Dear colleagues.

For the currency pair Euro / Dollar, the continuation of the upward movement is expected after the passage at the price range of 1.1809 - 1.1829. For the Pound / Dollar currency pair, the price is close to canceling the downward structure from September 20, which requires a breakdown at the level of 1.3204. For the Dollar / Franc currency pair, we clarified the key objectives from the upward structure on September 21. For the Dollar / Yen currency pair, we follow the local upward structure of September 13, continuing the upward movement forward after the breakdown of 113.01. For the currency pair Euro / Yen, we expect the continuation of the upward movement after the breakdown of 133.16. For the Pound / Yen currency pair, we expect the key development of the situation, the key resistance for the downward movement is the level of 147.59, the breakdown of 149.25 will have to develop an upward trend.

Forecast for September 27:

Analytical review of currency pairs in the scale of H1:

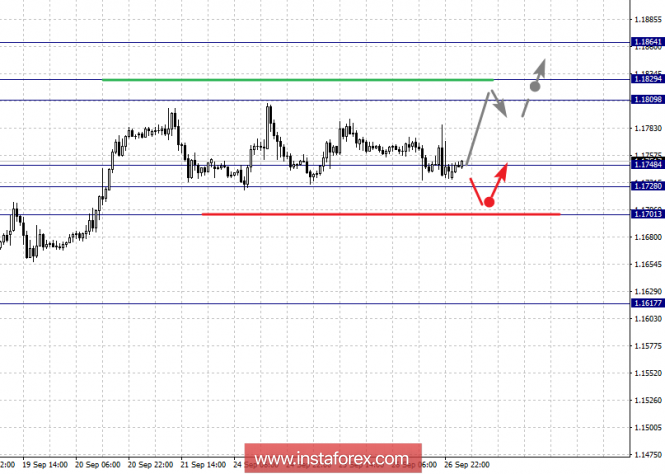

For the currency pair Euro / Dollar, the key levels on the scale of H1 are: 1.1864, 1.1829, 1.1809, 1.1748, 1.1728 and 1.1701. Here, we continue to follow the local upward structure of September 17. The short-term upward movement is expected in the range of 1.1809 - 1.1829 and the breakdown of the last value will lead to a movement to the potential target of 1.1864, upon reaching this level, we expect a rollback into correction.

The short-term downward movement is possible in the range of 1.1748 - 1.1728 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1701 and this level is the key support for the top.

The main trend is a local structure for the top of September 17, the area of correction.

Trading recommendations:

