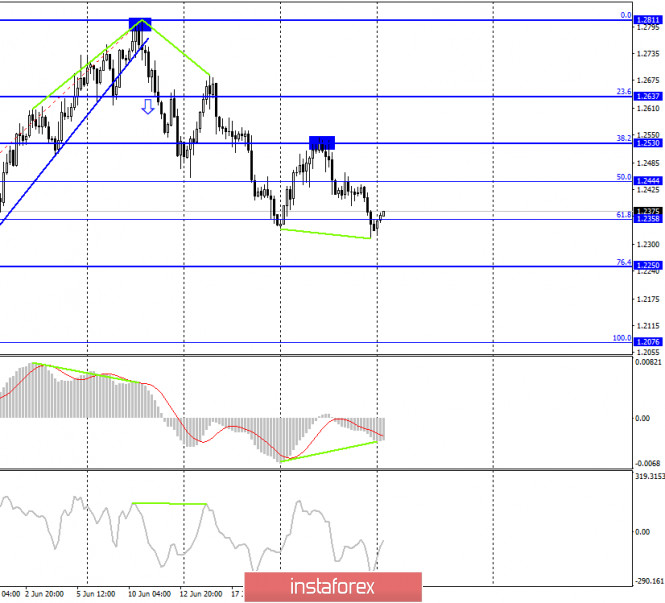

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues a very weak decline process. The previous downward corridor changed the angle of inclination and now again holds the pair inside, describing the current mood of traders as "bearish". At the same time, the growth of the US dollar is completely unconvincing, and other charts allow the pair to grow in the near future. The background information in the current circumstances could help traders decide. However, in the UK, it seems that everyone is on vacation. There is no news from Boris Johnson, the parliament or David Frost that is worthy of attention. Brexit negotiations continue to remain suspended in the air, and there are no prerequisites for them to be resolved positively for both sides. Well, I've already told you about the American news. They are now almost non-existent. At least those that could be of interest to the traders and reflected on the chart.

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair performed a fall under the corrective level of 61.8% (1.2358), however, today it performed a reversal in favor of the British, after the formation of a bullish divergence in the MACD indicator, and began the growth process in the direction of the corrective level of 50.0% (1.2444). Thus, the further fall of the British pound is canceled until the low divergence is passed by traders. In this case, the drop in quotes may resume in the direction of the corrective level of 76.4% (1.2250).

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a new reversal in favor of the US currency and anchored under the Fibo level of 50.0% (1.2462). Thus, the process of falling can be continued in the direction of the corrective level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Friday, the UK again did not have any economic reports. In the US, there were several reports of average significance, but none of them could get traders to trade more actively.

News calendar for the US and UK:

UK - Bank of England Governor Andrew Bailey will deliver a speech (09:30 GMT).

On June 29, the UK will host a potentially important speech by the Governor of the Bank of England, but no more news and reports are scheduled for this day.

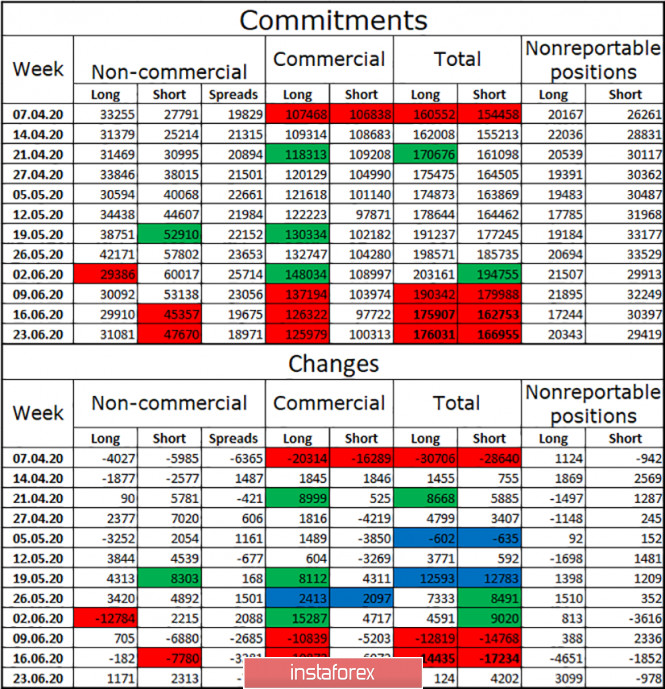

COT (Commitments of Traders) report:

The latest COT report for the British pound was even less interesting than the euro report. Major market players trading the British pound were even less active during the reporting week. In total, the Non-commercial group opened only 3,500 new contracts. A more or less normal value is the number of 10,000 or more contracts. Thus, the global mood of major market players has not changed at all. In the last 10 days, as in the case of the euro, the British pound first fell, then rose, then fell again. The Non-commercial group was even less active, opening 2,500 new short contracts and closing 343 long ones. Well, the general changes for all groups of traders are completely depressing. Thus, the overall conclusion is disappointing. No special changes in the mood of major market players during the reporting week can be noted.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with the goal of 1.2250, if the last low of the divergence is passed on the 4-hour chart. New purchases of the pair can be considered with the goal of 1.2444 due to the bullish divergence. However, on the hourly chart, we have a downward trend corridor. Thus, the growth of the British dollar's quotes is in doubt. Much will depend today on what Andrew Bailey says.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com