Markets can be punished for conceit. For a long time, investors ignored geopolitical risks and were confident that the North Sea grade of oil would be quoted within the range of $40-60 per barrel for long term. The is because the prices increased above the resistance level that will probably increase production in the U.S., and dropping below the support level will be the reason for its reduction. Unfortunately, the resultant strategy began to fail for a long time after the market returned to the balance sheet. This lead the reserves of the OECD countries to reach above their five-year averages of 170 million barrels but the difference from the beginning of the year was halved, indicating the effectiveness of the Vienna OPEC treaty.

It is one thing for the geopolitician in periods of global surplus, when the conflicts worsen and causes only short-term surges in prices for black gold. Another situation is considering it as a factor for long-term. The military clashes between Iraq and Kurdistan which reinforce the risks of export suspension around 400,000 barrels per stream day. If Turkey desires, they can block all supplies at 600,000 barrels per stream day, which will increase the chances of the market to move with a deficit. At the same time, this will help overcome Brent psychologically important mark of $60 per barrel. The main objective is that OPEC will not fail and extended the agreement on production cut beyond March 2018. The decision to roll over will be concluded in November, and it looks like investors have already believed in a favorable outcome.

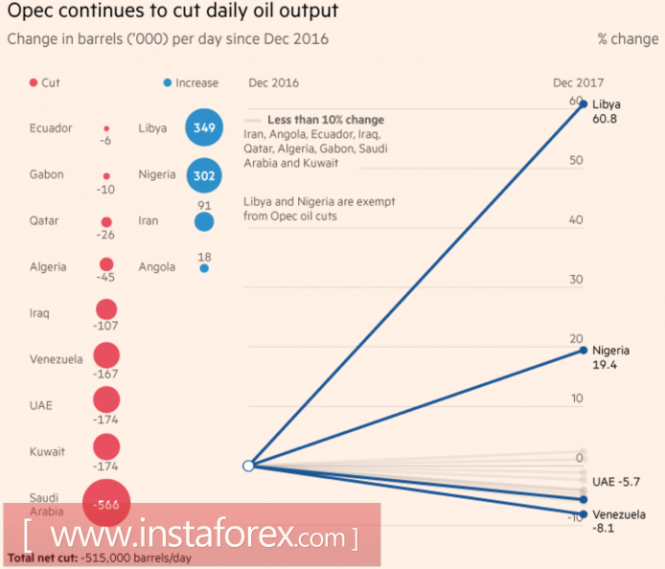

OPEC actions in bringing the oil market to the balance

Source: Financial Times.

According to the IEA, the cartel in September fulfilled its Vienna obligations by 86%, which is somewhat higher than in August. OPEC itself predicts that in 2018 the demand for its oil will increase to 33.1 million barrels per stream day, which is 200,000 more than the previous estimate. The main reasons are cuts in supplies from other countries and growth in global demand. From the latter point of view, China's active efforts to build up domestic reserves of black gold are important. In September, the oil imports of the Celestial Empire jumped to 9.03 million barrels per stream day, which is the second largest indicator in history and 11% higher than last year.

For Kurdistan, OPEC's readiness to extend the Vienna agreement and the growing demand from China added more risks in view of the resumption of economic sanctions against Iran and the effectiveness of implementing agreements on the cessation of the production of nuclear weapons, which U.S/ President Donald Trump questioned. Previously, it was about the loss of about 1 million barrels per stream day of exports from Tehran, and if the story repeats, then the quotes of Brent can go much higher than $60 per barrel.

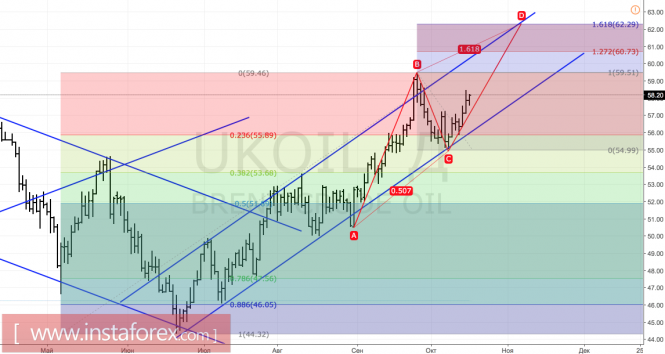

Technically, the September peak update near the $59.5 mark will activate the AB = CD pattern and increase the risks of selling its targets at 127.2% and 161.8%. These are located near the marks of $60.7 and $62.3 per barrel. In order for the "bears" to expect a correction, they need to take the price of Brent below the lower limit in the upward trading channel and take the resistance at $55.9.

Brent, daily chart