Buy 1.1810 Take profit: 1.1827

Buy 1.1830 Take profit: 1.1860

Sell: 1.1746 Take profit: 1.1730

Sell: 1.1726 Take profit: 1.1705

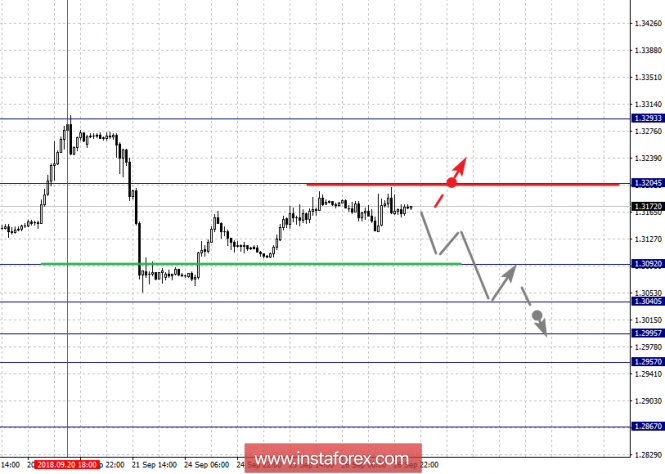

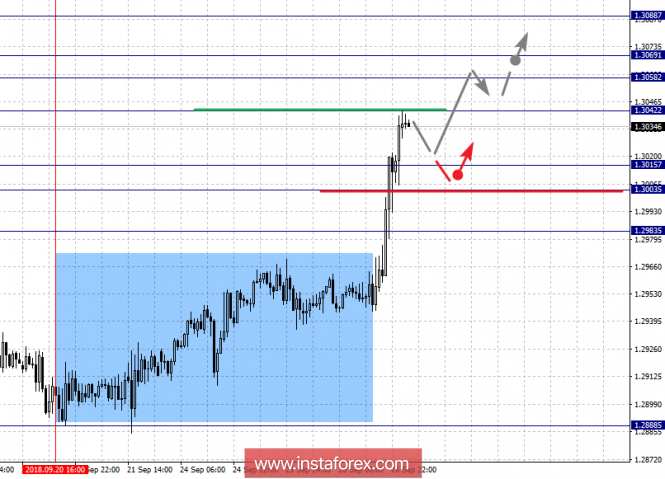

For the Pound / Dollar currency pair, the key levels on the scale of H1 are: 1.3293, 1.3204, 1.3092, 1.3040, 1.2995, 1.2957, 1.2867 and 1.2803. Here, we monitor the formation of a downward structure from September 20 and the level of 1.3204 is the key support. Its breakdown will have to form an upward structure. In this case, the target is 1.3293. The continuation of the movement downwards is expected after the breakdown of 1.3092. In this case, the first target is 1.3040 and the breakdown of which, in turn, will allow us to count on the movement to 1.2995, up to this level we expect the formation of pronounced initial conditions for the bottom. The passage at the price range of 1.2995 - 1.2957 will lead to the development of a pronounced downward movement. Here, the target is 1.2867. The potential value for the bottom is the level of 1.2803, upon reaching which we expect a rollback to the top.

The main trend is the formation of a downward structure from September 20, a stage of deep correction.

Trading recommendations:

Buy: 1.3206 Take profit: 1.3290

Buy: Take profit:

Sell: 1.3090 Take profit: 1.3042

Sell: 1.3040 Take profit: 1.2995

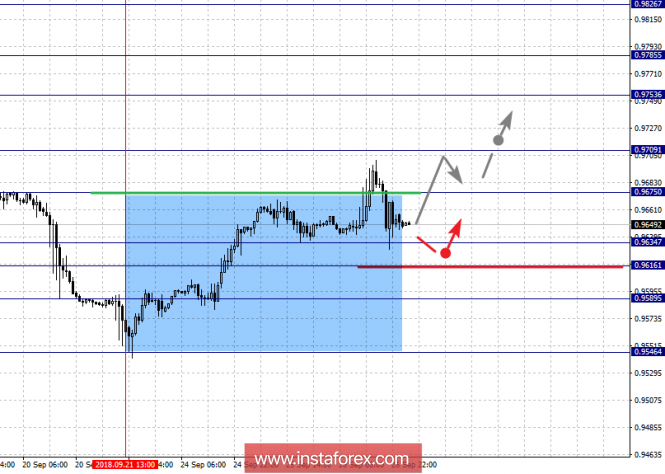

For the currency pair Dollar / Franc, the key levels on the scale of H1 are: 0.9826, 0.9785, 0.9753, 0.9709, 0.9675, 0.9634, 0.9616 and 0.9589. Here, we clarified the objectives for the upward structure of September 21. The continued upward movement is expected after the breakdown of 0.9675. In this case, the target is 0.9709 and near this level is the consolidation. The breakdown at the level of 0.9710 should be accompanied by a pronounced upward movement. Here, the target is 0.9753 and in the range of 0.9753 - 0.9785 is the short-term upward movement, and consolidation. The potential value for the top is the level of 0.9826, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 0.9634 - 0.9616 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9589 and this level is the key support for the top.

The main trend is the upward structure of September 21.

