Consumer spending in the US rose by 0.1% in June, the lowest in the current year.

Sales of cars in the US continues to decline.

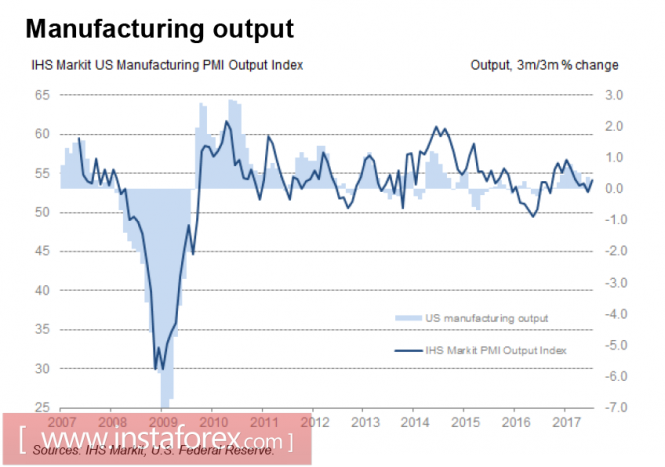

The PMI Markit index in the US manufacturing sector grew in July to 53.3p against 52p from a month earlier.

At the same time, the analogous index from the ISM fell slightly from the maximum in three years, showing 56.3p against 57.8p from a month earlier. This is slightly worse than the expert's expectations but it's still in the area of multi-month highs.

At the end of last week, US Treasury Secretary Mnuchin appealed once again to Congress with a request to immediately raise the ceiling of national debt. His concern is caused by the fact that in August, legislators will leave for vacation and the matter will be postponed until September. This is the last month in which the government will have some money to finance its current activities. The situation is quite alarming since the danger of remaining without funds to refinance your obligations becomes visible.

The Office of the US Congress on Budget (CBO) suggests that even with all available emergency measures, the government will be able to fulfill its obligations only until October. The situation is aggravated by the fact that the number of congressmen who are ready to vote for raising the limit of the state debt without any conditions is steadily declining. Meanwhile, the majority demands a plan that will make it clear where the money will be spent.

Obviously, to resolve the issue, Congress will have to see a detailed draft of the tax reform and not only see it, but also approve it. In other words, a successful procedure for raising the public debt ceiling will not take place until the issue of taxes and Medicare are resolved. All of these events should happen before the end of September, the month in which the Fed, in the opinion of the market, will announce the start of a budget cuts program.

The US economy is in a phase of unstable equilibrium. Positive expectations for the beginning of re-industrialization are exhausted, prices are slowing, and consumers are beginning to save and getting ready for the worst. Thus, the likelihood of a large-scale turmoil in the financial markets will grow in the coming month. These expectations will continue to weigh on the dollar and stimulate the growth in demand for defensive assets, primarily gold, euro and yen. The implementation of the scenario, in which the dollar will begin a new wave of strengthening in the near future, is becoming less likely.

The material has been provided by InstaForex Company - www.instaforex.com