Encouraged by the intentions of Saudi Arabia to reduce exports, the decline in US stocks and production, and the weak US dollar, oil managed to close July in positive territory. This is the first month this year that prices remained in the green zone, which indicates a change in the perspective of investors. They start to understand that the bottom on Brent is in the region of $40-45 per barrel, and actively build up the long positions. As a result, speculative long positions on WTI reached the maximum level for three months, and the combined shorts for the North Sea and Texan grades fell to the lowest level since November. The short-term contracts for Brent in the futures market moved from contango to backwardation, which signals that the physical asset market is close to the balance sheet.

Dynamics of speculative positions and oil prices

Source: Bloomberg.

The market is euphoric, but it is unlikely that anyone projects that oil will go for a mark of $60 per barrel. According to Bloomberg experts, based on the results of the week, US stocks will decrease by 3.3 million barrels by July 28, which will be the fifth five-day decline in a row. Nonetheless, the figure is 90 million barrels higher than the historical average for this period of the year. At the same time, the US produces 9.41 million b/d, which is the highest level since 2015. Let the shale companies discuss weak financial results in the first and second quarters, but the current increase in prices for black gold will make it necessary to activate hedging operations, which refers to the "bearish" factors for Brent and WTI.

Do not wear rose-colored glasses about Saudi Arabia's desire to cut exports. In July, OPEC oil production increased by 210 thousand b/d, to 32.87 million b/d. According to Commerzbank's research, even a strong global demand will not help the cartel to widen the supply deficit by more than 500, 000 b/d in the second half of the year.

There is no unequivocally correct opinion on the medium-term prospects of the US dollar. The US economy grew by 2.6% q/q in the second quarter. Consumers felt confident that, amid a strong labor market, there will be an acceleration of inflation. As a result, the chances of a third act of monetary restriction in 2017 will increase, and the USD index will pull away from the area of multi-month lows.

Thus, the increase of hedging volumes by American producers, the prevailing confusion within OPEC and the potential correction in the US dollar allows the discussion regarding the limited growth potential of Brent and WTI.

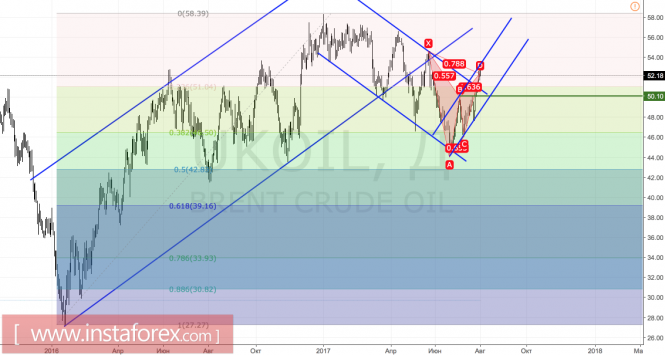

Technically, futures for the North Sea variety are moving within the framework of the upward trading channel. Breakthrough resistance at $50.1 and $51.05 per barrel contributed to the implementation of "bulls" target by 78.6% over the reversed pattern of Gartley. If within the next week or two buyers manage to gain a foothold above the level of 23.6% of the last rising wave, then they will have a chance to go to $56 and $57. In the opposite case, mid-term consolidation is expected in the range of $46-54 per barrel.

Brent, daily chart