Trading recommendations:

Buy: 0.9675 Take profit: 0.9707

Buy: 0.9712 Take profit: 0.9750

Sell: 0.9634 Take profit: 0.9617

Sell: 0.9614 Take profit: 0.9590

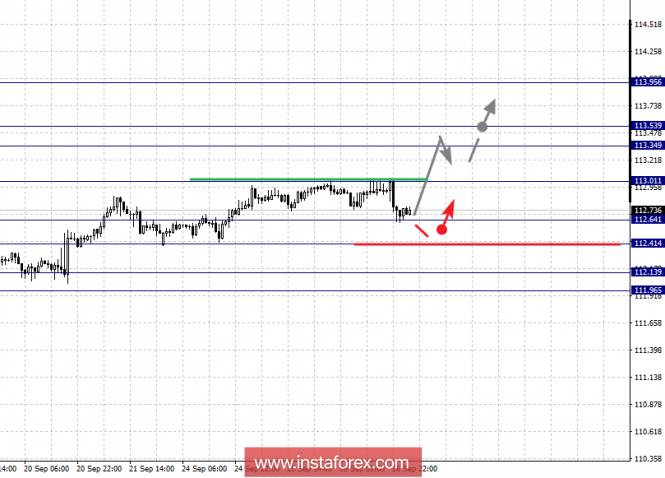

For the currency pair Dollar / Yen, the key levels on the scale of H1 are: 113.95, 113.53, 113.34, 113.01, 112.64, 112.41, 112.13 and 111.96. Here, we follow the local upward structure of September 13. The continued upward movement is expected after the breakdown of 113.01. In this case, the target is 113.34 and in the range of 113.34 - 113.53 is the consolidation. The potential value for the top is the level of 113.95, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 112.64 - 112.41 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 112.13 and the range of 112.13 - 111.96 is the key support for the top.

The main trend: the local upward structure of September 13.

Trading recommendations:

Buy: 113.01 Take profit: 113.34

Buy: 113.55 Take profit: 113.95

Sell: 112.62 Take profit: 112.45

Sell: 112.38 Take profit: 112.15

For the Canadian Dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3088, 1.3069, 1.3058, 1.3042, 1.3015, 1.3003 and 1.2983. Here, we follow the upward cycle of September 20. The continued upward movement is expected after the breakdown of 1.3042. In this case, the target is 1.3058 and in the range of 1.3058 - 1.3069 is the consolidation of the price. The potential value for the top is the level of 1.3088, after which we expect a pullback downwards.

The short-term downward movement is possible in the range of 1.3015 - 1.3003 and the breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2983 and this level is the key support for the upward structure of September 18.

The main trend is the upward cycle from September 20.

Trading recommendations:

Buy: 1.3042 Take profit: 1.3058

Buy: 1.3070 Take profit: 1.3085

Sell: 1.3015 Take profit: 1.3003

Sell: 1.3000 Take profit: 1.2985

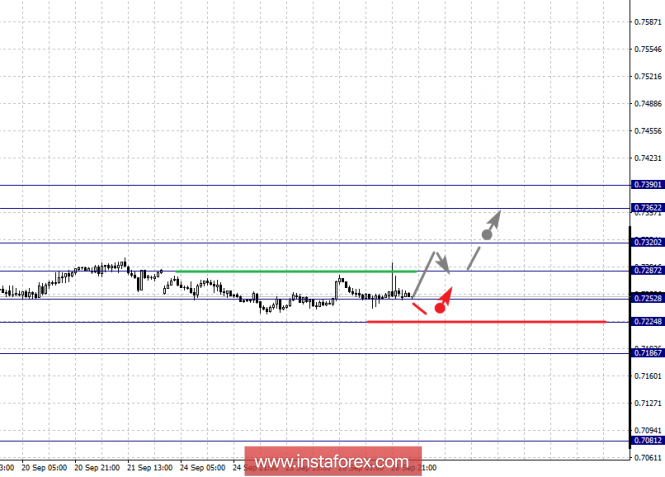

For the Australian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 0.7390, 0.7362, 0.7320, 0.7287, 0.7252, 0.7224 and 0.7186. Here, we follow the upward cycle of September 11. At the moment, the price is in correction. The short-term upward movement is expected in the range of 0.7287 - 0.7320 and the breakdown of the last value will lead to a movement to the level of 0.7362. The potential value for the top is the level of 0.7390, after which we expect consolidation.

The short-term downward movement is expected in the range of 0.7252 - 0.7224 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.7186 and this level is the key support.

The main trend is the ascending structure of September 11.

