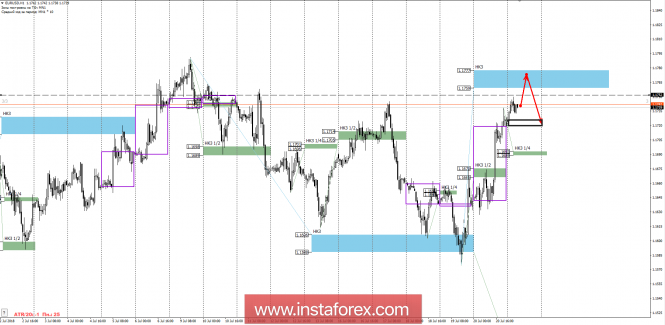

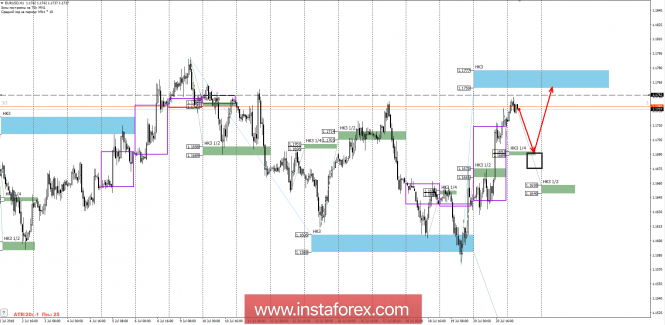

At the end of last week, the formation of a reversal upward model took place whereas the goal of which was a weekly control zone of 1.1759-1.1777. The test of this zone will determine the further priority for a week.

The last level of the offer is located at 1.1752, above which there were large limit orders for sale. A little above this level is the first target weekly control zone of 1.1759-1.1777. The test of the indicated marks will allow to fix the most part of purchases and to consider sales, in case of formation of a pattern of absorption and closing of the American session below the control zone. This will confirm the flattened structure of the movement.

For those who do not have a purchase, you will need a favorable price. This will make the reduction of the pair to the a control zone of 1.1693-1.1689 and hold the price above the zone. Purchases can be made with a limit order. An important factor for opening purchases from the limits of the specified zone is the drop from current marks without a weekly test. If the first short-term test takes place first, the limit will no longer be profitable and the entry points to the purchase will have to be transferred to lower prices.

For the formation of a reversal downward model, a breakdown and consolidation below a control zone of 1.1658-1.1649 are required for today's US session. The probability of implementing such a model is 30%, so it should only be used as an auxiliary.

The daytime CP is the daytime control zone. The zone formed by important data from the futures market that change several times a year.

The weekly CP is the weekly control zone. The zone formed by marks from important futures market which change several times a year.

The monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com