Data came out last Friday which, in the first half of the day, put pressure on the European currency. But then, good reports on German inflation returned demand for risky assets, leading to an update of daily highs. Nonetheless, from a technical point of view, the situation in the EUR / USD pair has not changed significantly.

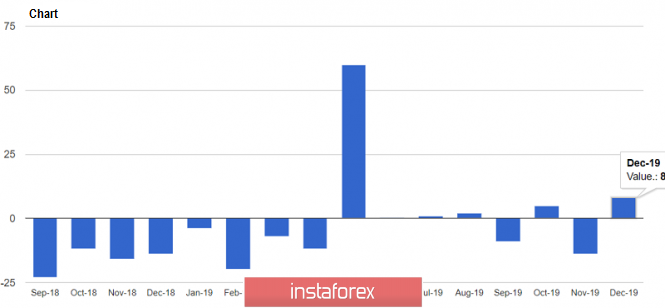

The report on the German labor market disappointed traders a little. According to the data, the number of unemployed in Germany on December of this year, with a seasonal adjustment, increased immediately by 8,000, whereas, in November, there was a decrease of 14,000. This is in contrast to the projected increase of only 5,000. Comparing to November, the unemployment rate remained unchanged in December and settled to 5.0%. This fully coincided with forecasts. All in all, the total number of unemployed in Germany was 2.227 million, against the November figure of 2.180 million.

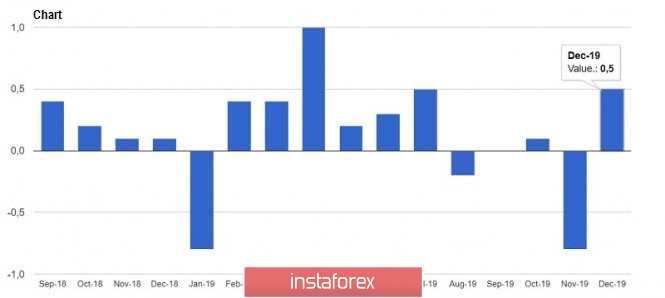

The prolonged fall of the Euro did not happen as the preliminary inflation report indicated a set of upward movement at the end of the year. According to the data, the preliminary consumer price index (CPI) in Germany on December last year increased by 0.5% compared to November, and increased by 1.5% compared to the same period in 2018. This is in contrast to the forecasted growth of 0.4 % and 1.5% respectively. As for the CPI harmonized by EU standards, an increase of 0.6% happened in December. Inflation may have fallen short of the European Central Bank's target of around 2.0%, but the first signs of recovery after the autumn downturn are beginning to be observed.

With regards to the report on lending in the Eurozone, the situation did not strongly influence the rate of the European currency, however, it is one of the leading indicators of economic growth and is strongly dependent on the availability of credit. According to the data, household lending in November 2019 increased by 3.5%, similar to the increase in October. Meanwhile, lending to companies increased by only 3.4%, as compared to 3.8% in October, indicating a decline in demand. On the other hand, the monetary aggregate M3 of the Euro zone increased by 5.6% in November, as compared to 2018.

Another report that did not attract the attention of traders was the inflation in France. According to preliminary data, the CPI in France on December increased by 0.4% as compared to November, and increased by 1.4% as compared to 2018. It is fully coincided with economists' forecasts. Additionally, the harmonized CPI was even better, showing an increase of 1.6% per annum.

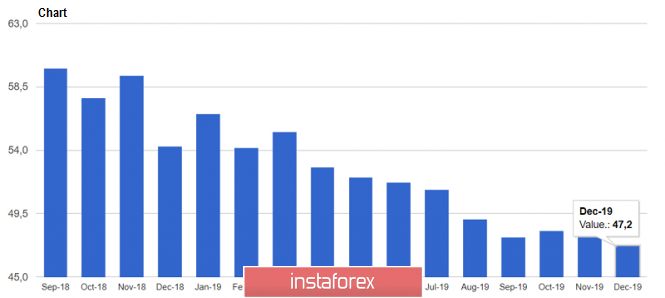

Meanwhile, data on the US manufacturing sector put additional pressure on the US dollar last Friday afternoon. The report indicated that activity continued to decline at a stronger pace than expected, thus, the PMI for the US manufacturing sector fell to 47.2 points in December, against November's 48.1 points. It was forecasted to have an increase of 49.0 points. The main pressure was created by the employment sub-index 'decline to 45.1 points, and the production sub-index' decline to 43.2 points against its 49.1 points in November. The sub-index of new orders was slightly less affected, but fell to 46.8 points in December.

From the technical point of view, there are no significant changes in the EUR / USD pair. Today, buyers of risky assets will fight for the resistance level of 1.1180, and the return of which will lead to a more active phase of purchases and growth of the trading instrument in the area of the highs of 1.1210 and 1.1240, where I recommend fixing profits. However, this is all possible if the bulls maintain the level of 1.1150, otherwise, its breakdown will lead to a larger downward movement in the area of the lows of 1.1125 and 1.1090.

GBP / USD

The British pound fell slightly last Friday because of the report that net consumer lending in the UK increased by only 4.5 billion pounds on November last year, as compared to 5.6 billion pounds in October. Net mortgage lending also fell to 4.1 billion pounds, as compared to 4.3 billion pounds in October, while the number of approved mortgages in the UK was at 64,990, against 64,660. The decline in lending was directly linked to tensions over Brexit, as well as to the UK elections that took place in December last year. Unsurprisingly, unsecured consumer lending also fell to 0.6 billion pounds, down from 1.3 billion pounds in October last year.

Today, traders of the British pound will be monitoring an important indicator of activity in the service sector, as this can determine the future direction of the market, since most of the economy falls on this sphere. The service sector index is expected to continue declining and remain unchanged at 49 points, similar to December last year. If the indicator returns beyond 50 points, this will indicate an increase in activity, and buyers of pound will quickly cope with the resistance of 1.3110 and return to the market. This is to ensure growth to the highs of 1.3200 and 1.3290.

On the contrary, weak indicators and continued pressure on the services sector will push the pound below the support of 1.3060, collapsing the trading instrument to the lows of 1.3000 and 1.2960. There is "close at hand" in the December levels.

The material has been provided by InstaForex Company - www.instaforex.com