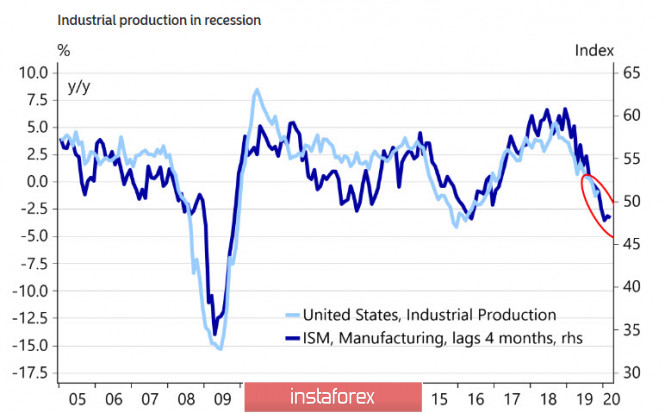

The PMI ISM index in production fell to 47.2p in December, which turned out to be the lowest result since June 2009, and declined outside the forecast range of 47.5-50.4p. Such a low result was an absolute surprise for the markets, since a positive response was expected to be concluded in the first phase of the trade agreement, financial conditions improved, and regional indices were generally quite positive.

As a result, December was the fifth consecutive month of PMI reduction, with the pace of decline accelerating. Moreover, almost all the components of the index are reduced - demand, new orders, consumption, employment, and the probability that the December employment report will also be worse than expected has decreased.

Trumponomics obviously fails, even though stock indices are increasing - the slowdown in production does not give any reason to hope for an improvement in the trade balance even taking into account the deal with China. The trend is so obvious that the question of why Trump needed a small victorious war has a clear answer - without clear signs of strength, the results of the November elections can be predicted without even being a soothsayer.

Against the backdrop of a sharp increase in geopolitical risks, oil updated its six-month high, returning to the level of $ 70 per barrel, while gold is even close to 7-year levels. In April 2013, when gold prices traded at $ 1,570 per ounce, the EUR/USD rate fluctuated in the range of 1.28 - 1.33, which is significantly higher than the current 1.11. Thus, this means that the potential for the dollar to decline in the coming months is quite strong.

On the other hand, the FOMC protocol for the December meeting did not have a noticeable effect on the markets, since their publication coincided with a period of low activity. The Fed proceeds from what has already been done enough to stop the threat of recession, and now, a pause will be taken to track incoming data.

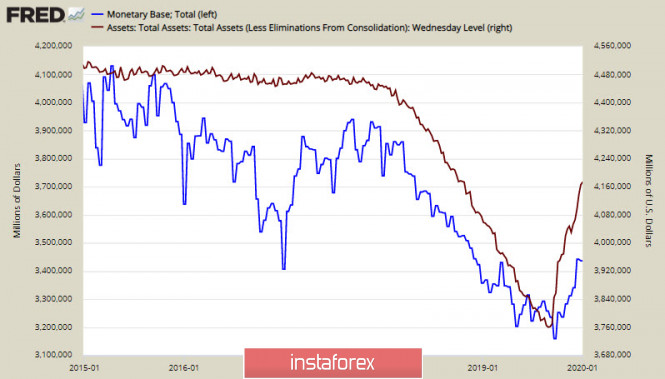

At the same time, the Fed sees risks downward, and the ISM index significantly enhances these risks. The likelihood that the rate will be reduced again in March is growing, and similar expectations will continue to put pressure on the dollar. The battle for the REPO, which the Fed seems to have won, has led to a sharp increase in its balance sheet and monetary base.

Meanwhile, the Fed reports that activity in the repo market will slow down, as reserves will be added through purchases of T-bills, from which the probability of QE4 is growing. As a result, the dollar is under pressure due to both growing liquidity and the approach of QE4, and because of the threat of a recession and an increase in the probability of a rate cut in March.

Collectively, the first week of 2020 indicates the likelihood of a depreciation of the dollar as well as an increase in gold and oil due to the threat of geopolitical risks and uncertainty about the form of Iran's response to the killing of the second person in the state, which will entail an increase in demand for protective assets.

USD/CAD

The Canadian dollar fixed below 1.30, which was facilitated by rising oil prices, but a further decrease in the loonie is unlikely. In addition, there are no internal factors for the Canadian growth - the PMI in production slowed down in December from 51.4p to 50.4p, and although formally it still remains in the expansion zone, the tendency to slow down can be clearly seen. In turn, geopolitical risks are high and can provoke a way out of commodity currencies at any time.

The decrease in USD/CAD was already 76.4% of the September maximum, the momentum is close to exhaustion, and a return to resistance of 1.3040 / 50 is possible. Now, if it goes above, the movement to the key level of 1.5150 / 75 is likely to develop.

USD/JPY

According to Jibun Bank, Manufacturing PMI of Japan continues to decline, confidently consolidating below 50p. In December, the index fell to 50.4p, and thus, the prospects became a little more clear for the yen. The threat of geopolitical risks leads to the demand for the yen as a protective currency, a slowdown in production and the US-China trade deal not in favor of Japanese exporters. As a result, the likelihood that the yen will strengthen amid worsening macroeconomic factors will push the Cabinet of Ministers and the Bank of Japan to take new measures to support the economy.

An attempt to gain a foothold below 107.88 support was unsuccessful, but the threat of a decrease in USD/JPY remains. The goals are 107.70 and 107.08, with a further decrease, verbal reaction of officials in order to prevent the strengthening of the yen will be likely.

The material has been provided by InstaForex Company - www.instaforex.com