Good day, dear traders!

Last week, the pound/dollar currency pair traded quite volatile and generally justified the forecast of a week ago. Let me remind you that it was recommended to sell the pound/dollar pair after corrective pullbacks to the price zone of 1.2500-1.2525. This pullback took place and even exceeded the expected levels. In the course of trading on June 22-26, the pair rose to 1.2541, then turned to decline, ending the week's trading at 1.2332. This is significantly lower than the important technical and psychological level of 1.2400, which kept the bears' pressure at bay for a long time.

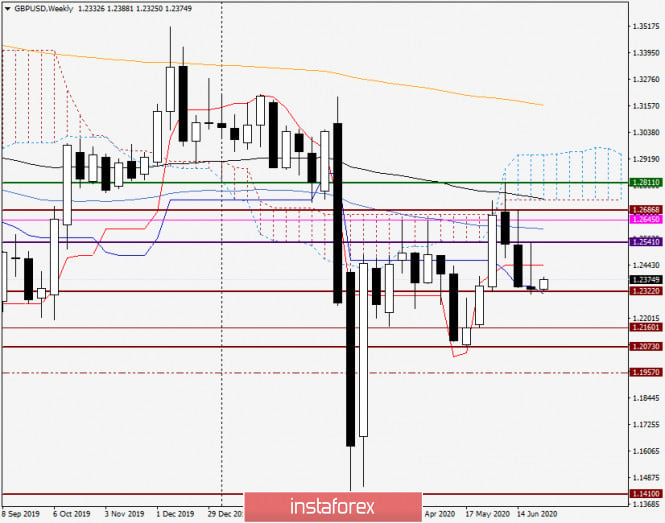

Weekly

Last week started positively for the pair, and the "Briton" showed strengthening. However, fears of a surge in the second wave of COVID-19 increased, which led to an increase in demand for the US currency. This is despite the fact that in the United States itself, the number of coronavirus infections remains quite high and riots continue, caused by the murder of an African-American George Floyd by police. In general, the situation in the US is far from calm. In addition to mass riots and the demolition of a number of monuments to the founding fathers, President Donald Trump has found time to escalate trade relations not only with China, but also with the European Union. However, this did not prevent the US dollar from strengthening against a number of major competitors, including the British pound.

If we return to the technical picture on the weekly chart, then, despite the candle with a very long upper shadow and the closing price below 1.2400, a small bearish body and the shape of the candle itself, it is not possible to give an unambiguous answer about the further direction of the quote. I'll explain the point. According to its shape, the last candle is a pure-looking "Tombstone" model, however, it can hardly be considered a reversal, because there is nothing to expand, by and large. If such a candle appeared at the end of an upward movement, for example under 1.2800, then it would have an exceptional reversal value and strength. As practice shows, after the appearance of such candles, approximately in the middle of the trading range, it is not uncommon for the subsequent strengthening of the exchange rate to occur.

If the situation for the pound/dollar currency pair develops in this way, the nearest target at the top will be the Tenkan line of the Ichimoku indicator, which runs at 1.2442. After that, the pair's bulls will need to raise the quote above the important psychological level of 1.2500 and break through the strong resistance of sellers at 1.2541, where the highs of the previous week were recorded. Closing weekly trading above 1.2541 will return bullish sentiment for the pound/dollar pair, and open the way to 1.2600, where the 50 simple moving average passes.

The bearish scenario will continue if the important and strong support zone of 1.2322-1.2311 breaks through, where the minimum values of last week were shown and the Kijun line passes. In this case, the next targets of the bears for the pound will be 1.2300, 1.2246 and 1.2200.

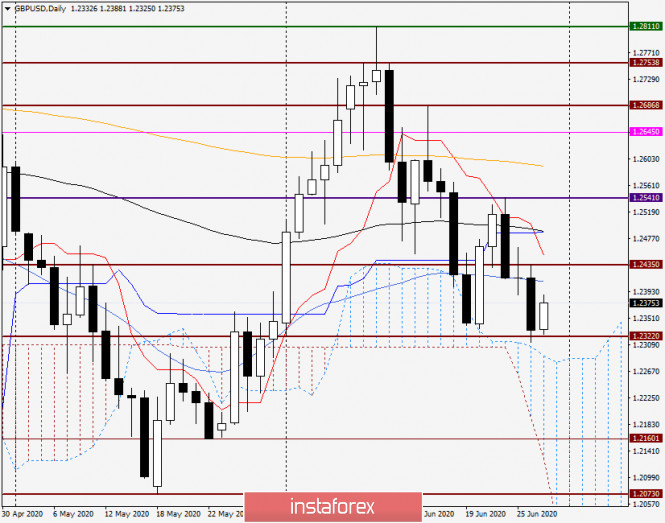

Daily

On the last trading day of last week, the pound/dollar fell significantly, however, the pair failed to break through the support of 1.2322. The price bounced back from this level and Friday's trading ended at 1.2332.

Today, at the end of this article, the pound/dollar pair shows quite good growth, trading near 1.2370. If the rise continues, its nearest target will be the 50 simple moving average, which runs at 1.2410. Above, the resistance is represented by Friday's highs at 1.2435, and after passing this mark, the pound bulls will have to test the strength of the Tenkan line of the Ichimoku indicator, which is at a strong technical level of 1.2450. However, in my opinion, the pair will face the most important resistance on the approach to the iconic psychological mark of 1.2500, under which 89 EMA and the Kijun line converged.

To resume the bearish scenario, players on the downside need to break through support in the area of 1.2322-1.2313, and then consolidate under the level of 1.2300. If this can be done, I do not exclude the price entering the limits of the Ichimoku indicator cloud, the upper limit of which is at 1.2280.

Trading recommendations for GBP/USD:

The most likely scenario is that the pair will continue to show a downward trend. This means that the main trading idea for GBP/USD will be considered sales, which I recommend considering after short-term rises in the price zone of 1.2435-1.2475. Above, to open short positions, it is worth looking at the pair's attempts to return above 1.2500. However, we will talk about this in subsequent articles on this tool.

This week, a lot of important macroeconomic data will be published, which will be mentioned on the day of their release. If you want to define today's events, you should pay attention to the speech of the head of the Bank of England, Andrew Bailey, which will take place at 10:30 London time.

Good trading!

The material has been provided by InstaForex Company - www.instaforex.com