The recent weak macroeconomic statistics on the US economy lowered the demand for the US dollar. It canceled out all the positions the currency gained last week amid the news of worsening trade relations between the US, China and Europe.

The only bright report was the data published by the Ifo Institute regarding employment in Germany, which according to their calculations, continued to rise in June due to many companies becoming less pessimistic about the employment situation in the country. The index determined to 92.3 points, much higher than the previous value of 88.3 points in May. Although many companies still conduct lay-offs, the tendency of it is gradually slowing down especially in the service sector. Some are also observed in the trade and manufacturing sectors.

A rather important report on Germany's inflation will be released today, the value of which may set the direction of the euro this week. The data should turn out to be better than the forecasts, since a lower value may become a problem for the central bank of Germany, which will lead to the weakening of the European currency.

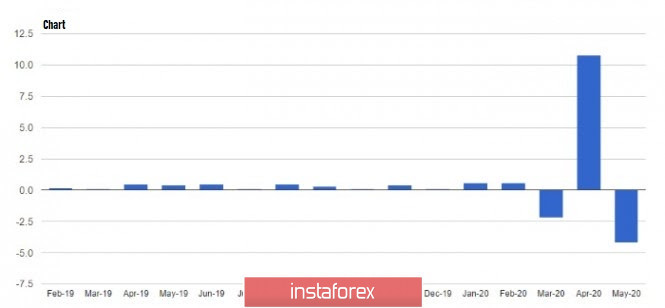

Meanwhile in the US, the macroeconomic reports published last Friday turned out to be weak, which disappointed traders, as it became clear that a quick recovery is out of the question. Consumer spending was less than the value predicted by economists, which led to the weakening of the US dollar against risky assets. The recovery of the US economy is clearly not at the level that many expected. According to the data published by the US Department of Commerce, consumer spending in the US rose by 8.2% in May, while economists expected the figure to rise 8.7%. The resumption of activity after a two-month quarantine in connection with the coronavirus pandemic did not become as rapid as predicted, but thanks to stimulating measures by the government, the growth became very impressive.

Household income declined at a slower pace, also thanks to the financial support. Recent data revealed that revenues in May decreased by 4.2%, despite the increasing concerns on the rate of the coronavirus since 33 states in the US observed a huge jump in coronavirus cases last week. A number of companies were forced to close again due to it.

It is not surprising that with such factors, the Americans' assessment on the US economy worsened again at the end of June. The report of the University of Michigan revealed that in the four weeks that passed, consumer sentiment fell from 78.9 points to 78.1 points. Apparently, another surge in coronavirus infection will put serious pressure on the final index of consumer activity for June this year.

Meanwhile, the current conditions index rose to 87.1 points at the end of June, while the expectations index jumped from 65.9 points to 72.3 points in May.

As for the technical picture of the EUR/USD pair, the upward correction of the European currency may continue at the beginning of this week, if the data on German inflation turns out to be better than economists' forecasts. However, the deterioration of trade relations between China, Europe and the US, as well as the surge in coronavirus infections, may still curb the demand for risky assets. Thus, the bulls need to work on a technical breakout from the resistance level of 1.1280, as such occurrence will open an opportunity to push the quotes up to the highs last week in the area of 1.1345. But if there are no active purchases above the level of 1.1280, the bears will try to form the upper boundary of a new downward channel, which will return the quotes under the support level of 1.1235. It will increase the pressure on the EUR/USD pair and lead the quotes back to the weekly lows in the areas of 1.1200 and 1.1160.

The material has been provided by InstaForex Company - www.instaforex.com