Trading recommendations:

Buy: 0.7287 Take profit: 0.7320

Buy: 0.7322 Take profit: 0.7360

Sell: 0.7252 Take profit: 0.7226

Sell: 0.7222 Take profit: 0.7188

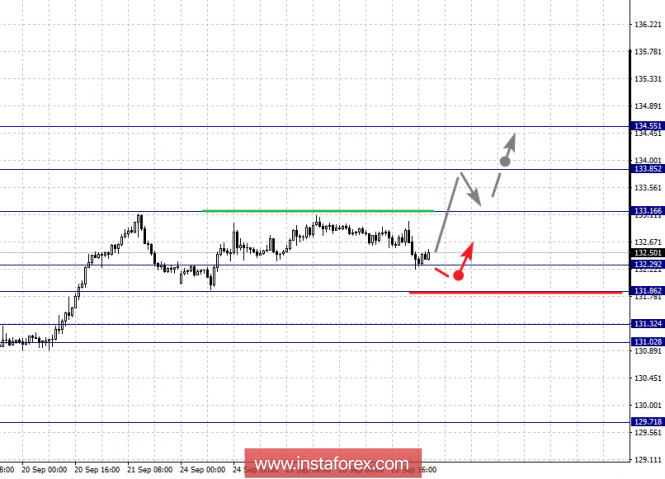

For the Euro / Yen currency pair, the key levels on the scale of H1 are: 134.55, 133.85, 133.16, 132.29, 131.86, 131.32 and 131.02. Here, we continue to follow the development of the upward cycle of September 10. At the moment, the price is in correction. The continuation of the upward movement is expected after the breakdown of 133.16. In this case, the target is 133.85 and near this level is the consolidation. The potential value for the upward trend is the level of 134.55, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 132.29 - 131.86 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 131.32 and the range of 131.32 - 131.02 is the key support for the top.

The main trend is the upward cycle of September 10.

Trading recommendations:

Buy: 133.16 Take profit: 133.80

Buy: 133.90 Take profit: 134.50

Sell: 132.27 Take profit: 131.88

Sell: 131.80 Take profit: 131.36

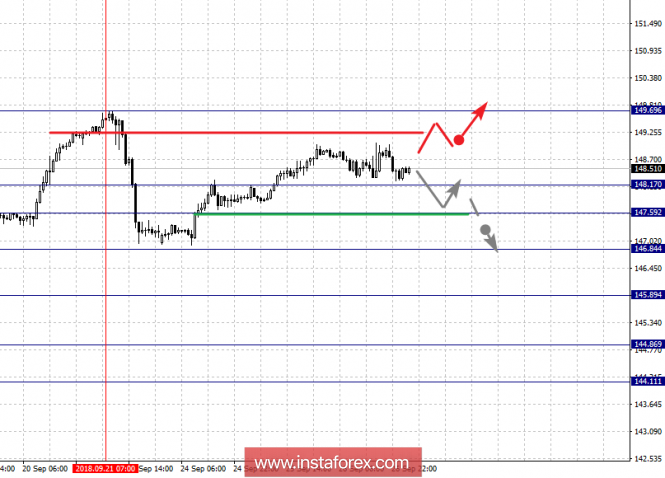

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 149.69, 148.17, 147.59, 146.84, 145.89, 144.86 and 144.11. Here, the descending structure of September 21 is still relevant as potential initial conditions. The short-term downward movement is possible in the range of 148.17 - 147.59 and the breakdown of the latter value will lead to the development of a downward trend. In this case, the first target is 146.84 and its breakdown in turn will lead to a movement of 145.89, near this level is the consolidation. The breakdown of the level of 145.89 will lead to the development of a pronounced movement. Here, the target is 144.86. We consider the level of 144.11 to be a potential value for the bottom, after which we expect a rollback to the top.

Regarding the upward movement, from the level of 149.69, we expect the formation of a pronounced structure of the initial conditions for the subsequent definition of goals.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 148.15 Take profit: 147.65

Sell: 147.55 Take profit: 146.90

The material has been provided by InstaForex Company - www.instaforex.com