Markets are clearly tired of the constant pressure of negative news and are looking for any positive to buy risky assets and, as a result, to sell the US dollar.

The obvious desire of bidders not to notice that there is no reason yet to reach a trade agreement between Washington and Beijing, as well as there are significant tensions in the negotiation process between the United States and Canada, as well as the European Union, is manifested in the weakening of the US dollar. And this happens with a "defiant" view on the background of the Fed meeting, from which the markets expect an increase in interest rates by 0.25%. It is assumed with a 95% probability, according to the dynamics of futures on Federal funds rates, that the key interest rate will be increased from 2.00% to 2.25%.

The fact that the markets have taken this into account, as they say, in the quotations of the dollar, is understandable. The main result of the meeting of the central bank will not be a decision on rates, which in fact no one doubts, but long-term plans for their further hike. Recall that earlier the Fed and its head, J. Powell, following the last meeting on monetary policy gave a clear signal that the rates could be raised once again this year, a fourth time before the end of the year. This caused not only the growth of the dollar, but also the discontent of the American President D. Trump, who has repeatedly stated that he does not need a strong dollar, which will interfere with economic growth.

Probably, the weak upward dynamics of the dollar is largely connected with this. In addition, if the markets previously perceived the impact of trade conflicts as a positive for its course, since they estimated the safe haven from the position of the currency, now there the opposite picture is observed, which was last year. Namely, the weakness of the dollar was seen through the prism of political squabbles in Washington.

Well, how can the market react to the Fed rate hike and its decision not to deviate from the planned vector of monetary policy? In our opinion, if the decision of the central bank is not only an increase in interest rates, as well as signaling the continuation of this process in the future, it will provide local support for the dollar, although it is probably not worth waiting for its serious local upward turn, based on the reasons shown above.

The forecast for today.:

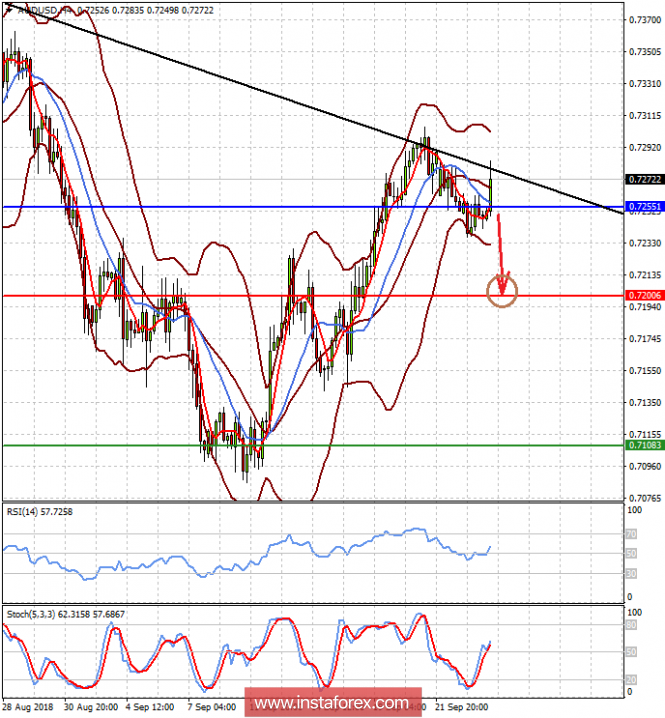

The AUDUSD pair is trading above 0.7255 pending the outcome of the Fed meeting. If the regulator gives a clear signal about the intention to continue raising rates, that is, there will be no pause – this can be a good reason for a local reversal of the pair downwards, which may fall to 0.7200 after crossing the mark of 0.7255.

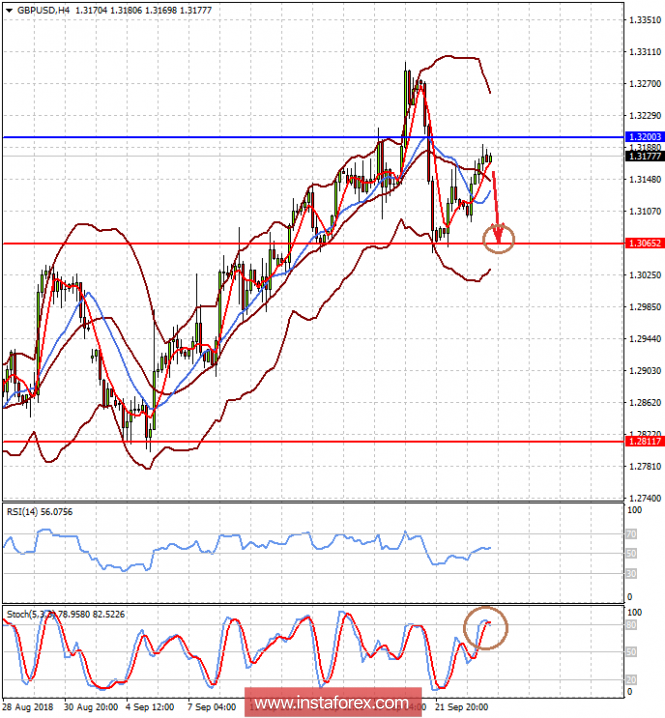

The GBPUSD pair is trading with an increase below 1.3200. The positive outcome of the meeting for the dollar may lead to a decrease in the price to 1.3065.