Last week, Trump criticized the Fed's monetary policy, saying that raising the Fed's interest rates leads to a strengthening of the dollar against the currencies of other countries that pursue a soft monetary policy. First of all, his statement concerned, of course, the euro. According to Trump, if the ECB does not raise rates and the dollar grows against the euro and against the renminbi, they will generally fall like a stone.

Of course, this statement was quite unexpected and led to the fall of the dollar index, but the situation again normalized after the Trump administration made an explanation in which it stated that "the president respects the independence of the Fed and does not interfere in its decisions."

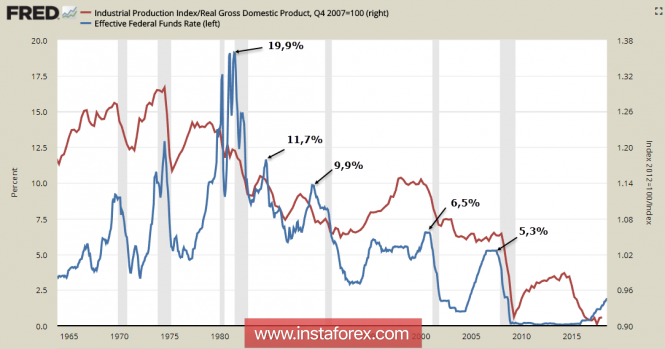

In fact, Trump, oddly enough, is completely right. Always, after the cycle of raising the rates of the Fed during the year, there was a recession.

It is clear that, after 1982, lower rates were required to provoke a recession. The current target for the rate for the Fed is only 3%, but even this level raises serious concerns.

It is also clear that each cycle of rate hikes led to a decrease in the volume of industrial production in the structure of the US economy, that is, the current cycle jeopardizes Trump's re-industrialization program. On this point, Trump is absolutely right, raising rates will level out all work to accelerate the growth of the economy, and the growth of the dollar worsens the situation on foreign trade.

This is the first public criticism of the Trump policy of the Fed, and repeated twice - on Thursday and Friday. The situation is probably more serious than it is estimated by the markets, and further strengthening of the dollar can significantly worsen Trump's position. Perhaps, this demarche was provoked by the calculations of the Trump administration on the forecast of the budget deficit, which were announced a little earlier. According to these calculations, in each of the next three years, the budget deficit will grow by about $ 100 billion a year, and in fiscal year 2019 will exceed 1 trillion. According to The Wall Street Journal, these calculations were sent to Congress in time, but no one paid any attention to them, and then Trump reacted to the criticism of the Fed's policy.

Obviously, the overly strengthening dollar is severely hampered by Trump, who is playing to raise rates in the trade war with China. At the past, he had to announce the readiness to use the mechanism to raise duties on all imports from China, that is, $ 500 billion. China, in turn, devalues the yuan, which in the moment reached the level of 6.81 per dollar - the maximum value for more than a year. The mechanism of the devaluation is based on the launch of a counterpart of the LTRO program by China - instead of loans, the companies will raise funds through the issue of bonds that will be repurchased by banks, but banks under these bonds will have access to zero-rate loans. China thus reduces the level of threat for corporate defaults, which will inevitably grow because of the complications of the conditions for exports. Furthermore, China also consciously focuses on the growth of the domestic market, that is, will continue to support the program "Strategy 2025", which the United States is against.

The macroeconomic calendar for today is calm. The Bundesbank, which will publish a monthly report, and the FRB of Chicago will report on the level of economic activity in the region. They will make a troublemaker of the calm and a report on sales in the secondary market of the US will be released later.

The USD/CNY pair is confidently moving to the level of 7.00, and the trade-weighted dollar exchange rate will continue to grow. Against the euro, a strong pound is not expected, and trade with high probability will pass in the range.

The USD/JPY pair, after the strong growth last week on Monday, is corrected. The reason lies in the emerged reports about a possible correction of the policy of the Bank of Japan in the control of profitability. At the opening of trading, the yield on 10-year bonds jumped from 0.033% to 0.084% while the USD/JPY rate dropped to 110.8. During the day, it is possible to reach 109.30 and the scenario is clearly bearish.

The euro and the pound look more neutral while the EUR/USD may fall to 1.1702 and hold a day near this level and the GBPUSD will be aiming for 1.3045. For a more blue drop, there are no good reasons.

The material has been provided by InstaForex Company - www.instaforex.com