The British pound managed to grow against the US dollar by the end of the week of October 13. This success could be more significant than it turned out. The uncertainty surrounding the negotiations on Brexit and the future of Theresa May as the head of the conservative party and as prime minister restrict the attacks of bulls on the GBP / USD pair. Politics is a kind of poison for sterling, limiting its growth potential even against the background of the firm desire of the Bank of England to raise the repo rate.

If in the beginning of October the focus of investors was on the possible displacement of Theresa May as the leader of the Conservative Party, by the middle of the month their gaze shifted to negotiations on the withdrawal of Britain from the EU. The pound collapsed to the base of the 31st figure, after Michel Barnier stated that the dialogue between London and Brussels had reached a dead end. Nevertheless, information leaked to the press after a few minutes stating that he could offer the Foggy Albion a transitional period. This allowed the "bulls" on GBP / USD to go into a counterattack.

Divorce is not easy. Most often, the focus is on mercantile interests. In particular, the question of how much Britain should pay for it. Large banks believe that the absence of a deal will be disastrous for sterling. In particular, Morgan Stanley believes that its course in this development will collapse to $ 1.11. Meanwhile, other experts commented about the shift of GBP / USD. Mizuho says a figure of $ 1.1 will be the result while Nomura predicts that it will go to the range of $1.1-1.2. However, there are also optimists. ING believes that the maximum that "bears" can count on is at 1.2 while Rabobank and does say about the field of 1.3.

In any case, uncertainty contributes to the growth of volatility and does not bode well for the sterling. In this respect, the increase in the ratio of premiums on options with no intrinsic value and options in money to a 2-month high is an original answer to the question of why the pound is not growing. Investors doubt that the tightening of monetary policy by the Bank of England will be able to outweigh political risks. They expect higher volatility in the coming days, particularly, up until November 2 when the Bank of England will make a statement about the fate of repo rates.

Dynamics of the ratio of demand for options

Source: Bloomberg.

It is curious that the Chamber of Commerce and Industry calls on Mark Carney and his colleagues not to tighten up monetary policy, nodding at the weakness of the economy of the Foggy Albion. In this regard, releases of data on inflation, the labor market, and retail sales are able to clarify the situation. According to forecasts of Bloomberg experts, consumer prices in September rose to 3%, exceeding the forecasts of the Central Bank and forcing the latter to raise the repo rate. In conditions when employment will continue to rejoice and retail sales, judging by the leading indicator from BRC, may exceed the BoE consensus estimate, there will be no arguments to keep it at the same level. It's another matter if statistics disappointment.

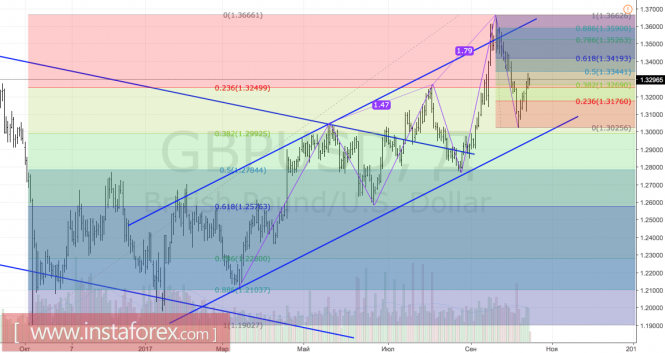

Technically, the future fate of GBP / USD will depend on the ability of the bulls to hold the quotes above the area of 1.325-1.327.

GBP / USD, daily chart