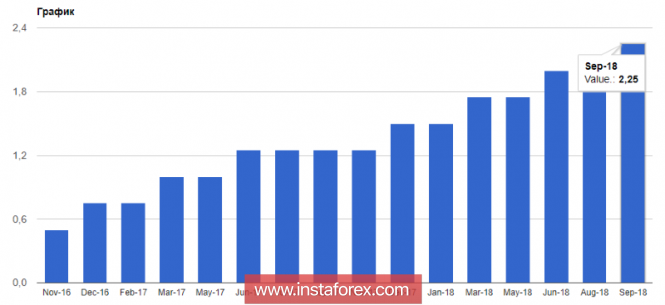

Yesterday, it became known that the US Federal Reserve System set the range of interest rates for federal funds between 2.00% and 2.25%. The Fed also raised the discount rate to 2.75% by 0.25 percentage points. This decision by the committee on open market operations took the number of votes to 9 against 0.

Despite the fact that the Fed raised interest rates, the committee also signaled another planned increase this year, which is likely to happen in December.

It should be noted that the Fed has left unchanged the statement concerning the economy, including the labor market and inflation, saying that the labor market situation has continued to improve and economic activity has grown at a strong pace.

The increase in the interest rate, along with the latest economic indicators, also allowed the Fed to remove from its statement the word "soft" as applied to monetary policy. This suggests that the achievement of a neutral level of interest rates is gradually approaching.

Let's talk about the forecast for the interest rate, as investors pay attention to changes in these indicators, building their future strategy:

- Federal Reserve forecast for a key interest rate: 2.4% at the end of 2018

- Federal Reserve forecast for the key interest rate: 3.1% at the end of 2019

- Federal Reserve forecast for the key interest rate: 3.400% at the end of 2020

The most important point, which I drew attention in my yesterday's review, was the forecast of the Fed on the key interest rate at the end of 2021, where the rate is expected at 3.4%.

This again indicates that the committee is close to the end of the period of interest rate increase since in the long term the rate is expected to be at the level of 3%.

As for the growth of the economy, the Fed's average forecast for GDP growth has been raised to 3.1% this year and 2.5% for the year after. The Fed's average forecast for the unemployment rate at the end of 2018 was also raised to 3.7% from 3.6% in June, which indicates a slight decline in the labor market. Indicators of longer-term inflation expectations remained unchanged.

Following the publication of the Fed's decision, Chairman Jar Powell said that short-term interest rates remain low, and the disappearance of the word "soft" on the statement does not signal a change in policy.

Powell once again stressed that in the decision-making process, the Fed is not guided by political considerations, but by setting rates, only financial conditions are taken into account.

Fundamental data

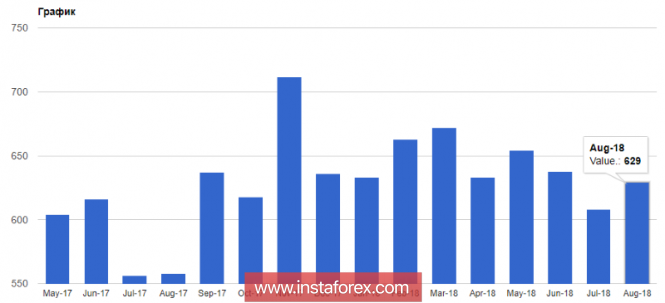

Data on the growth in sales of new homes in the US in August this year were ignored by the market.

According to the report of the US Department of Commerce, sales in the primary housing market increased by 3.5% in August 2018 compared to the previous month, amounting to 629,000 homes per year. Economists had expected growth of 0.5% compared to the same period of the previous year when sales grew by 12.7% in August.

Technical picture of EUR / USD pair:

Another unsuccessful consolidation above the resistance of 1.1800 led to profit taking by major investors, who took advantage of the volatility of the market after raising interest rates.

The breakthrough of support 1.1725 points to the problematic growth of problems among euro buyers. If you quickly fail to return to this area, then, most likely, the uptrend will be broken, which will lead to new levels of support 1.1650 and 1.1620.

The material has been provided by InstaForex Company - www.instaforex.com