Main conclusion

The activity and effectiveness of the players to increase, which allowed them to achieve good results in the daily half-time to outline the opportunities for the weekly and perform the upward correction on the monthly time interval, has been stopped. Its further prospects are either unclear or not yet available.

Technical picture

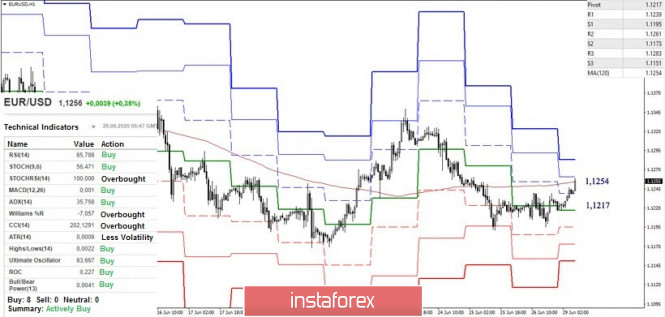

The indicated conclusions find some consonance in the technical analysis of the situation. The downward corrections of the daily and weekly timeframes did not receive development last week and take the form of consolidation. This week, we are closing the month. The next COT report will just contain information on the final conclusions and decisions for the month of June. In June, the EUR/USD pair tested the monthly medium-term trend (1.1360), as a result, the shape of the monthly candle will be important, especially significant in this case - the size of the upper shadow.

In the meantime, the pair at the lower time interval is fighting for the key H1 boundaries, which are joining forces at 1.1217-54 (central Pivot-level of the day + weekly long-term trend) today. The analyzed technical indicators are ready to support further strengthening of the bullish positions, but the main advantage of forces on H1 is still maintained on the side of the players to decline. On the other hand, the resistance within the day can be noted 1.1261 and 1.1283, while support for the classic Pivot levels are located today at 1.1217 - 1.1195 - 1.1173 - 1.1151.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com