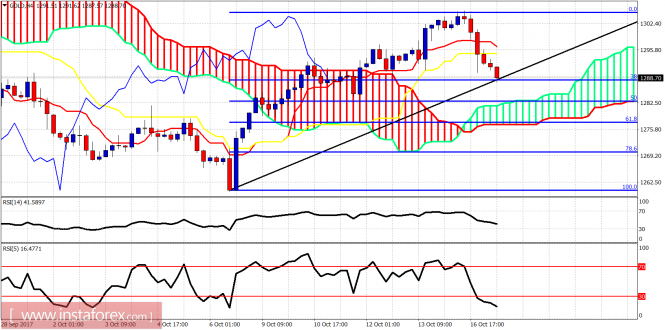

Gold price reversed yesterday and has pulled back below $1,300. As we mentioned a couple days ago, the area of $1,305-$1,310 is an important resistance area and a pullback from that area towards $1,280 was justified.

In Ichimoku cloud terms, this pullback is considered a buying opportunity. Price is above the 4-hour Kumo. Price is correcting the recent upward move from $1,260 to $1,306. Price has just reached the 38% Fibonacci retracement. Price could reach the Kumo and the 50% retracement before the up trend resumes.