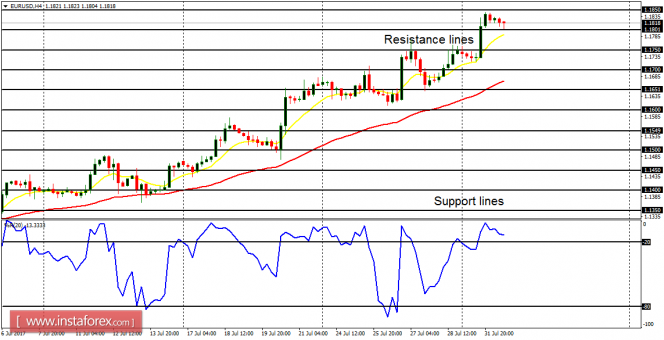

EUR/USD: This pair is in a strong bullish mode; it trended upwards yesterday continuing the general bullishness that has been seen so far this year. The price is currently above the support line at 1.1800 and it may reach the resistance line at 1.1850, which would be breached to the upside if the price goes further upwards to test another resistance line at 1.1900.

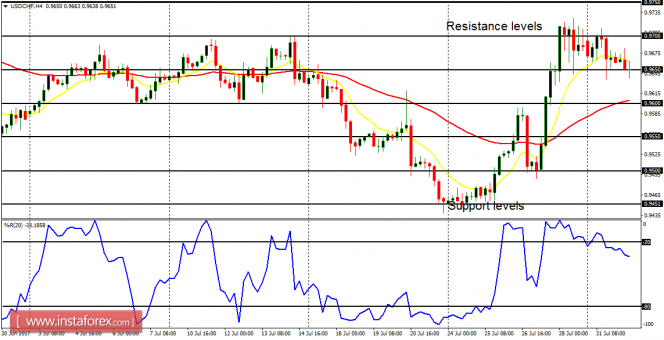

USD/CHF: USD/CHF went sideways on Monday, while the bullish signal that was generated last week is still intact. As long as CHF is weak, the bullish signal in the market would be sustained. While the resistance level at 0.9700 could be tested once again, the market would go down in case CHF gains stamina.

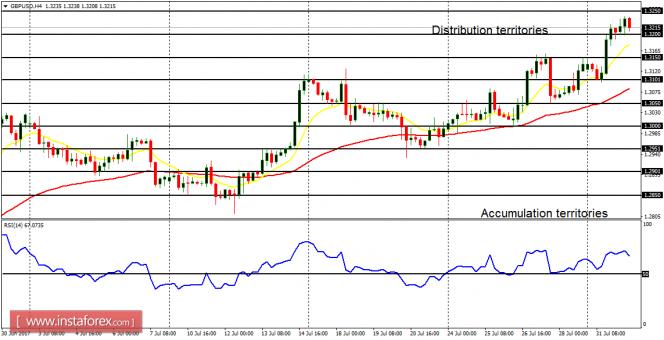

GBP/USD: The Cable has added additional 130 pips this week, having gained over 350 pips within the last few weeks. There is the Bullish Confirmation Pattern on the 4-hour chart. Further upward movement is anticipated, as the price goes towards the distribution territories at 1.3250, 1.3300 and 1.3350.

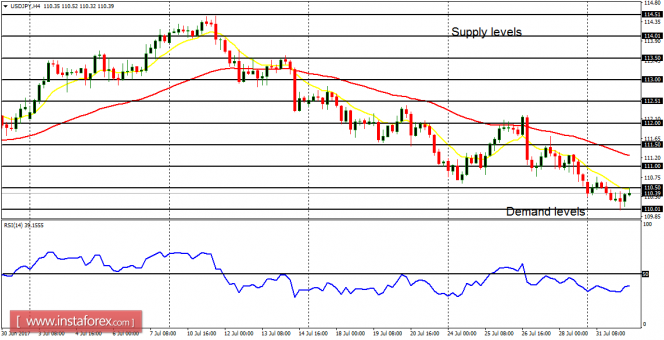

USD/JPY: The USD/JPY pair has gone further downwards. In this market, any rallies ought to be seen as opportunities to sell short, for the outlook on the market is bearish for this week and this month. The next targets for bears are located at the demand levels of 110.00 and 109.50, which would be reached within the next several trading days.

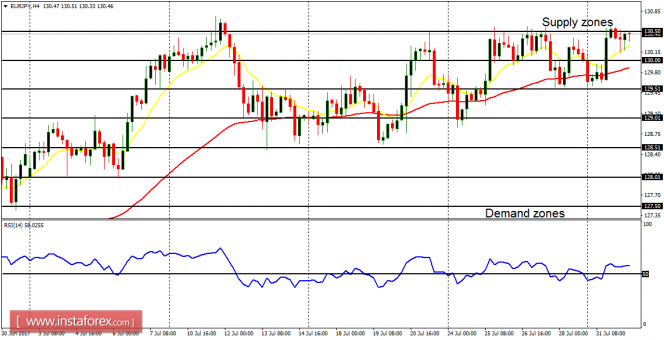

EUR/JPY: EUR/JPY is in a consolidation mode and the bias in the market has become neutral. Further consolidation would put more emphasis on the current neutrality in the market. Movements below the demand zone at 128.50 would result in a bearish signal, while a movement above the supply zone at 130.50 would result in a bullish signal.