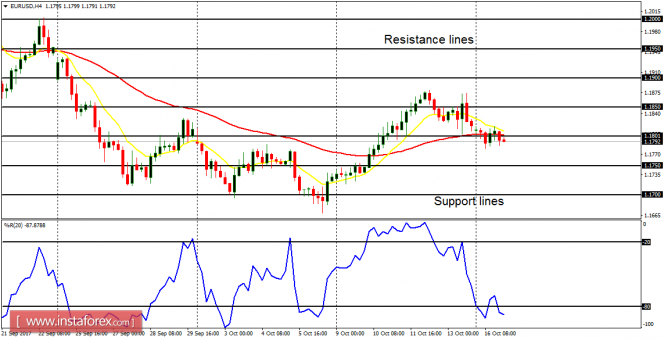

EUR/USD: The EUR/USD has been going downwards gradually since Friday, creating a directionless scenario on the market. It is better to stay away from the market until there is a strong breakout to the upside or to the downside, which would create a directional bias (a movement of about 200 pips).

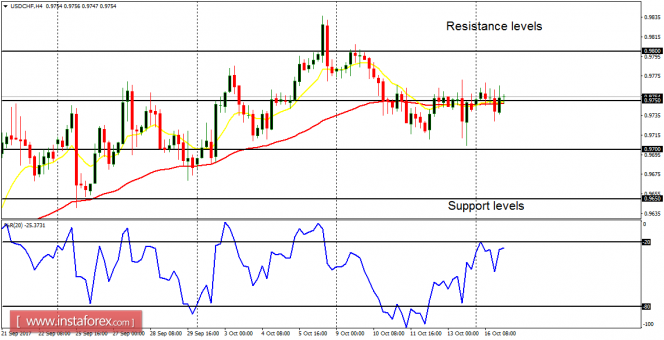

USD/CHF: The USD/CHF simply consolidated yesterday, but a rise in momentum is expected anytime this week. Soon, the price would either go above the resistance level at 0.9850; or it would go below the support level at 0.9650, creating a directional bias on the market.

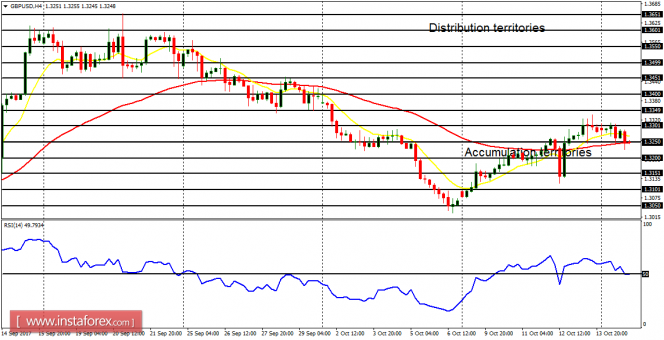

GBP/USD: The Cable is now bullish both in the long-term. There is a Bullish Confirmation Pattern in the market, which would become more conspicuous as price goes further upwards towards the distribution territories at 1.3300 and 1.3350. There are accumulation territories at 1.3200 and 1.3151, which would try to hinder some bearish attempts.

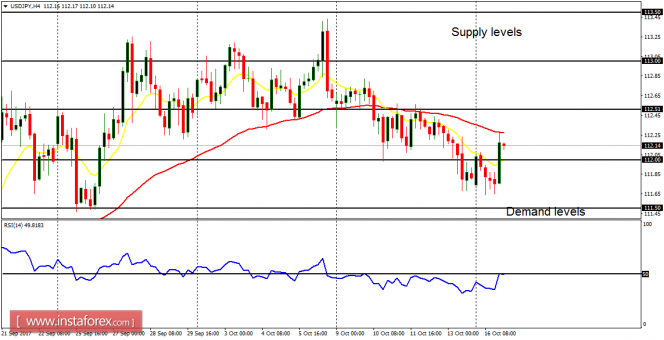

USD/JPY: On Monday, this currency trading instrument bounced upwards in the context of a short-term downtrend. Further upwards movement above the supply level at 113.00 would result in a bullish bias; while a movement to the downside would confirm the recent short-term bearish bias on the market.

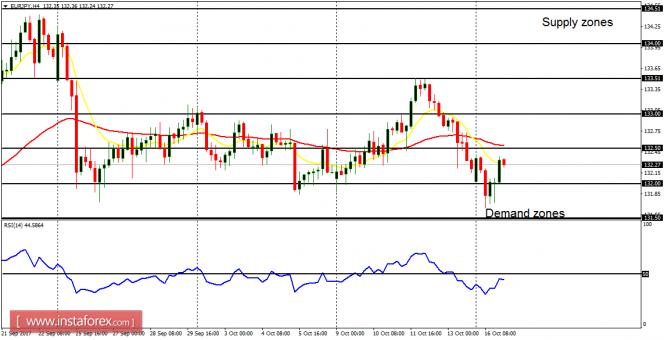

EUR/JPY: This currency trading instrument is bullish in the long-term. The outlook on EUR pairs is bearish for this week, it is possible that price would continue to go downwards towards the demand zones at 132.00 (which was previously tested), 131.50 and 131.00. A northwards movement of 150 pips from here would render this expectation invalid.