USD/CAD recently broke above 1.2950 resistance area with a daily close after impulsive bullish non-volatile pressure. This week is going to be quite volatile and interesting for this pair as high impact economic reports and events are going to be held in the US and Canada this week, including CAD Overnight Rate and US NFP and Unemployment Rate.

Today, Canada BOC Rate Statement is going to be held along with Overnight Rate which is expected to be unchanged at 1.25%. The economic event and report is expected to have a great impact on CAD which might lead to certain gains against USD in the process. Though there has not been any news about Rate Hike, unchanged Overnight Rate may lead to short to medium-term bearish gains in the process.

On the USD side, this week Non-Farm Employment Change report is going to be published which is expected to increase to 190k from the previous figure of 164k, Average Hourly Earnings is expected to increase to 0.3% from the previous value of 0.1% and Unemployment Rate is expected to be unchanged at 3.9%. Though the economic reports are expected to have a positive impact on the market but actual data is going to be the final confirmation in this case. Today Prelim GDP report is going to be published which is expected to be unchanged at 2.3%, Goods Trade Balance report is expected to increase in deficit to -71.2B from the previous figure of -68.3B, Prelim GDP Price Index report is also expected to be unchanged at 2.0% and Prelim Wholesale Inventories report is expected to increase to 0.4% from the previous value of 0.3%.

As for the current scenario, CAD is expected to gain momentum for a certain period before USD pushes the price higher in the coming days. As Canada's reports do not have any strong forecasts to attract the market sentiment at this point, USD is expected to gain the momentum in the process.

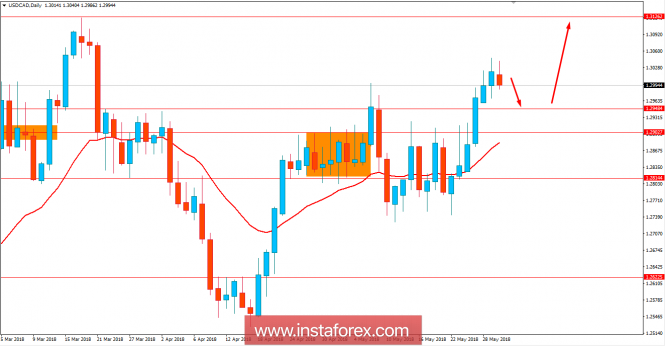

Now let us look at the technical view. The price is currently quite impulsive with the bearish gains after the break above 1.29 with a daily close. As for the current structure and breakout retest formation, the price is expected to retrace towards 1.2950 area before showing further bullish momentum with a target towards 1.3120 area in the future. As the price remains above 1.28 area, the bullish bias is expected to continue further.