Здравствуйте, уважаемые коллеги.

По паре Евро/Доллар следим за краткосрочным восходящим циклом от 19 июля. По паре Фунт/Доллар цена формирует восходящую структуру от 19 июля. По паре Доллар/Франк нисходящий цикл от 13 июля рассматриваем в качестве основной структуры. По паре Доллар/Иена ожидаем оформления среднесрочной нисходящей структуры. По паре Евро/Иена следим за нисходящей структурой от 17 июля. По паре Фунт/Иена ожидаем движение к уровню 145.01.

Прогноз на 23 июля:

Аналитический обзор валютных пар в масштабе Н1:

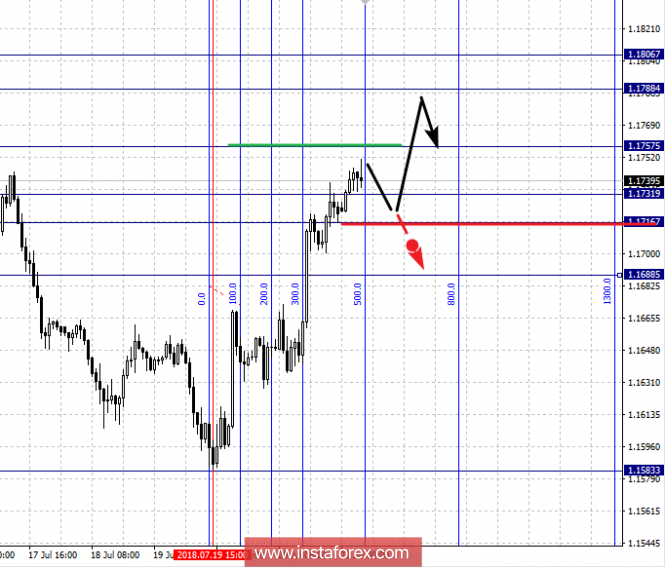

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1806, 1.1788, 1.1757, 1.1731, 1.1716 and 1.1688. Here, we follow the short-term upward structure of July 19. The continuation of the upward movement is possible after the breakdown of 1.1757. In this case, the target is 1.1788. In the area of 1.1788 - 1.1806 is short-term upward movement. From here, we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.1731-1.1716. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1688. This level is the key support for the upward structure.

The main trend is the upward cycle of July 19.

Trading recommendations:

