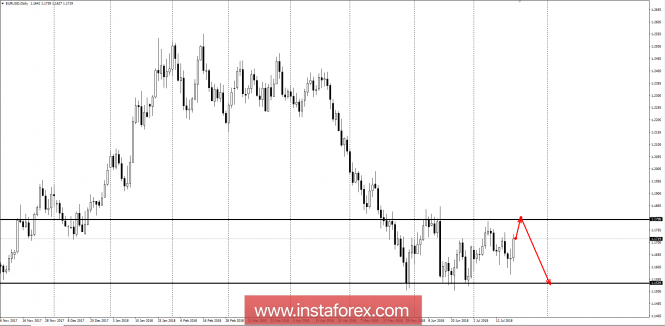

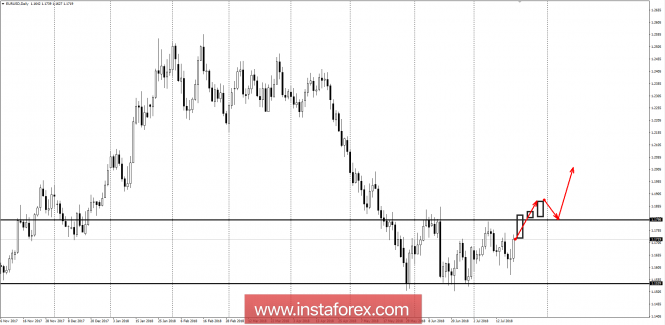

The prevailing movement this year is the depreciation. The main decline occurred in April and May, which allowed the pair to fall by 7%. The last two months, the price is held in a certain range.

The flange range began to form at the beginning of June, and its upper limit can be considered level 1.1798. To overcome this mark, the pair can not already the third month, which indicates the presence of a major interest above the June maximum. Defining support is the level of 1.1539, the test of which invariably leads to the appearance of a large offer. This indicates the presence of large limit orders below the specified mark. Work in a protracted flat means looking for deals from the range boundaries, not forgetting that the long-term priority remains a fall.

The most favorable prices for the sale of the instrument are located above the level of 1.1798. The size of the stop-loss must be calculated in such a way that it is less than the potential profit, which is located at support level 1.1539. Since the size of the profit will be 257 points, the stop-loss is not recommended to do more than 80 pips. When determining the entry point within a day after the test level 1.1798, such an opportunity will appear.

To breach the descending structure, a breakdown and consolidation above level 1.1798 of one of the American trading sessions will be required. The fastening will look like the closing of trading sessions above the resistance level. It will be enough one or two days to talk about the emergence of new interests of major players and the abolition of the downward medium-term movement.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com