EUR/AUD is still trading in a non-volatile manner in the bearish bias since it broke below 1.5750 area with a daily close. There has not been much of a pullback throughout the momentum which indicates the impulsive pressure AUD have over EUR for a while.

After the recent ECB Monetary Policy Meeting Accounts providing data for slower growth of the Eurozone's economy, EUR has lost further momentum against all major currencies in the market. Today, the eurozone released a number of economic reports with mixed results which somehow injected some volatility in the market but that was not quite sufficient to counter the overall AUD momentum. Today, German Retail Sales report was published with an increase to 2.3% from the previous negative value of -0.4%, German Prelim CPI increased to 0.5% from the previous value of 0.0%, and French Prelim GDP was published with a decrease to 0.2% which was expected to be unchanged at 0.3%.

On the other hand, today Australia's Building Approvals report was published with a significant decrease to -5.0% from the previous positive value of 3.5%. The worse report weakened AUD in the meantime but it was temporary with the sustainability.

As for the current scenario, AUD is expected to resume its bearish pressure over EUR until the EUR comes up with better economic reports to counter the AUD gains with an impulsive momentum in the process. While Australia posts weaker data in the coming days, this may also lead to certain gains on the EUR side in the future. To sum up, AUD gains may lead to shorter term gains in the coming days whereas odds are against EUR which seem to fade away sooner due to the recent ECB prediction about the Eurozone economic plans.

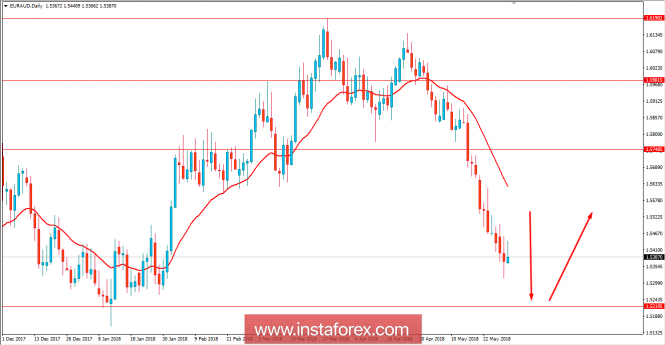

Now let us look at the technical view. The price has already rejected the bulls quite well today after an impulsive gain which indicates the strength of the bears in the process. Though after the break, certain retracement was expected but as the bearish pressure was quite strong, upcoming bearish momentum towards 1.52 is expected to be without any intervention. As the price reaches 1.52, certain bullish pressure may be observed which may lead to certain bullish impulsiveness in the pair in the future.