Buy: 1.1757 Take profit: 1.1785

Buy 1.1789 Take profit: 1.1804

Sell: 1.1730 Take profit: 1.1718

Sell: 1.1714 Take profit: 1.1690

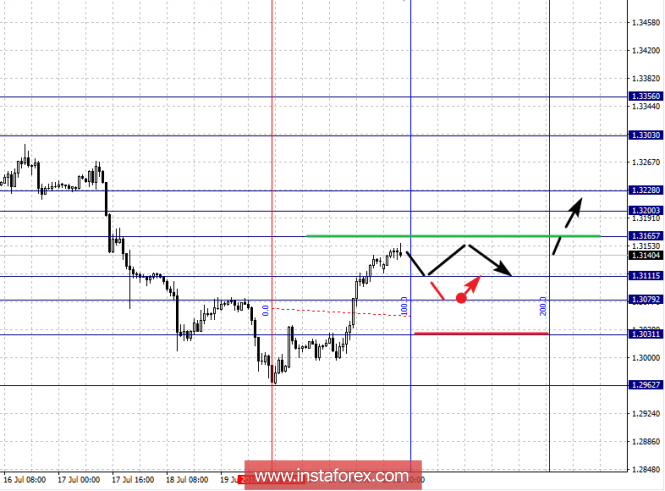

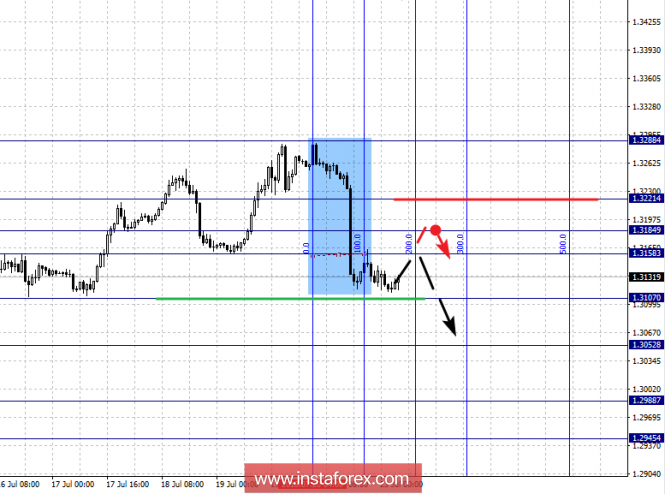

For the GBP / USD pair, the key levels on the scale of H1 are 1.3356, 1.3303, 1.3228, 1.3200, 1.3165, 1.3111, 1.3079 and 1.3031. Here, we follow the formation of the initial conditions for the top of July 19. The continuation of the upward movement is expected after the breakdown of 1.3165. In this case, the target is 1.3200. Near this level, a prolonged consolidation to the end of the second zone is possible. Passing the price of the noise range of 1.3200 - 1.3228 should be accompanied by a pronounced upward movement. Here, the target is 1.3303. The potential value for the top is the level of 1.3356. The probable achievement of this level is on July 25-26.

Short-term downward movement is possible in the area of 1.3111 - 1.3079. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3031. This level is the key support for the top.

The main trend is the formation of the initial conditions for the top of July 19.

Trading recommendations:

Buy: 1.3165 Take profit: 1.3200

Buy: 1.3230 Take profit: 1.3300

Sell: 1.3110 Take profit: 1.3080

Sell: 1.3076 Take profit: 1.3034

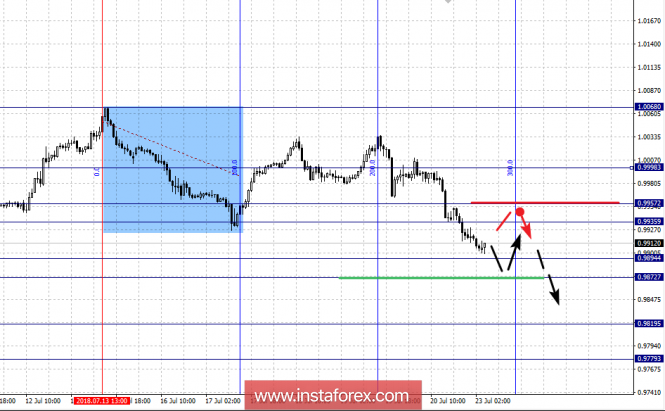

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9998, 0.9957, 0.9935, 0.9894, 0.9872, 0.9819 and 0.9779. Here, we continue to follow the downward structure of July 13 as the main one. The continuation of the downward movement is expected after passing through the noise range of 0.9894 - 0.9872. In this case, the target is 0.9819. The potential value for the bottom is the level of 0.9779. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the range 0.9935 - 0.9957. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9998.

The main trend is the downward structure of July 13.

Trading recommendations:

Buy: 0.9935 Take profit: 0.9955

Buy: 0.9960 Take profit: 0.9995

Sell: 0.9870 Take profit: 0.9822

Sell: 0.9817 Take profit: 0.9782

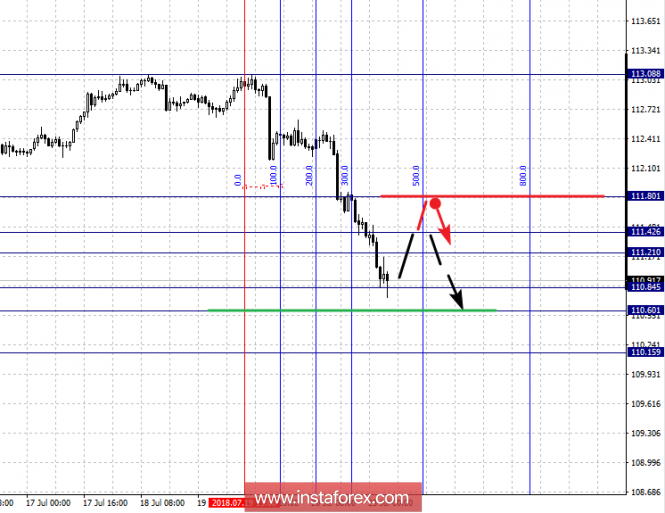

For the USD / JPY pair, the key levels on a scale are: 111.80, 111.42, 111.21, 110.84, 110.60 and 110.15. Here, we expect the design of the medium-term downward structure of July 19. The continuation of the downward movement is possible after passing through the noise range of 110.84 - 110.60. In this case, the potential target is 110.15. Upon reaching this level, we expect a correction.

Short-term upward movement is possible in the area of 111.21 - 111.42. The breakdown of the last value will lead to in-depth correction. Here, the target is 111.80.

For the main trend, we expect the design of the medium-term downward structure of July 19.

Trading recommendations:

Buy: 111.21 Take profit: 111.40

Buy: 111.44 Take profit: 111.80

Sell: 110.82 Take profit: 110.62

Sell: 110.58 Take profit: 110.17

For the CAD / USD pair, the key H1 scale levels are: 1.3221, 1.3184, 1.3158, 1.3107, 1.3052, 1.2988 and 1.2945. Here, we follow the formation of a downward structure from July 20. The continuation of the downward movement is expected after the breakdown of 1.3107. In this case, the target is 1.3052. Near this level is the consolidation of the price. The breakdown at the level of 1.3050 should be accompanied by a pronounced downward movement. Here, the target is 1.2988. The potential value for the bottom is the level of 1.2945. The probable date of reaching this level July 24-25. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.31.58 - 1.3184. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3221. This level is the key support for the top.

The main trend is the formation of a downward structure from July 20.

Trading recommendations:

Buy: 1.3158 Take profit: 1.3182

Buy: 1.3185 Take profit: 1.3220

Sell: 1.3105 Take profit: 1.3054

Sell: 1.3050 Take profit: 1.2990

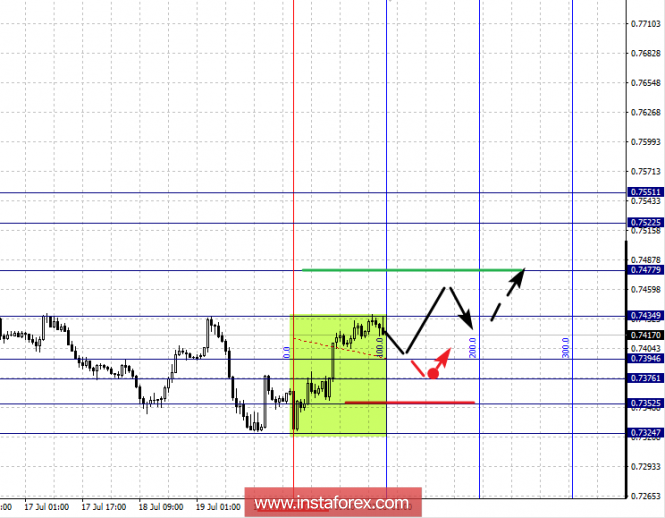

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7551, 0.7522, 0.7477, 0.7434, 0.7394, 0.7376, 0.7352 and 0.7324. Here, we follow the formation of the upward structure of July 20. The continuation of the development of the initial conditions is expected after the breakdown of 0.7434. Here, the target is 0.7477. Near this is the consolidation level up to the 2nd zone. The breakdown at the level of 0.7477 should be accompanied by a pronounced upward movement. Here, the target is 0.7551. In the area of 0.7522 - 0.7551 is the consolidation of the price.

Short-term downward movement is possible in the area of 0.7394 - 0.7376. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7352. This level is the key support for the top.

The main trend is the formation of the upward structure of July 20.

Trading recommendations:

Buy: 0.7435 Take profit: 0.7475

Buy: 0.7478 Take profit: 0.7520

Sell: 0.7374 Take profit: 0.7354

Sell: 0.7350 Take profit: 0.7325

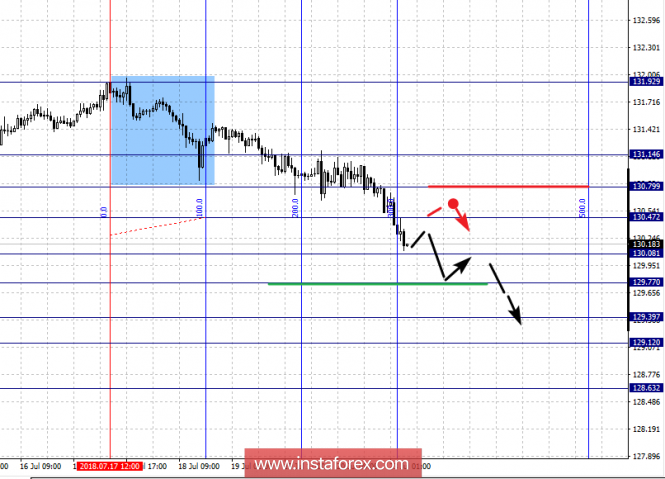

For the of EUR / JPY pair, the key levels on the scale of H1 are: 131.14, 130.79, 130.47, 130.08, 129.77, 129.39, 129.12 and 128.63. Here, we follow the development of the downward movement of July 17. Short-term downward movement is expected in the area of 130.08 - 129.77. The breakdown of the last value will lead to a pronounced movement. Here, the target is 129.39. In the area of 129.39 - 129.12 is the consolidation of the price and hence, the probability of a turn up is high. The potential value for the bottom is the level of 128.63.

Short-term upward movement is possible in the area of 130.47 - 130.79. The breakdown of the last value will lead to in-depth correction. Here, the target is 131.14.

The main trend is the downward structure of July 17.

Trading recommendations:

Buy: 130.47 Take profit: 130.76

Buy: 130.81 Take profit: 131.14

Sell: 130.06 Take profit: 129.80

Sell: 129.75 Take profit: 129.46

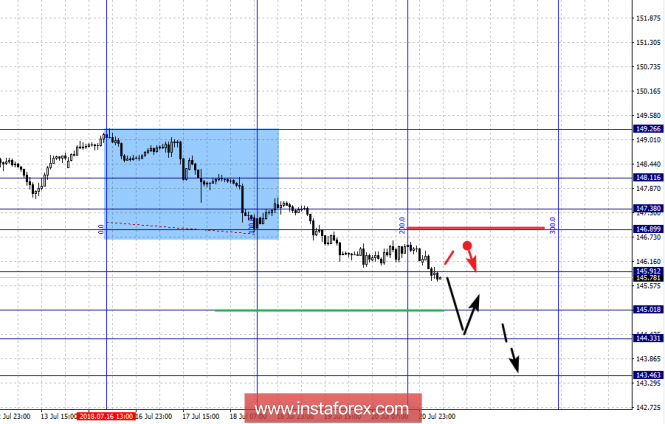

For the GBP / JPY pair, the key levels on the scale of H1 are: 148.11, 147.37, 146.89, 145.91, 145.01, 144.33 and 143.46. Here, we continue to follow the downward structure of July 16. At the moment, we expect the movement towards 145.01. In the area of 145.01 - 144.33 is short-term downward movement as well as the consolidation of the price. The potential value for the bottom is the level of 143.46. The probable date of reaching it is on July 21 and beyond.

Short-term upward movement is possible in the area of 146.90 - 147.37. The breakdown of the last value will lead to in-depth correction. Here, the target is 148.10. This level is the key support for the downward structure.

The main trend is the downward structure of July 16.

Trading recommendations:

Buy: 146.90 Take profit: 147.35

Buy: 147.45 Take profit: 148.10

Sell: 145.90 Take profit: 145.10

Sell: 145.00 Take profit: 144.40

The material has been provided by InstaForex Company - www.instaforex.com